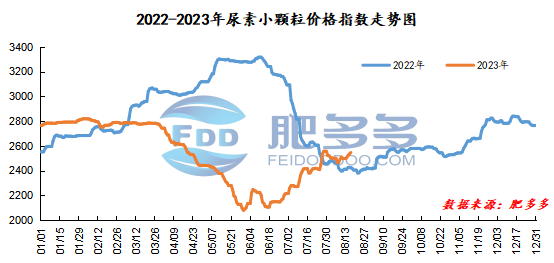

The implementation of the stamp label is good for exports and urea prices continue to rise

Introduction: (printing mark landing China, as a major exporter, the export volume has greatly increased, which is good for the higher price of China's urea market. )

Introduction: on the evening of July 25, India released a new round of bidding for non-quantitative import of urea. After nearly half a month of twists and turns, the landing of the printing mark was ushered in on the afternoon of August 9, and the price of urea in China began to rise obviously during this period.

Before the landing of the printing mark, China's agricultural demand has entered the seasonal end, and agricultural fertilization is in the off-season, but the positive news of the printing mark also affects the high-level arrangement of China's urea market. The landing of the printing mark this month, due to the stable high international urea price, and the price is much higher than the Chinese urea market price, China's export enthusiasm is high, concentrated port stock, increased demand and high prices, boosting the production enthusiasm of Chinese urea enterprises. After the landing of the printing mark, the export volume increased than expected, and urea plants have more export orders to be issued, enterprises have no sales pressure, most enterprises have obvious willingness to raise prices, and the market bullish atmosphere is becoming more and more serious.

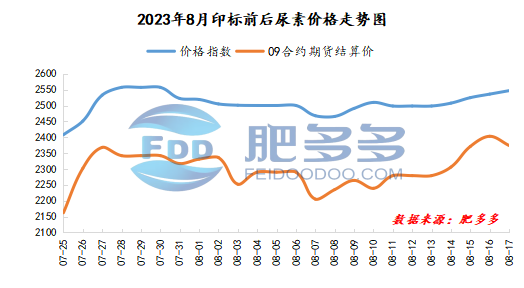

Price index: since the release of bidding information, urea prices in China began to rise. Before India launched the tender on the 25th, the price index of urea in China was 2407.86. As of August 17, the price index of urea in China was 2546.86, up 139 and 5.77 per cent from the previous month.

Futures settlement price: the release of printed marks is also affecting the changes of urea futures at the same time. On the 25th, the futures settlement price of China's urea UR2309 was 2162. As of August 9, before the UR2309 changed months, the futures settlement price of China's urea was 2264, and the futures settlement price rose 102%, up 4.72% from the previous month. On August 10, the urea main contract was switched, and 01 contract became the new main contract. On the 10th, the futures settlement price of China Urea UR2401 was 1997. As of August 17, the futures settlement price of UR2401 China Urea was 2100. The futures settlement price rose by 103%, up 5.16% from the previous month.

Detailed data are shown in the following table:

correlation analysis: the bidding in India stimulated China's export of urea to a certain extent, and the market price of urea and the futures price of 09 contract also rose accordingly. Draw a line chart of the price index of urea and the settlement price of 09 contract futures before and after printing the label.

From the urea price trend chart before and after printing, we can see that there is a certain correlation between the urea price index and the settlement price of 09 contract futures. In order to explore the degree of correlation between them, we will analyze the correlation between them. Because the data do not meet the normal distribution, this analysis will use Spearman correlation coefficient to analyze.

The data are calculated by using Spearman correlation coefficient formula, and the correlation coefficient table between urea price index and 09 contract futures settlement price is obtained.

From the above table, it can be seen that the correlation coefficient between the urea price index and the settlement price of 09 contract futures is 0.821, and the correlation is very strong, in which P = 0.000 futures 0.05, P value is significant, indicating that there is a correlation between the price index and the settlement price of 09 contract futures, that is, the price index changes synchronously with the settlement price of 09 contract futures. & nbsp

Future forecast: judging from the current rising trend of urea printing marks, as the specific number of printing marks has not yet landed, but it is reported that there are a large number of Chinese enterprises, which to a certain extent boosted the production enthusiasm of Chinese enterprises. China's urea prices will also rise synchronously, and it is expected that in a short period of time, China's urea market prices still have room to rise. In addition, from the point of view of the international market price, the current international market price is much higher than the Chinese market price, and the international price minus the related costs is much higher than that quoted by the Chinese urea plant, and the Chinese urea market is dominant. To a certain extent, it provides support for the rise of urea prices. On the whole, it is expected that the price of urea in China will remain high in the near future.