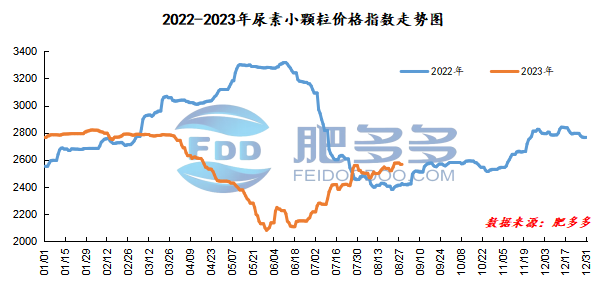

Daily Review of Urea: Reduced market demand and price shocks (August 29)

China Urea Price Index:

According to Feiduo data, the urea small pellet price index on August 29 was 2,559.68, down 6.36 from yesterday, down 0.25% month-on-month, and up 5.55% year-on-year.

Urea futures market:

The opening price of the Urea UR2401 contract: 2200, the highest price: 2210, the lowest price: 2109, the settlement price: 2148, and the closing price: 2145. The closing price dropped 98 compared with the settlement price of the previous trading day, and the month-on-month decline was 4.37%. The daily fluctuation range was 2109-2210, and the spread was 101; The 01 contract reduced its position by 1459 lots today, and so far, it held 316134 lots.

Spot market analysis:

Today, China's urea market prices have stabilized and moved slightly, and downstream demand has been sluggish. Some high-priced companies have slightly lowered their quotations. Other orders have been shipped, and prices have maintained a stable trend.

Specifically, prices in Northeast China have stabilized at 2,450 - 2,520 yuan/ton. Prices in North China fell to 2,400 - 2,600 yuan/ton. Prices in Northwest China fell to 2,500 - 2,510 yuan/ton. Prices in Southwest China fell to 2,400 - 2,800 yuan/ton. Prices in East China have stabilized at 2,540 - 2,620 yuan/ton. The price of small and medium-sized particles in Central China fell to 2,480 - 2,700 yuan/ton, and the price of large particles stabilized at 2,550 - 2,580 yuan/ton. Prices in South China fell to 2,620 - 2,680 yuan/ton.

Market outlook forecast:

On the supply side, some enterprises are currently undergoing equipment maintenance, and the daily output is showing a downward trend, and the amount of goods available for circulation in the market has decreased. On the demand side, China is currently in the off-season of demand, and high-priced purchases have slowed down. There has been no significant improvement in demand. The downstream is mainly wait-and-see, and the market procurement atmosphere is flat. In terms of market mentality, the overall market is currently in a stalemate. Coupled with the continued decline in international prices, support for the Chinese market has weakened. Downstream purchases are cautious, and the market is mainly wait-and-see.

On the whole, there are certain positive benefits on the supply side of the urea market at present, but the demand side has a negative impact. It is expected that the urea market will fluctuate in a short period of time.