PVC: Futures long funds entered the market strongly, turning red at the beginning of the week, and the spot market rose twice

PVC futures analysis: August 21 V2401 contract opening price: 6215, highest price: 6304, lowest price: 6188, position: 605048, settlement price: 6249, yesterday settlement: 6203, up: 46, daily trading volume: 798317 lots, precipitated capital: 2.659 billion, capital inflow: 221 million.

List of comprehensive prices by region: yuan / ton

|

Area |

Price 8.18 |

Price 8.21 |

Rise and fall |

Remarks |

|

North China |

6020-6070 |

6050-6120 |

30/50 |

Send to cash remittance |

|

East China |

6090-6130 |

6150-6190 |

60/60 |

Cash out of the warehouse |

|

South China |

6160-6250 |

6180-6270 |

20/20 |

Cash out of the warehouse |

|

Northeast China |

5950-6100 |

6000-6100 |

50/0 |

Send to cash remittance |

|

Central China |

6100-6170 |

6130-6170 |

30/0 |

Send to cash remittance |

|

Southwest |

5940-6100 |

5990-6150 |

50/50 |

Send to cash remittance |

PVC spot market: China PVC market mainstream transaction prices again high continued to rise, market sentiment warmed up. Compared with the valuation, it rose 30-50 yuan / ton in North China, 60 yuan / ton in East China, 20 yuan / ton in South China, 50 yuan / ton in Northeast China, 30 yuan / ton in Central China and 50 yuan / ton in Southwest China. The ex-factory prices of upstream PVC production enterprises have been raised by 30-50 yuan / ton individually, and most enterprises have not adjusted their prices, and some enterprises set prices on Tuesday. The futures price is strong and high up, the spot market quotation mentality is restored, the price offer of traders is higher than that of last Friday, and some intraday quotations are raised by about 20 yuan / ton again, but the corresponding high prices are generally less enthusiastic and more difficult to close a deal. Spot price and one-bite price coexist in early trading, and disappear with the upside price advantage of futures price. The spot in the ethylene method also followed the upward trend, but the traders reported that the transaction was not good, and there were fewer orders downstream under the high price. On the whole, the spot price atmosphere improved on Monday, with some traders receiving goods, but some brands had a tight supply and slightly higher prices. The downstream wait-and-see intention is obvious.

Futures point of view: PVC2401 contract last Friday night trading price volatility mainly, there is no obvious volatility direction. After the start of morning trading, futures prices rose rapidly, intraday sentiment rose and even broke highs, and afternoon highs fluctuated to the end. 2401 contracts range from 6188 to 6304 throughout the day, with a price difference of 166. 01 contracts with an increase of 45783 positions and 604995 positions so far. The 2309 contract closed at 6209, with 125901 positions.

PVC Future Forecast:

Futures: PVC2401 contract prices showed a strong start at the beginning of the week, the futures price continued to rise, and there was obvious bullish sentiment in the market, in which the trading opened 27.2% higher than the short opening 23.9%, and the off-market long funds entered the market and did not close the position at the end of the day. Most of the main Chinese futures contracts rose at midday. Soda ash rose by 9.02%, glass by more than 4%, and fuel oil, urea and PTA by more than 3%. PVC main contracts on the one hand are also affected by commodity sentiment upward, on the other hand, we also mentioned earlier that the third quarter PVC expectations are still there, so there is still the possibility to continue to rise. Overall, the short-term futures price will observe the performance of the upper track pressure level of 6330.

Spot: first the price increases in the two markets are affected by the strong strength of commodities, most commodities rise in the afternoon, but some commodities feedback spot did not follow. The same is true of the PVC spot market, some merchants still feedback light shipments. On the other hand, there is growing market news that Saudi Arabia has signed a cooperation agreement of more than 1.33 billion US dollars with China, involving infrastructure, financing, housing and other fields. Secondly, last Friday 18 news, the central bank and other three departments stepped in to adjust and optimize the real estate credit policy, and pay attention to excavating new credit growth points. We have also mentioned more than once that in the volatility of the PVC market, the volatility caused by emotion is often greater than that provided by the fundamentals. And at present, after the emergence of bullish sentiment, it is very easy to hype the fundamentals of PVC, although it is only the support of calcium carbide rising cost port, there are not many other variables. On the whole, the spot price of PVC may continue to run high in the short term, and there is a certain positive performance.

PVC spread arbitrage analysis:

|

Arbitrage Analysis of PVC spread |

||||

|

PVC |

Contract price difference |

8.18 |

8.21 |

Rate of change |

|

V2309 collection |

6228 |

6278 |

50 |

|

|

Average spot price in East China |

6110 |

6170 |

60 |

|

|

Average spot price in South China |

6205 |

6225 |

20 |

|

|

PVC2309 basis difference |

-118 |

-108 |

10 |

|

|

V2401 collection |

6259 |

6310 |

51 |

|

|

V2309-2401 closed |

-31 |

-32 |

-1 |

|

|

PP2309 collection |

7574 |

7630 |

56 |

|

|

Plastic L2309 collection |

8302 |

8352 |

50 |

|

|

V--PP basis difference |

-1346 |

-1352 |

-6 |

|

|

Vmure-L basis difference of plastics |

-2074 |

-2074 |

0 |

|

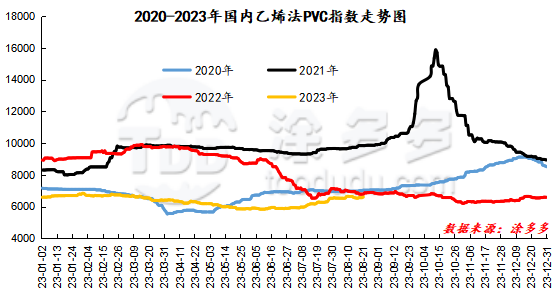

China PVC Index: according to Tuduoduo data, China calcium Carbide PVC spot Index rose 36.45, or 0.597%, to 6145.74 on August 21. The ethylene PVC spot index was 6599.29, up 68.47, with a range of 0.586%. The calcium carbide index rose, the ethylene index rose, and the ethylene-calcium carbide index spread was 453.55.

PVC warehouse receipt daily:

|

Variety |

Warehouse / branch warehouse |

8.18 warehouse orders |

8.21 warehouse receipts |

change |

|

Polyvinyl chloride |

China Reserve shares |

501 |

501 |

0 |

|

|

Guangzhou materials |

141 |

141 |

0 |

|

|

China Central Reserve Nanjing |

360 |

360 |

0 |

|

Polyvinyl chloride |

Cosco sea logistics |

231 |

231 |

0 |

|

|

Zhenjiang Middle and far Sea |

231 |

231 |

0 |

|

Polyvinyl chloride |

Zhejiang International Trade |

2,762 |

2,762 |

0 |

|

Polyvinyl chloride |

Peak supply chain |

1,000 |

1,000 |

0 |

|

Polyvinyl chloride |

Jiangyin Xiefeng |

1,180 |

1,374 |

194 |

|

Polyvinyl chloride |

Benniu Port, Changzhou |

6,288 |

6,168 |

-120 |

|

Polyvinyl chloride |

Jiangsu Zhengsheng |

2,031 |

2,031 |

0 |

|

Polyvinyl chloride |

Changxing, Zhejiang |

120 |

120 |

0 |

|

Polyvinyl chloride |

Jiangsu Yanjin |

2,467 |

2,467 |

0 |

|

Polyvinyl chloride |

Chuanhua mandarin |

50 |

50 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Shanghai Xiangyu) |

100 |

100 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Benniu Port) |

298 |

298 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Zhejiang International Trade) |

149 |

149 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Benniu Port) |

900 |

900 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Railway Changxing) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Yongan Capital (Benniu Port) |

1,200 |

1,200 |

0 |

|

Polyvinyl chloride |

Specialty petrochemical (Benniu Port) |

2,399 |

2,399 |

0 |

|

Polyvinyl chloride |

Specialty Petrochemical (Zhejiang International Trade) |

1,800 |

1,800 |

0 |

|

Polyvinyl chloride |

Sino-Thai Duojing (Zhejiang International Trade) |

1,238 |

1,238 |

0 |

|

Polyvinyl chloride |

Tiantai International Trade (Benniu Port) |

600 |

600 |

0 |

|

PVC subtotal |

|

25,614 |

25,688 |

74 |

|

Total |

|

25,614 |

25,688 |

74 |

PVC long bears hold the list of bulls:

The information provided in this report is for reference only.