PVC: The negative column of futures prices showed a late decline, but the 01 contract increased significantly, and the spot price was consolidated within a narrow range.

PVC futures analysis: August 16 V2309 contract opening price: 6067, highest price: 6109, lowest price: 6033, position: 309872, settlement price: 6073, yesterday settlement: 6056, up: 17, daily trading volume: 422525 lots, precipitated capital: 1.311 billion, capital outflow: 204 million.

V2401 contract opening price: 6099, highest price: 6125, lowest price: 6054, position: 516371, settlement price: 6090, yesterday settlement: 6097, down: 7, daily trading volume: 451768 lots, precipitated capital: 2.192 billion, capital inflow: 212 million.

List of comprehensive prices by region: yuan / ton

|

Area |

Price 8.15 |

Price 8.16 |

Rise and fall |

Remarks |

|

North China |

5920-6010 |

5920-6010 |

0/0 |

Send to cash remittance |

|

East China |

5950-6000 |

5970-6040 |

20/40 |

Cash out of the warehouse |

|

South China |

6050-6160 |

6050-6140 |

0/-20 |

Cash out of the warehouse |

|

Northeast China |

5900-6000 |

5900-6000 |

0/0 |

Send to cash remittance |

|

Central China |

5970-6070 |

5970-6070 |

0/0 |

Send to cash remittance |

|

Southwest |

5840-6000 |

5840-6000 |

0/0 |

Send to cash remittance |

PVC spot market: China PVC market mainstream transaction prices are weak and continue, the spot market trading is light. The comparison of valuation shows that North China is stable, East China is up 20-40 yuan / ton, South China is down 20 yuan / ton, and Northeast, Central China and Southwest China are stable. Upstream PVC production enterprise factory price most choose stable price wait-and-see, individual flexible adjustment price, ethylene part of the reduction of 50 yuan / ton, but the contract is not enough. Futures prices are still weak and downward, traders have a poor mentality of quotation, a price offer is lower than yesterday, high offer is difficult to close, only some brands have a tight supply and the price is slightly higher. The point price supply has the price advantage, the basis does not change much compared with yesterday, basically biases in the 01 offer, the individual point 09 contract. Among them, East China base offer 01 contract-(80-100), South China 01 contract-(0-50) good fans + (20-50), North 01 contract-(350-480), Southwest 01 contract-(200). On the whole, the purchasing enthusiasm of the downstream is not high, some wait and see temporarily, and the trading atmosphere in the spot market is weak.

Futures point of view: PVC2401 contract night futures opened low and high once rose significantly in intraday trading. But the increase was small and then went down. Prices have been volatile since the start of morning trading, but prices weakened again in the afternoon and continued to fall in late trading. 2401 contracts fluctuate in the range of 6054-6125 throughout the day, with a price difference of 71. 01. The contract increased its position by 54089 hands, and has held 516371 positions so far. The 2309 contract closed at 6045, with 309872 positions.

PVC Future Forecast:

Futures: PVC2401 contract price night performance is relatively strong, late afternoon decline, the operation of the price as we expected is still twining at a low level. However, the 01 contract showed a trend of substantial increase in positions, in which more than 27.3% of the opening was compared with 27.0% of empty entry, and so on. On the one hand, the change of positions and months of the 09 contract, the entry of hedging, on the other hand, there is still a certain multi-order expectation in the low price operation. The technical level shows that the opening of the lower rail in the Bolin belt (13,13,2) is obvious downward, and the KD line and MACD line at the daily level tend to be dead-forked. At present, the overall commodity index is running low, and in the short term, 01 contracts will continue to run, observing the support around 6030 in January and the performance of the prefix of 09 contracts.

Spot aspect: first of all, there is no large guidance at the current macro level, and then there are not many variables from the fundamentals of PVC, and the fundamental factors currently have insufficient impact on the prices of the two cities in the PVC period, which can not play a traction role. For the current spot market sentiment, on the one hand, in the case of prevailing spot prices, traders have a greater demand for hedges, but based on the operation of the 01 contract at the current point, low hedging also has greater risks. We still believe that there are some upside expectations for the third quarter, but the range may be limited. However, for the long-term market, the high point of 2023 or doomed at the beginning of the year, in the absence of additional black swan events, it is difficult to reverse the weak situation. The poor performance of real estate data has always restricted the development of PVC terminal products. On the outside, international oil prices fell further as poor Chinese economic data added to the pressure on economic growth and concerns that the unexpected cut in key policy interest rates by the Chinese government would not be enough to support the recovery. On the whole, PVC spot prices will continue to be low and narrow in the short term.

PVC spread arbitrage analysis:

|

Arbitrage Analysis of PVC spread |

||||

|

PVC |

Contract price difference |

8.15 |

8.16 |

Rate of change |

|

V2309 collection |

6083 |

6045 |

-38 |

|

|

Average spot price in East China |

5975 |

6005 |

30 |

|

|

Average spot price in South China |

6105 |

6095 |

-10 |

|

|

PVC2309 basis difference |

-108 |

-40 |

68 |

|

|

V2401 collection |

6119 |

6065 |

-54 |

|

|

V2309-2401 closed |

-36 |

-20 |

16 |

|

|

PP2309 collection |

7418 |

7375 |

-43 |

|

|

Plastic L2309 collection |

8116 |

8074 |

-42 |

|

|

V--PP basis difference |

-1335 |

-1330 |

5 |

|

|

Vmure-L basis difference of plastics |

-2033 |

-2029 |

4 |

|

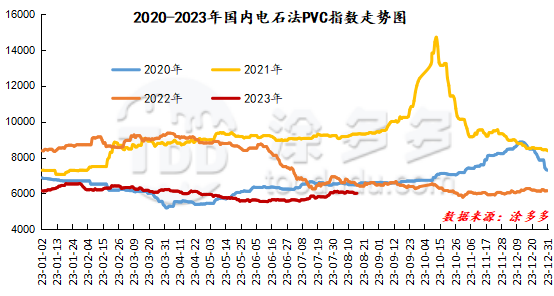

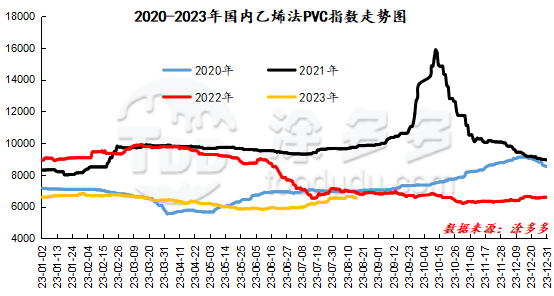

China PVC Index: according to Tuduoduo data, the spot index of China's calcium carbide PVC rose 6.75% to 6007.42, or 0.112%. The ethylene method PVC spot index was 6534.17, down 21.01%, with a range of 0.321%. The calcium carbide method index rose, the ethylene method index decreased, and the ethylene-calcium carbide index spread was 526.75.

PVC warehouse receipt daily:

|

Variety |

Warehouse / branch warehouse |

8.15 warehouse orders |

8.16 warehouse orders |

change |

|

Polyvinyl chloride |

China Reserve shares |

501 |

501 |

0 |

|

|

Guangzhou materials |

141 |

141 |

0 |

|

|

China Central Reserve Nanjing |

360 |

360 |

0 |

|

Polyvinyl chloride |

Cosco sea logistics |

0 |

231 |

231 |

|

|

Zhenjiang Middle and far Sea |

0 |

231 |

231 |

|

Polyvinyl chloride |

Zhejiang International Trade |

2,762 |

2,762 |

0 |

|

Polyvinyl chloride |

Peak supply chain |

1,000 |

1,000 |

0 |

|

Polyvinyl chloride |

Jiangyin Xiefeng |

1,180 |

1,180 |

0 |

|

Polyvinyl chloride |

Benniu Port, Changzhou |

6,156 |

6,156 |

0 |

|

Polyvinyl chloride |

Jiangsu Zhengsheng |

2,031 |

2,031 |

0 |

|

Polyvinyl chloride |

Changxing, Zhejiang |

120 |

120 |

0 |

|

Polyvinyl chloride |

Jiangsu Yanjin |

2,467 |

2,467 |

0 |

|

Polyvinyl chloride |

Chuanhua mandarin |

50 |

50 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Shanghai Xiangyu) |

100 |

100 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Benniu Port) |

298 |

298 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Zhejiang International Trade) |

149 |

149 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Benniu Port) |

900 |

900 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Railway Changxing) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Yongan Capital (Benniu Port) |

1,200 |

1,200 |

0 |

|

Polyvinyl chloride |

Specialty petrochemical (Benniu Port) |

2,399 |

2,399 |

0 |

|

Polyvinyl chloride |

Specialty Petrochemical (Zhejiang International Trade) |

1,800 |

1,800 |

0 |

|

Polyvinyl chloride |

Sino-Thai Duojing (Zhejiang International Trade) |

1,238 |

1,238 |

0 |

|

Polyvinyl chloride |

Tiantai International Trade (Benniu Port) |

600 |

600 |

0 |

|

PVC subtotal |

|

25,251 |

25,482 |

231 |

|

Total |

|

25,251 |

25,482 |

231 |

PVC long bears hold the list of bulls:

The information provided in this report is for reference only.