Daily Review of Urea: There are no positive factors to stimulate the firm operation of the urea market (September 5)

China Urea Price Index:

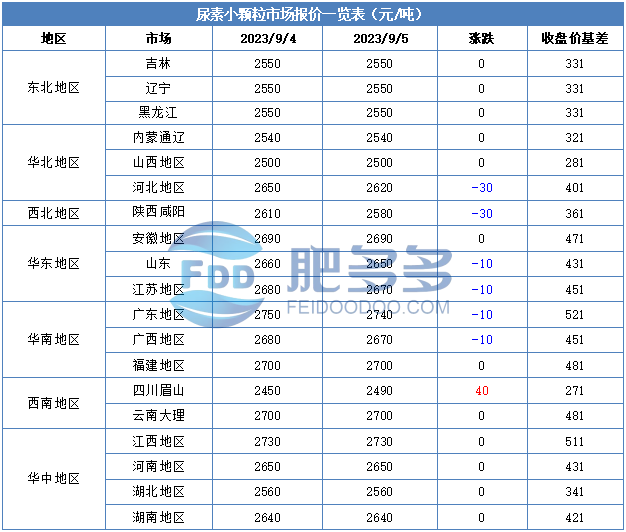

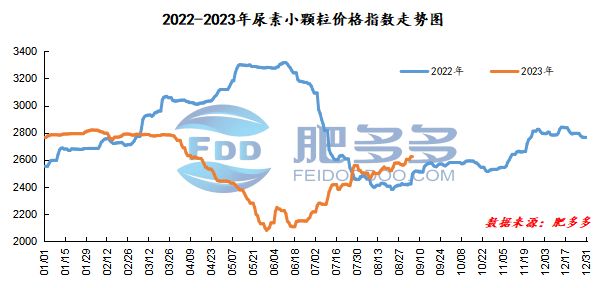

According to Feiduo data, the urea small pellet price index on September 5 was 2,620.59, down 2.73 from yesterday, down 0.1% month-on-month, and up 5.05% year-on-year.

Urea futures market:

The opening price of the Urea UR2401 contract: 2219, the highest price: 2261, the lowest price: 2192, the settlement price: 2221, the closing price: 2219, the closing price fell 13 compared with the settlement price of the previous trading day, and the month-on-month decline was 0.58%. The daily fluctuation range was 2192-2261, and the spread was 69; The 01 contract increased its positions by 11267 lots today, and so far, it held 318869 lots.

Spot market analysis:

Today, China's urea market prices fell slightly. Various regions lowered their quotations to range from 10 to 30 yuan/ton. Positive factors in the market decreased, and companies were relatively cautious in quoting prices.

Specifically, prices in Northeast China have stabilized at 2,500 - 2,560 yuan/ton. Prices in North China fell to 2,500 - 2,630 yuan/ton. Prices in Northwest China fell to 2,580 - 2,590 yuan/ton. Prices in Southwest China rose to 2,480 - 2,800 yuan/ton. Prices in East China have stabilized at 2,640 - 2,700 yuan/ton. The price of small and medium-sized particles in Central China has stabilized at 2,550 - 2,750 yuan/ton, and the price of large particles has stabilized at 2,620 - 2,640 yuan/ton. Prices in South China fell to 2,650 - 2,750 yuan/ton.

Market outlook forecast:

On the supply side, some companies still deal with early shipments and advance receipts, suspend quotations, and deliver small quantities of high-priced goods in the market. In addition, due to the shutdown of equipment by some companies for maintenance, the inventory of urea companies is still at a low level, daily output is declining, and overall supply is low. On the demand side, although it is currently in the off-season for agricultural demand, autumn fertilizer orders from downstream compound fertilizer manufacturers have started well, and there are still some delivery orders in the market. Internationally, following the decline in international urea prices some time ago, the FOB price of Egypt's urea exports has increased significantly. In terms of exports, customs legal inspection policies have changed, port legal inspection has been blocked, factory legal inspection is uncertain, and China's urea export is currently more difficult.

On the whole, there is no obvious positive stimulus in the urea market, and the market atmosphere is relatively flat. It is expected that the spot price of urea will fall slightly in the short term.