PVC: The upward trend of the futures price is pushing towards the previous high, and the bullish sentiment has returned, but the position volume has not changed much, and the spot has strengthened.

PVC futures analysis: September 1st V2401 contract opening price: 6269, highest price: 6399, lowest price: 6267, position: 675207, settlement price: 6340, yesterday settlement: 6288, up: 52, daily trading volume: 915061 lots, precipitated capital: 3.02 billion, capital inflow: 105 million.

List of comprehensive prices by region: yuan / ton

|

Area |

Price 8.31 |

Price 9.1 |

Rise and fall |

Remarks |

|

North China |

6100-6170 |

6130-6220 |

30/50 |

Send to cash remittance |

|

East China |

6150-6220 |

6230-6280 |

80/60 |

Cash out of the warehouse |

|

South China |

6220-6300 |

6280-6360 |

60/60 |

Cash out of the warehouse |

|

Northeast China |

6050-6250 |

6100-6250 |

50/0 |

Send to cash remittance |

|

Central China |

6230-6260 |

6260-6300 |

30/40 |

Send to cash remittance |

|

Southwest |

6000-6150 |

6050-6200 |

50/50 |

Send to cash remittance |

PVC spot market: China PVC market mainstream transaction prices rise, and the increase is considerable. Compared with the valuation, North China rose 30-50 yuan / ton, East China 60-80 yuan / ton, South China 60 yuan / ton, Northeast China 50 yuan / ton, Central China 30-40 yuan / ton, and Southwest China 50 yuan / ton. Upstream PVC production enterprises factory price part of a small increase of 30-50 yuan / ton, most stable happened to be few contracts signed on Friday, and high-price inquiry is less willing to sign orders. The futures price continues to rise, the spot market traders push up the offer price, and the supply advantage of the spot price basically disappears after the futures price goes up, but there is still a basis offer and the basis does not change much. Among them, East China basis offer 01 contract-(50-70-110), South China 01 contract-(0-70), North 01 contract-(340-480), Southwest 01 contract-(260). The ethylene method is synchronously adjusted, but the merchants report that the pace of shipment is slow. On the whole, the price adjustment during the week is relatively frequent to face the situation of sharp rise and fall, and the transaction became weak after the price went up today.

Futures point of view: PVC2401 contract night futures prices fluctuate in a narrow range, but the opening price is the lowest throughout the day. After the start of morning trading, the futures price rose significantly and the increase was considerable. The afternoon peak of 6399 went straight to the previous high, but did not exceed it. The afternoon price is high and narrow. 2401 contracts range from 6267 to 6399 throughout the day, with a spread of 132. 01 contracts with an increase of 8377 positions and 675207 positions so far. The 2309 contract closed at 6294, with 675207 positions.

PVC Future Forecast:

Futures: PVC2401 contract prices end the volatility trend of night trading, there has been a high continued to rise, but the high point of the futures price did not exceed the previous high. In terms of trading, there was an obvious long sentiment in the market, in which the opening was 26.1% higher than the short opening 21.6%, but the volume increase was only 8377 hands, and some retail investors took profits under the high futures price. During the week, the market fell sharply and rose sharply, showing an obvious V-shaped trend, and returned strongly on Thursday and Friday after falling below the middle rail for two consecutive days. The technical turn shows that the Bollinger belt (13, 13, 2) all turn to the upper opening, and there is a trend of turning to gold fork at the daily level of KD and MACD, but the current operation of futures prices has risen, but in the case of poor attention, we think that the upward range of futures prices is limited and observe the performance of the pressure range of 6400-6450.

Spot: first of all, the sharp rise and fall in prices in the two markets stems from less fundamental impact, more driven by commodity sentiment, recent commodity sentiment is on the high side, most commodities are strong, and PVC has followed the overall trend with obvious sharp fluctuations in the market. First of all, under the high futures price, on the one hand, spot merchants cooperate with the supply of goods for hedging suppression, on the other hand, the fundamentals do not clearly support the factors that the high price continues to rise, so there will be an obvious trend of volatility under the high price. The view we have been expressing is that there are still expectations in the third quarter, but there may still be a contradiction between supply and demand in the fourth quarter. Therefore, in the current market, it is recommended to be treated with caution. On the outer disk, oil prices have risen sharply, as supply constraints will persist and there is a possibility of further deterioration. Market analysts said Saudi Arabia was expected to further extend its voluntary plan to cut production by an additional 1 million b / d to October, which would intensify OPEC + 's production cuts. On the whole, the spot price of PVC will continue to adjust frequently in the short term.

PVC spread arbitrage analysis:

|

Arbitrage Analysis of PVC spread |

||||

|

PVC |

Contract price difference |

8.31 |

9.1 |

Rate of change |

|

V2401 collection |

6246 |

6390 |

144 |

|

|

Average spot price in East China |

6185 |

6255 |

70 |

|

|

Average spot price in South China |

6260 |

6320 |

60 |

|

|

PVC2401 basis difference |

-61 |

-135 |

-74 |

|

|

V2405 collection |

6282 |

6421 |

139 |

|

|

V2401-2405 closed |

-36 |

-31 |

5 |

|

|

PP2401 collection |

7745 |

7851 |

106 |

|

|

Plastic L2401 collection |

8325 |

8420 |

95 |

|

|

V--PP basis difference |

-1499 |

-1461 |

38 |

|

|

Vmure-L basis difference of plastics |

-2079 |

-2030 |

49 |

|

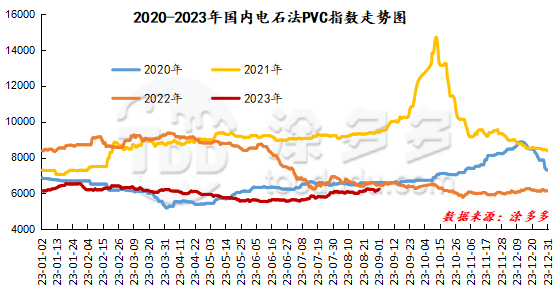

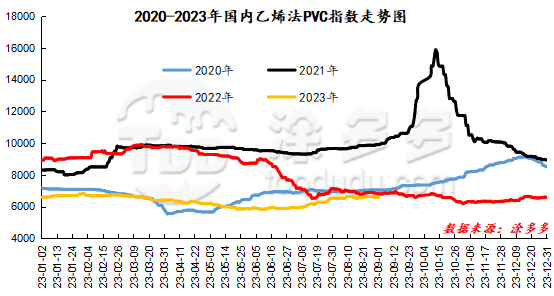

China PVC Index: according to Tuduoduo data, China calcium Carbide PVC spot index rose 52.72, or 0.852%, to 6239.29 on Sept. 1. The ethylene method PVC spot index is 6581.73, up 7.17, the range is 0.109%, the calcium carbide method index rises, the ethylene method index rises, the ethylene method-calcium carbide method index price difference is 342.44.

PVC warehouse receipt daily:

|

Variety |

Warehouse / branch warehouse |

8.31 warehouse orders |

9.1 warehouse receipt quantity |

change |

|

Polyvinyl chloride |

China Reserve shares |

501 |

501 |

0 |

|

|

Guangzhou materials |

141 |

141 |

0 |

|

|

China Central Reserve Nanjing |

360 |

360 |

0 |

|

Polyvinyl chloride |

Cosco sea logistics |

287 |

287 |

0 |

|

|

Zhenjiang Middle and far Sea |

287 |

287 |

0 |

|

Polyvinyl chloride |

Zhejiang International Trade |

2,762 |

2,762 |

0 |

|

Polyvinyl chloride |

Peak supply chain |

1,000 |

1,000 |

0 |

|

Polyvinyl chloride |

Jiangyin Xiefeng |

1,143 |

1,143 |

0 |

|

Polyvinyl chloride |

Benniu Port, Changzhou |

7,039 |

7,099 |

60 |

|

Polyvinyl chloride |

Jiangsu Zhengsheng |

1,531 |

1,531 |

0 |

|

Polyvinyl chloride |

Changxing, Zhejiang |

120 |

120 |

0 |

|

Polyvinyl chloride |

Jiangsu Yanjin |

2,124 |

2,124 |

0 |

|

Polyvinyl chloride |

Chuanhua mandarin |

50 |

50 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Shanghai Xiangyu) |

100 |

100 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Benniu Port) |

298 |

298 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Zhejiang International Trade) |

149 |

149 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Benniu Port) |

900 |

900 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Railway Changxing) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Yongan Capital (Benniu Port) |

1,200 |

1,200 |

0 |

|

Polyvinyl chloride |

Specialty petrochemical (Benniu Port) |

2,399 |

2,399 |

0 |

|

Polyvinyl chloride |

Specialty Petrochemical (Zhejiang International Trade) |

1,800 |

1,800 |

0 |

|

Polyvinyl chloride |

Sino-Thai Duojing (Zhejiang International Trade) |

1,238 |

1,238 |

0 |

|

Polyvinyl chloride |

Tiantai International Trade (Benniu Port) |

600 |

600 |

0 |

|

PVC subtotal |

|

25,541 |

25,541 |

60 |

|

Total |

|

25,541 |

25,541 |

60 |

PVC long bears hold the list of bulls:

The information provided in this report is for reference only.