PVC: Futures fell below the mid-track and were suppressed. This wave of market ended and the spot market weakened significantly

PVC futures analysis: August 29th V2401 contract opening price: 6261, highest price: 6271, lowest price: 6153, position: 655328, settlement price: 6211, yesterday settlement: 6321, down: 110, daily trading volume: 845993 lots, precipitated capital: 2.829 billion, capital outflow: 23.36 million.

List of comprehensive prices by region: yuan / ton

|

Area |

Price 8.28 |

Price 8.29 |

Rise and fall |

Remarks |

|

North China |

6160-6220 |

6060-6120 |

-100/-100 |

Send to cash remittance |

|

East China |

6170-6240 |

6050-6150 |

-120/-90 |

Cash out of the warehouse |

|

South China |

6250-6320 |

6160-6230 |

-90/-90 |

Cash out of the warehouse |

|

Northeast China |

6100-6200 |

6000-6150 |

-100/-50 |

Send to cash remittance |

|

Central China |

6210-6270 |

6110-6270 |

-100/0 |

Send to cash remittance |

|

Southwest |

6000-6150 |

5950-6100 |

-50/-50 |

Send to cash remittance |

PVC spot market: China PVC market mainstream transaction price center of gravity has fallen, the spot market atmosphere has weakened. From the comparison of valuation, it fell by 100 yuan / ton in North China, 90-120 yuan / ton in East China, 90 yuan / ton in South China, 50-100 yuan / ton in Northeast China, 100 yuan / ton in Central China and 50 yuan / ton in Southwest China. Most of the ex-factory quotations of upstream production enterprises have been reduced by 50-100 yuan / ton. Including the synchronous downward price of the remote warehouse, the contract signing is mainly based on the basic quantity, and there is no large volume performance. Futures prices weakened again in intraday trading, spot market traders quoted prices lower than yesterday, some brands supply slightly higher prices. After the futures price goes down, the supply price advantage of point price is relatively more obvious, in which East China base offer 01 contract-(50-110), South China 01 contract-(0-70) good fan + 30, North 01 contract-(330-370-470), southwest 01 contract-(260), ethylene method is also reduced mainly. On the whole, there is a certain transaction performance at the low level of the point price, the downstream low price rigid demand replenishment, and the trading atmosphere in the spot market has improved.

From the perspective of futures: PVC01 contract night futures prices maintain a volatile trend, the volatility range is relatively narrow and the direction is unknown. The futures price fluctuated all the way down after the start of the morning trading, and the afternoon low did not improve until the end of the day. 2401 contracts range from 6153 to 6271 throughout the day, with a spread of 118,02401 and an increase of 4614 positions, with 655328 positions so far. The 2309 contract closed at 6090, with 39361 positions.

PVC Future Forecast:

Futures: PVC01 contract price all the way down the middle track support level, the technical level shows that the Bollinger belt (13, 13, 2) three-track opening has changed, in which the lower rail to the lower middle rail also has a downward trend, and fell sharply for two consecutive days, making the daily level of KD line and MACD line dead cross trend more obvious, and the distance between the two lines expanded. With the emergence of commodity sentiment, although the market refreshed before the highest point of 6405, but the market reversal is also faster, high futures prices did not appear a certain horizontal trend, that is, began to fall sharply in a row. In terms of trading, the short opening of 25.1% is compared with an increase of 21.7%. In the short term, the operation of the futures price may continue to hover at a low level, and observe the performance near the support level 6100-6130.

Spot aspect: & the downward price of nbsp; futures in the two cities has led to an improvement in transaction today. From the spot level, rigid demand exists, but in view of the current market trend, the terminal real order mostly appears in the form of buying down rather than buying up, and is more inclined to low hanging order actual replenishment, so the transaction after the futures price decline is slightly better than the rising period. In addition, when the rising market is high before the year, speculative demand without a long-term upward trend can not be sustained, and both production enterprises and traders report that the pace of shipment is not good in the rising and falling market. In terms of PVC fundamentals, calcium carbide prices continue to rise separately, and the current cost port support exists, but the changes in the prices of the two markets are not guided by the fundamentals and are more inclined to fluctuate with the overall commodity trend. In the outer disk, the price of US crude oil futures rose, which will be supported by the tropical storm along the Gulf of Mexico, but the Federal Reserve may raise interest rates further to curb the rise in oil prices. The chairman of the Federal Reserve / FED said further interest rate increases may be needed to cool inflation, which is still too high. On the whole, the spot price of PVC will still be weak and narrow in the short term.

PVC spread arbitrage analysis:

|

Arbitrage Analysis of PVC spread |

||||

|

PVC |

Contract price difference |

8.28 |

8.29th |

Rate of change |

|

V2309 collection |

6261 |

6166 |

-95 |

|

|

Average spot price in East China |

6205 |

6100 |

-105 |

|

|

Average spot price in South China |

6285 |

6195 |

-90 |

|

|

PVC2309 basis difference |

-56 |

-66 |

-10 |

|

|

V2401 collection |

6297 |

6206 |

-91 |

|

|

V2309-2401 closed |

-36 |

-40 |

-4 |

|

|

PP2309 collection |

7628 |

7617 |

-11 |

|

|

Plastic L2309 collection |

8289 |

8233 |

-56 |

|

|

V--PP basis difference |

-1367 |

-1451 |

-84 |

|

|

Vmure-L basis difference of plastics |

-2028 |

-2067 |

-39 |

|

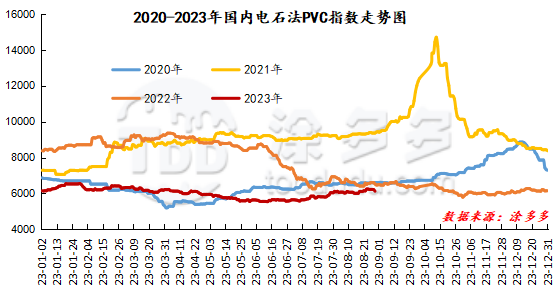

China PVC Index: according to Tuduoduo data, the China calcium Carbide PVC spot Index fell 87.12, or 1.403%, to 6121.7 on Aug. 29. The ethylene PVC spot index was 6575.96, down 54.46, or 0.821%. The calcium carbide index fell, the ethylene index fell, and the ethylene-calcium carbide index spread was 454.26.

PVC warehouse receipt daily:

|

Variety |

Warehouse / branch warehouse |

8.28 warehouse orders |

8.29 warehouse orders |

change |

|

Polyvinyl chloride |

China Reserve shares |

501 |

501 |

0 |

|

|

Guangzhou materials |

141 |

141 |

0 |

|

|

China Central Reserve Nanjing |

360 |

360 |

0 |

|

Polyvinyl chloride |

Cosco sea logistics |

231 |

231 |

0 |

|

|

Zhenjiang Middle and far Sea |

231 |

231 |

0 |

|

Polyvinyl chloride |

Zhejiang International Trade |

2,762 |

2,762 |

0 |

|

Polyvinyl chloride |

Peak supply chain |

1,000 |

1,000 |

0 |

|

Polyvinyl chloride |

Jiangyin Xiefeng |

1,074 |

1,143 |

69 |

|

Polyvinyl chloride |

Benniu Port, Changzhou |

7,263 |

7,443 |

180 |

|

Polyvinyl chloride |

Jiangsu Zhengsheng |

1,531 |

1,531 |

0 |

|

Polyvinyl chloride |

Changxing, Zhejiang |

120 |

120 |

0 |

|

Polyvinyl chloride |

Jiangsu Yanjin |

2,124 |

2,124 |

0 |

|

Polyvinyl chloride |

Chuanhua mandarin |

50 |

50 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Shanghai Xiangyu) |

100 |

100 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Benniu Port) |

298 |

298 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Zhejiang International Trade) |

149 |

149 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Benniu Port) |

900 |

900 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Railway Changxing) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Yongan Capital (Benniu Port) |

1,200 |

1,200 |

0 |

|

Polyvinyl chloride |

Specialty petrochemical (Benniu Port) |

2,399 |

2,399 |

0 |

|

Polyvinyl chloride |

Specialty Petrochemical (Zhejiang International Trade) |

1,800 |

1,800 |

0 |

|

Polyvinyl chloride |

Sino-Thai Duojing (Zhejiang International Trade) |

1,238 |

1,238 |

0 |

|

Polyvinyl chloride |

Tiantai International Trade (Benniu Port) |

600 |

600 |

0 |

|

PVC subtotal |

|

25,640 |

25,889 |

249 |

|

Total |

|

25,640 |

25,889 |

249 |

PVC long bears hold the list of bulls:

The information provided in this report is for reference only.

Original: Pei Zhongxue