PVC: Futures prices continued to fall and fell below support. Short-sellers returned, and spot prices were obviously weak.

PVC futures analysis: August 14 V2309 contract opening price: 6155, highest price: 6166, lowest price: 6030, position: 407243, settlement price: 6083, yesterday settlement: 6147, down: daily trading volume: 679918 lots, precipitated capital: 1.723 billion, capital outflow: 99.15 million.

V2401 contract opening price: 6190, highest price: 6212, lowest price: 6084, position: 423558, settlement price: 6137, yesterday settlement: 6197, down: 60, daily trading volume: 430541 lots, precipitated capital: 1.808 billion, capital inflow: 70.09 million.

List of comprehensive prices by region: yuan / ton

|

Area |

Price 8.11 |

Price 8.14 |

Rise and fall |

Remarks |

|

North China |

5950-6070 |

5920-6030 |

-30/-40 |

Send to cash remittance |

|

East China |

6020-6080 |

5970-6000 |

-50/-80 |

Cash out of the warehouse |

|

South China |

6130-6230 |

6090-6180 |

-40/-50 |

Cash out of the warehouse |

|

Northeast China |

5900-6050 |

5900-6050 |

0/0 |

Send to cash remittance |

|

Central China |

6060-6120 |

5970-6070 |

-90/-50 |

Send to cash remittance |

|

Southwest |

5900-6050 |

5850-6000 |

-50/-50 |

Send to cash remittance |

PVC spot market: China PVC market mainstream transaction prices weakened, the spot market fell at the beginning of the week. Compared with the valuation, it fell by 30-40 yuan / ton in North China, 50-80 yuan / ton in East China, 40-50 yuan / ton in South China, stable in Northeast China, 50-90 yuan / ton in Central China and 50 yuan / ton in Southwest China. Upstream PVC production enterprise factory price part cut 40-50 yuan / ton, some enterprises stable price wait and see, but Monday spot generation transaction is not good. The price of futures declined obviously, and the price offer of traders was slightly lower than that of last Friday, but after the weakening of futures price, there was a price advantage in the supply of point price, and the basis was slightly adjusted compared with last Friday. Among them, East China base offer 01 contract-(100), South China 01 contract-(0-50) good fan + (20-50), North 01 contract-(350-480), Southwest 01 contract-(200). Even so, the downstream procurement enthusiasm is still not high, the low point price has a certain rigid demand transaction, but after the weak atmosphere, the operation of the spot market has always been slightly light.

From the perspective of futures: PVC2401 contracts showed signs of weakness in Friday night trading, but the overall decline in night trading was not obvious. Prices fell further after the start of morning trading, continued weak intraday operation, and continued to weaken in late afternoon trading and pass on new intraday lows. 2309 contracts range from 6084 to 6212 throughout the day, with a spread of 128. 01 contracts with an increase of 22985 positions and 423558 positions so far. The 2309 contract closed at 6045, with 407243 positions.

PVC Future Forecast:

Futures: PVC2401 contract prices have declined significantly. First of all, the operating range of futures prices has expanded. 01 contract positions are obviously increased, of which 25.8% are open and 21.9% are absolutely suppressed. Secondly, the downward price of futures is affected by many negative factors, the technical level shows that the futures price falls below the lower rail support of the Bollinger belt, the low penetration position shows a negative column throughout the day, and the daily level of KD and MACD continue to show a dead fork trend. As the 09 contract ends soon with the passage of time, it is recommended that the 09 position be closed or moved as soon as possible. At the beginning of the week, the trend of weakness in the two cities shows that there is still greater operating pressure on futures prices in the short term. Continue to observe the performance of 2401 contract strong support position 6020, 09 contract observation 6 prefix.

Spot: first of all, let's take a look at all aspects of the market news, the Shanghai Composite Index weakened (intraday low 3144.66), and the cultural goods index fell synchronously, the overall commodity rose less and fell more in the afternoon, especially the plasticizing plate and the black plate fell significantly. The exposure of the real estate sector and the trust sector has had an impact on the market, with the expected rise from the early meeting of the political Bureau of the CPC Central Committee coming to an end, coupled with export stimulus coming to an end. Although there are still some supporting factors from the fundamentals of PVC, such as the rise in calcium carbide prices and even a small rise in some coal prices, the overall weak macro level can not be shaken, so commodity sentiment weakens, and the current two cities in PVC period fall. At present, the overall market may be pinning its hopes on the crude oil sector, but changes in crude oil will have little impact on PVC. On the whole, PVC spot market prices still face some downward pressure in the short term, but the range is expected to produce certain restrictions within a week.

PVC spread arbitrage analysis:

|

Arbitrage Analysis of PVC spread |

||||

|

PVC |

Contract price difference |

8.11 |

8.14 |

Rate of change |

|

V2309 collection |

6152 |

6045 |

-107 |

|

|

Average spot price in East China |

6050 |

5985 |

-65 |

|

|

Average spot price in South China |

6180 |

6135 |

-45 |

|

|

PVC2309 basis difference |

-102 |

-60 |

42 |

|

|

V2401 collection |

6199 |

6099 |

-100 |

|

|

V2309-2401 closed |

-47 |

-54 |

-7 |

|

|

PP2309 collection |

7423 |

7376 |

-47 |

|

|

Plastic L2309 collection |

8166 |

8096 |

-70 |

|

|

V--PP basis difference |

-1271 |

-1331 |

-60 |

|

|

Vmure-L basis difference of plastics |

-2014 |

-2051 |

-37 |

|

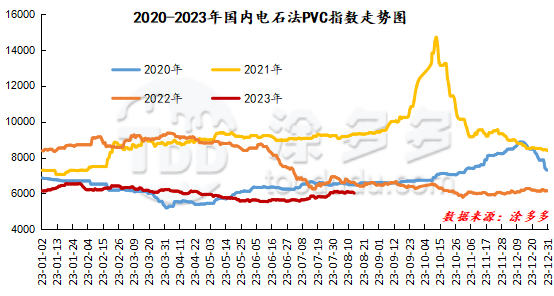

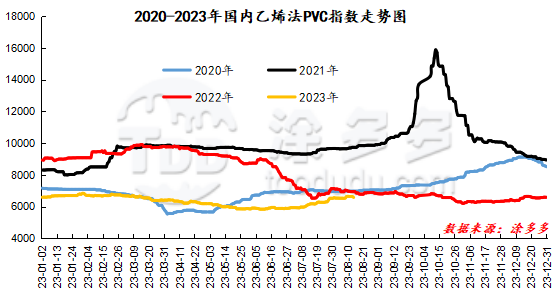

China PVC Index: according to Tuduoduo data, the Chinese calcium carbide PVC spot index was 6014.33, down 49.65, or 0.819%. The ethylene PVC spot index was 6574.83, down 60.72, with a range of 0.915%. The calcium carbide index fell, the ethylene index fell, and the ethylene-calcium carbide index spread was 560.5.

PVC warehouse receipt daily:

|

Variety |

Warehouse / branch warehouse |

8.11 warehouse orders |

8.14 warehouse orders |

change |

|

Polyvinyl chloride |

China Reserve shares |

360 |

501 |

141 |

|

|

Guangzhou materials |

0 |

141 |

141 |

|

|

China Central Reserve Nanjing |

360 |

360 |

0 |

|

Polyvinyl chloride |

Zhejiang International Trade |

2,562 |

2,762 |

200 |

|

Polyvinyl chloride |

Peak supply chain |

1,000 |

1,000 |

0 |

|

Polyvinyl chloride |

Jiangyin Xiefeng |

1,180 |

1,180 |

0 |

|

Polyvinyl chloride |

Benniu Port, Changzhou |

5,004 |

6,156 |

1,152 |

|

Polyvinyl chloride |

Jiangsu Zhengsheng |

2,031 |

2,031 |

0 |

|

Polyvinyl chloride |

Changxing, Zhejiang |

120 |

120 |

0 |

|

Polyvinyl chloride |

Jiangsu Yanjin |

2,467 |

2,467 |

0 |

|

Polyvinyl chloride |

Chuanhua mandarin |

50 |

50 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Shanghai Xiangyu) |

100 |

100 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Benniu Port) |

298 |

298 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Zhejiang International Trade) |

149 |

149 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Benniu Port) |

900 |

900 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Railway Changxing) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Yongan Capital (Benniu Port) |

1,200 |

1,200 |

0 |

|

Polyvinyl chloride |

Specialty petrochemical (Benniu Port) |

2,399 |

2,399 |

0 |

|

Polyvinyl chloride |

Specialty Petrochemical (Zhejiang International Trade) |

1,800 |

1,800 |

0 |

|

Polyvinyl chloride |

Sino-Thai Duojing (Zhejiang International Trade) |

1,238 |

1,238 |

0 |

|

Polyvinyl chloride |

Tiantai International Trade (Benniu Port) |

260 |

600 |

340 |

|

PVC subtotal |

|

23,418 |

25,251 |

1,833 |

|

Total |

|

23,418 |

25,251 |

1,833 |

PVC long bears hold the list of bulls:

The information provided in this report is for reference only.