PVC: There is nothing new about the narrow fluctuations in futures prices. Is it dormant or a blow? Spot interval sorting

PVC futures analysis: August 11 V2309 contract opening price: 6138, highest price: 6175, lowest price: 6115, position: 423183, settlement price: 6147, yesterday settlement: 6185, down: 38, daily trading volume: 521943 lots, precipitated capital: 1.822 billion, capital outflow: 66.2 million.

V2401 contract opening price: 6202, highest price: 6226, lowest price: 6165, position: 400573, settlement price: 6197, yesterday settlement: 6234, down: 37, daily trading volume: 303982 lots, precipitated capital: 1.738 billion, capital inflow: 4689.

List of comprehensive prices by region: yuan / ton

|

Area |

Price 8.10 |

Price 8.11 |

Rise and fall |

Remarks |

|

North China |

5950-6070 |

5950-6070 |

0/0 |

Send to cash remittance |

|

East China |

6040-6090 |

6020-6080 |

-20/-10 |

Cash out of the warehouse |

|

South China |

6150-6240 |

6130-6230 |

-20/-10 |

Cash out of the warehouse |

|

Northeast China |

5900-6050 |

5900-6050 |

0/0 |

Send to cash remittance |

|

Central China |

6060-6120 |

6060-6120 |

0/0 |

Send to cash remittance |

|

Southwest |

5900-6100 |

5900-6050 |

0/-50 |

Send to cash remittance |

PVC spot market: China PVC market mainstream transaction prices fell slightly, market sentiment weakened. The comparison of valuation shows that North China is stable, East China is down 10-20 yuan / ton, South China is down 10-20 yuan / ton, Northeast and Central China is stable, and Southwest China is down 50 yuan / ton. The ex-factory prices of upstream PVC production enterprises mostly remain stable, with no obvious adjustment action, but there are few contracts signed on Friday. Futures price volatility fell, early in the morning traders during the price offer slightly lower than yesterday, the point price supply part has a slight advantage, the basis has little change compared with yesterday. Among them, East China base offer 01 contract-(120-150), South China 01 contract-(20-50) good fan + 20, North 01 contract-(350-400), Southwest 01 contract-(200). Ethylene process also synchronously reduced some of the sources of quotation. On the whole, the narrow adjustment of prices in the two cities did not drive the enthusiasm of downstream purchases, some wait and see temporarily, and the trading atmosphere in the spot market is general.

Futures point of view: PVC2309 contract night futures price volatility is relatively narrow, the overall direction is not clear. After the start of morning trading, futures prices continued to fluctuate, but slightly lower in intraday trading, although afternoon prices rebounded, but the range was small, and there was nothing new about the price fluctuations throughout the day. 2309 contracts range from 6115 to 6175 throughout the day, with a spread of 60,009 and a reduction of 15230 positions, with 423183 positions so far. The 2401 contract closed at 6199, with 400573 positions.

PVC Future Forecast:

Futures: PVC09 contract price trend continues to change positions for the month, but today Friday 01 contract trend is insufficient, the overall increase of only 11245 hands is relatively inactive. As time goes by, 09 contracts may have only one week left from a trading point of view, so it is recommended that 09 contract positions be moved or closed as soon as possible. Today's overall futures price volatility is relatively narrow, 2401 contract technical level shows the Bollinger belt (13, 13, 2) three-track opening, we have also repeatedly stressed that the narrowing trend may herald a new round of market. Daily-level KD and MACD continue to show a dead-end trend. Friday's closing line cross star, short-term price fluctuations may still be relatively narrow, take a further look at the support near 9 contract 6100 and 01 contract 6150.

Spot aspect: was first affected by Taiwan Formosa Plastics' quotation in the week, and the market basically came to an end on Friday. Overall, the increase in the price of Formosa Plastics was much better than expected on Tuesday and Wednesday, greatly benefiting Chinese manufacturers and foreign trade orders. During the week, export orders heard feedback from some enterprises. Domestic trade has also aroused the enthusiasm of inquiry for a time, but the actual transaction is always far from satisfactory. Merchants feedback that the pace of domestic trade shipments is still slow. At present, the narrow fluctuation of the two cities leads to a decline in the activity of the two cities. There are not many other variables in the fundamentals of PVC, and there is no major direction for the policy port. International oil prices closed lower on the outside, but Brent crude prices remained around January highs as speculation of another US interest rate hike receded after the inflation data and the Organization of Petroleum Exporting countries (OPEC) remained optimistic about the outlook for oil demand. On the whole, we still maintain the previous point of view, PVC short-term spot price fluctuations will be relatively narrow fluctuations.

PVC spread arbitrage analysis:

|

Arbitrage Analysis of PVC spread |

||||

|

PVC |

Contract price difference |

8.10 |

8.11 |

Rate of change |

|

V2309 collection |

6154 |

6152 |

-2 |

|

|

Average spot price in East China |

6065 |

6050 |

-15 |

|

|

Average spot price in South China |

6195 |

6180 |

-15 |

|

|

PVC2309 basis difference |

-89 |

-102 |

-13 |

|

|

V2401 collection |

6206 |

6199 |

-7 |

|

|

V2309-2401 closed |

-52 |

-47 |

5 |

|

|

PP2309 collection |

7400 |

7423 |

23 |

|

|

Plastic L2309 collection |

8177 |

8166 |

-11 |

|

|

V--PP basis difference |

-1246 |

-1271 |

-25 |

|

|

Vmure-L basis difference of plastics |

-2023 |

-2014 |

9 |

|

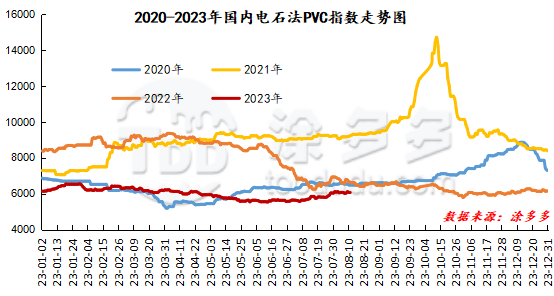

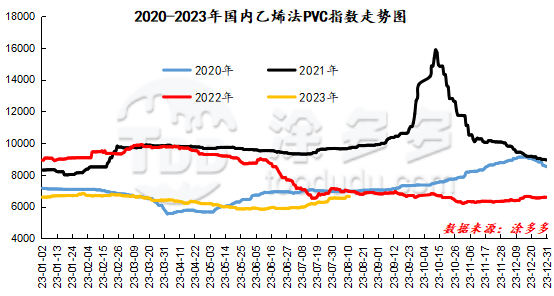

China PVC Index: according to Tuduoduo data, the Chinese calcium carbide PVC spot index fell 10.02, or 0.165%, to 6063.98 on Aug. 11. The ethylene PVC spot index was 6635.55, down 8.19, or 0.123%. The calcium carbide index fell, the ethylene index fell, and the ethylene-calcium carbide index spread was 571.57.

PVC warehouse receipt daily:

|

Variety |

Warehouse / branch warehouse |

8.10 warehouse orders |

8.11 warehouse orders |

change |

|

Polyvinyl chloride |

China Reserve shares |

360 |

360 |

0 |

|

|

China Central Reserve Nanjing |

360 |

360 |

0 |

|

Polyvinyl chloride |

Zhejiang International Trade |

2,562 |

2,562 |

0 |

|

Polyvinyl chloride |

Peak supply chain |

1,000 |

1,000 |

0 |

|

Polyvinyl chloride |

Jiangyin Xiefeng |

880 |

1,180 |

300 |

|

Polyvinyl chloride |

Benniu Port, Changzhou |

4,245 |

5,004 |

759 |

|

Polyvinyl chloride |

Jiangsu Zhengsheng |

1,821 |

2,031 |

210 |

|

Polyvinyl chloride |

Changxing, Zhejiang |

120 |

120 |

0 |

|

Polyvinyl chloride |

Jiangsu Yanjin |

2,467 |

2,467 |

0 |

|

Polyvinyl chloride |

Chuanhua mandarin |

50 |

50 |

0 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Shanghai Xiangyu) |

100 |

100 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Benniu Port) |

298 |

298 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Zhejiang International Trade) |

149 |

149 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Benniu Port) |

900 |

900 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Railway Changxing) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Yongan Capital (Benniu Port) |

1,200 |

1,200 |

0 |

|

Polyvinyl chloride |

Specialty petrochemical (Benniu Port) |

2,399 |

2,399 |

0 |

|

Polyvinyl chloride |

Specialty Petrochemical (Zhejiang International Trade) |

1,800 |

1,800 |

0 |

|

Polyvinyl chloride |

Sino-Thai Duojing (Zhejiang International Trade) |

1,238 |

1,238 |

0 |

|

Polyvinyl chloride |

Tiantai International Trade (Benniu Port) |

260 |

260 |

0 |

|

PVC subtotal |

|

22,149 |

23,418 |

1,269 |

|

Total |

|

22,149 |

23,418 |

1,269 |

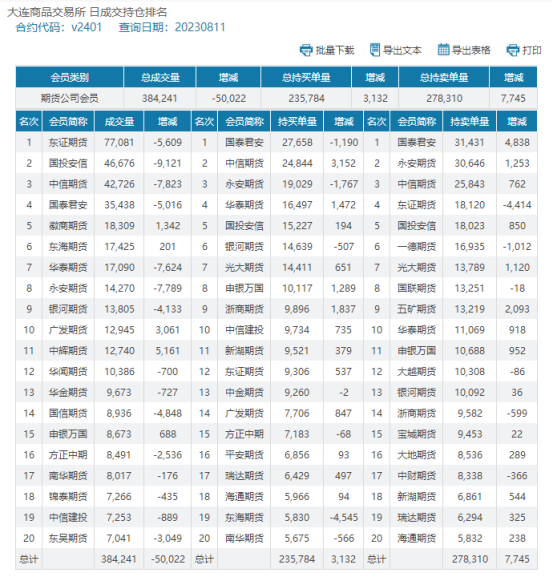

PVC long bears hold the list of bulls:

The information provided in this report is for reference only.