Daily Review of Urea: Low demand prices in China and abroad show a downward trend (August 28)

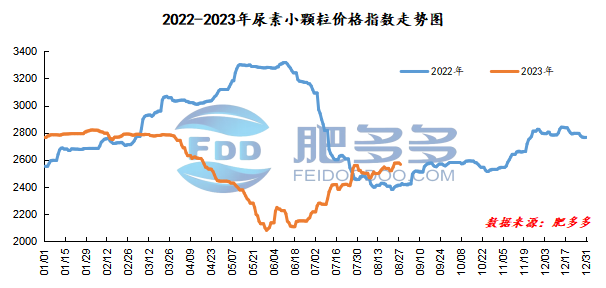

China Urea Price Index:

According to Feiduo data, the urea small pellet price index on August 28 was 2,566.05, down 10 from last Friday, down 0.39% month-on-month, and up 6.36% year-on-year.

Urea futures market:

The opening price of the Urea UR2401 contract: 2309, the highest price: 2319, the lowest price: 2177, the settlement price: 2243, and the closing price: 2216. The closing price dropped 59 compared with the settlement price of the previous trading day, and the month-on-month decline of 2.59%. The daily fluctuation range is 2177-2319, and the spread is 142; The 01 contract has reduced its position by 13289 lots today, and has held 317593 lots so far.

Spot market analysis:

Today, China's urea market prices have shown a downward trend. Currently, demand from China and abroad has declined, and market benefits have weakened. Companies in many places have lowered their factory quotations.

Specifically, prices in Northeast China have stabilized at 2,450 - 2,520 yuan/ton. Prices in North China fell to 2,400 - 2,610 yuan/ton. Prices in the northwest region are stable at 2,540 - 2,550 yuan/ton. Prices in Southwest China are stable at 2,450 - 2,800 yuan/ton. Prices in East China fell to 2,540 - 2,620 yuan/ton. The price of small and medium-sized particles in Central China fell to 2,480 - 2,700 yuan/ton, and the price of large particles stabilized at 2,550 - 2,580 yuan/ton. Prices in South China fell to 2,620 - 2,680 yuan/ton.

Market outlook forecast:

In terms of enterprises, some companies have stopped quoting, supported by orders pending in the early stage, and the transaction situation of new orders is average. In addition, the recent increase in equipment maintenance by enterprises has resulted in good supply support. On the demand side, we are currently in the off-season of agricultural demand, and industrial demand has also slowed down. The market demand is relatively general, and the demand side has a negative impact. In terms of market mentality, due to the continuous rise in urea prices in the early period, the market price was temporarily high, which led to serious fear of heights in the downstream, and the market was cautious in purchasing. On the international front, international urea prices continue to decline on a large scale. As of last Friday, the FOB price at Algeria ports was lowered to US$381.5/ton, equivalent to approximately RMB 600/ton.

On the whole, it is currently difficult to make high-priced transactions in the urea market, and the emotional pull is lacking in sustainability. It is expected that the urea market will fluctuate in a short period of time.