[Hot Focus]: Supply and demand increase methanol may remain high in the short term and fluctuate at a high level

Lead: Since mid-June, methanol has been rising for about two consecutive months. Macroscopic good news continues, futures markets continue to rise, and spot market quotations have also gradually increased. From a fundamental perspective, after entering August, China's methanol market starts to start gradually. At the same time, with the passing of the plum rainy season, demand in the traditional downstream market has improved. The Chinese market starts to start slowly, and demand is expected to increase. The methanol market shows a double increase in supply and demand.

Supply: Simultaneous increase in supply from China and foreign countries

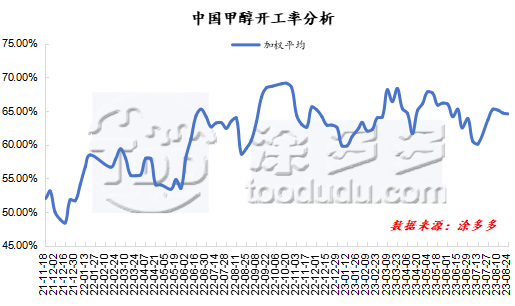

As of August 24, the average weekly operation of China's methanol market was 64.56%, and the international methanol market was 73.2%. At present, the centralized maintenance of equipment in the Chinese market has come to an end, and the preliminary maintenance equipment has been restarted one after another. Yankuang Guohong's 640,000-ton unit has resumed dual furnace operation. There are plans to restart 600,000-ton units in the second phase of Xinao recently, and there are expectations for increased market supply in some areas. However, at the same time, Baofeng MTO Phase III was put into operation, and Gansu Huating olefin equipment was restarted. At present, the load is gradually increasing, and its methanol sales volume has decreased. In addition, with the expiration of contracts at the end of the month, the inventory of some factories has decreased. The performance of the supply side in the Chinese market has been mixed. In the later stage, it is necessary to pay close attention to the operation of on-site equipment.

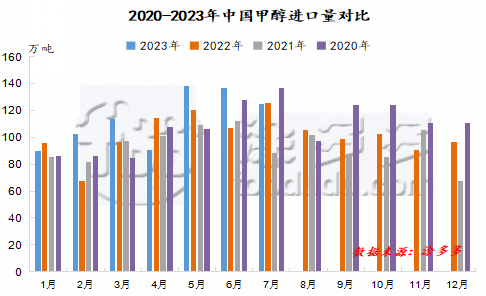

In terms of imports, after entering the second quarter, China's methanol imports have begun to surge, and the total import volume in the past three months has remained above 1.25 million tons. Although some Iranian units have been temporarily suspended, it has a small impact on the overall import volume of methanol. In addition, some early shutdown units in Trinidad and Tobago have also been restored. It is estimated that China's total methanol imports may still remain relatively high in September. In the later stage, we also need to pay attention to the actual loading situation of imported cargo and the subsequent unloading speed at the port.

Demand side: Downstream start-up has steadily increased

As the hot weather has faded, the construction of the traditional downstream market has gradually increased, and the price of raw material methanol has recently been running high. The profits of downstream companies have improved driven by costs. The demand in the terminal market has good expectations, which has boosted the market mentality. However, considering that the current inventory in the traditional downstream market is on the high side, and as the price of methanol continues to increase, some companies are gradually resistant to high prices, and only maintain just demand when entering the market. Therefore, although downstream start-ups have increased, However, the overall transaction volume was average.

At present, the margin of supply and demand of methanol has gradually improved. Most manufacturers in the Chinese market have relatively firm quotations supported by low inventory pressure. However, under the influence of high inventory, some downstream companies are not enthusiastic about purchasing new orders and are mainly in need of transactions. The volume of market transactions is limited, and the price adjustment in the spot market is relatively cautious. Currently, the supply and demand sides of the methanol market are increasing, and the game between the upstream and downstream markets is still continuing. It is expected that the methanol price market may be strong and volatile in the short term. However, in the later stage, we need to pay close attention to macro aspects, crude oil and coal prices, on-site equipment operation and downstream demand follow-up.