Daily Review of Urea: Supply is good, Urea prices rise (August 31)

China Urea Price Index:

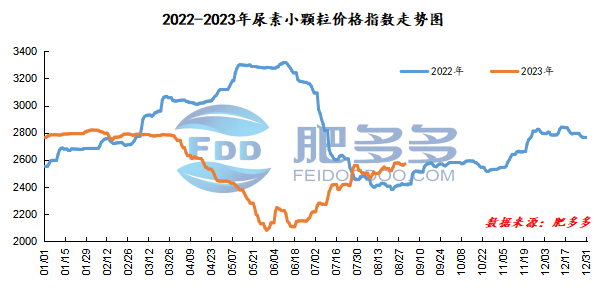

According to Feiduo data, the urea small pellet price index on August 31 was 2,570.14, up 8.18 from yesterday, up 0.32% month-on-month, and up 6.27% year-on-year.

Urea futures market:

The opening price of the Urea UR2401 contract: 2270, the highest price: 2304, the lowest price: 2246, the settlement price: 2271, and the closing price: 2255. The closing price increased by 22 compared with the settlement price of the previous trading day, and the month-on-month increase by 0.99%. The daily fluctuation range is 2246-2304, and the spread is 58; the 01 contract has increased its positions by 4063 lots today, and so far, it has held 309447 lots.

Spot market analysis:

Today, China's urea market price increased slightly, and the market supply was low, which was good for corporate prices to rise.

Specifically, prices in Northeast China have stabilized at 2,450 - 2,520 yuan/ton. Prices in North China rose to 2,430 - 2,640 yuan/ton. Prices in the northwest region are stable at 2,500 - 2,510 yuan/ton. Prices in Southwest China are stable at 2,400 - 2,800 yuan/ton. Prices in East China rose to 2,570 - 2,620 yuan/ton. The price of small and medium-sized particles in Central China has risen to 2,520 - 2,700 yuan/ton, and the price of large particles has stabilized at 2,550 - 2,580 yuan/ton. Prices in South China rose to 2,620 - 2,680 yuan/ton.

Market outlook forecast:

In terms of enterprises, some enterprises still implement pre-issuance and export advance receipt, and the transaction volume of new orders is small. On the supply side, at present, enterprises have stopped for maintenance more equipment, daily output has dropped, enterprises 'inventories are temporarily low, and the market supply is tight. On the demand side, China is currently in the off-season of demand, with low market volume. Downstream seeking low prices and replenishing goods, and low-priced orders have improved. However, high-priced transactions are still difficult, and traders 'purchasing activity has increased. In terms of futures, futures prices rose today, which is good for the market. Market sentiment has improved again, and urea manufacturers have increased their willingness to support prices.

On the whole, the current inventory is low and the supply side is good, but the demand side support is weak, resulting in insufficient momentum for price rebound. The urea market is expected to fluctuate slightly in a short period of time.