Supply is shrinking, expected main contract price hits daily limit

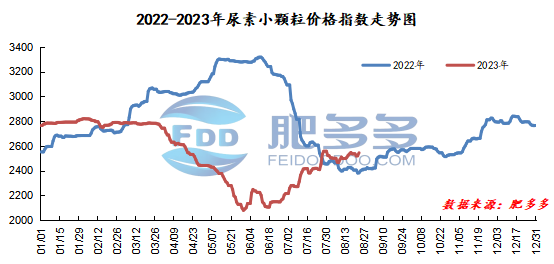

Lead: After entering August, the urea market has been "turbulent". The positive results of Indian bidding have continued to ferment, market prices have continued to rise, industry bullish sentiment is obvious, and the market transaction atmosphere is hot. After entering the second half of the year, with the effective end of the printed label quotation, the market price increase has slowed down slightly, but at this time, there is still strong support for market prices in the short term.

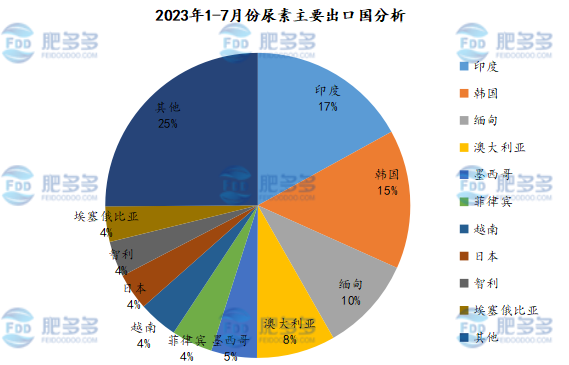

As China's main exporter of urea, India has always ranked first among exporting countries in its total urea exports. According to customs data, as of July 2023, China's total urea exports are approximately 1.3322 million tons, of which exports to India The total amount is approximately 226,300 tons, accounting for 17% of the total exports. Therefore, the impact of Indian bidding on China's urea is very great, and everyone's attention is also very high. As the news of marking continues to spread, this is undoubtedly a great positive support for the urea market, which is already in the off-season of demand.

After entering late August, as the printing came to an end, the transaction atmosphere in the Chinese market weakened slightly, and the market quotation was not willing to continue to charge higher. After the news of the printing was digested, there were positive news from the supply side. The futures market pulled up strongly, which added a certain amount of confidence to the players in the market.

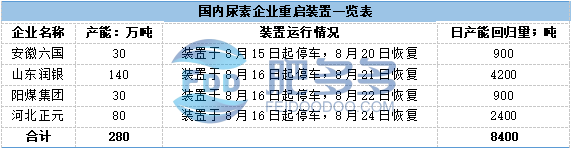

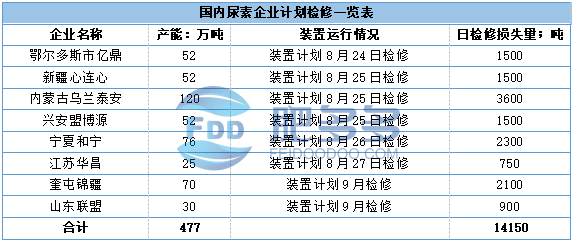

Recently, the Shanxi market has been affected by factors such as environmental protection and coal mine accidents. The output of urea raw materials may be reduced to a certain extent, and the cost side has provided certain support for urea. In addition, from late August to early September, equipment maintenance plans exist for some areas of the Chinese market. According to incomplete statistics, the planned maintenance of equipment from late August to early September involves approximately 4.77 million tons of production capacity, involving daily maintenance losses of approximately 14150 tons. In the later period, it is not ruled out that a few enterprises have equipment failures and short stops; However, at the same time, there are also a few companies that have restart plans. The daily production capacity of Yangmei, Zhengyuan and other units is about 8400 tons. In contrast, the daily maintenance loss in the Chinese market is greater than the daily production capacity, and the overall supply is expected to decrease. However, in the later stage, we still need to pay attention to the operation of the on-site equipment and the commissioning of new equipment. If the new equipment is successfully put into operation, the decline in daily production may slow down slightly.

At present, there have been many centralized maintenance of equipment in the urea market recently. In addition, due to the impact of environmental protection policies, the starting load of some units may have been reduced. After the coal mine accident, the strict safety inspections have been strengthened or have an impact on the production capacity of coke oven gas. There is a certain impact. Supported by simultaneous positive benefits from the supply side and the cost side, the futures market rose strongly to the daily limit. Driven by this, the Chinese market quotes followed suit, and the trading atmosphere on the floor was boosted, and the focus of the overall negotiations shifted. On the whole, the positive support is strong, and the urea market price is expected to be high in the short term. However, in the later stage, we still need to pay attention to the operation of on-site equipment and the ability of downstream operators to accept high-priced supplies after spot prices continue to be high.