PVC: Futures prices continue to ferment and break through upward. The 01 contract has significantly increased positions, and the spot price has risen slightly.

PVC futures analysis: August 9 V2309 contract opening price: 6152, highest price: 6232, lowest price: 6120, position: 458531, settlement price: 6184, yesterday settlement: 6141, up: 43, daily trading volume: 632719 lots, precipitated capital: 1.999 billion, capital outflow: 117 million.

List of comprehensive prices by region: yuan / ton

|

Area |

Price 8.8 |

Price 8.9 |

Rise and fall |

Remarks |

|

North China |

5950-6050 |

6000-6120 |

50/70 |

Send to cash remittance |

|

East China |

6000-6070 |

6090-6150 |

90/80 |

Cash out of the warehouse |

|

South China |

6060-6200 |

6180-6270 |

120/70 |

Cash out of the warehouse |

|

Northeast China |

5900-6050 |

5900-6050 |

0/0 |

Send to cash remittance |

|

Central China |

5980-6040 |

6060-6120 |

80/80 |

Send to cash remittance |

|

Southwest |

5850-6000 |

5900-6100 |

50/100 |

Send to cash remittance |

PVC spot market: China PVC market mainstream transaction prices rose slightly, the spot market atmosphere is active. Compared with the valuation, North China rose 50-70 yuan / ton, East China 80-90 yuan / ton, South China 70-120 yuan / ton, Northeast China stable, Central China 80 yuan / ton, Southwest China 50-100 yuan / ton. The ex-factory prices of upstream PVC production enterprises are mostly raised by 30-50 yuan / ton, including the simultaneous upward price of remote storage in East and South China, and 70-100 yuan / ton in radical enterprises and a few 3 / 8 enterprises. Futures prices continued to climb, driving the spot market atmosphere active, inquiry enthusiasm slightly increased, traders a price offer higher than yesterday, point price supply advantage weakened after the futures price upward, the basis has not changed much since yesterday's adjustment. Among them, East China base offer 01 contract-(150-170), South China 01 contract-(30-50), North 01 contract-(450-520), Southwest 01 contract-(280-300). The ethylene law has also been synchronously adjusted, the port foreign trade offer has been raised by 10-20 US dollars / ton, and the downstream purchasing part is temporarily waiting to be seen.

From the perspective of futures: PVC2309 contract night trading price fluctuation is not obvious, the overall trend of narrow operation, after the beginning of the morning session, the futures price has been significantly increased, the intraday high 6232 began to sort out after the high level, and the trend has not changed in the afternoon. 2309 contracts range from 6120 to 6232 throughout the day, with a spread of 11209.09 contracts reducing positions by 31166 hands, with 458531 positions so far. The 2401 contract closed at 6275, with 369014 positions.

PVC Future Forecast:

Futures: PVC09 contract futures prices continue to ferment the outer disk price increase this factor, while the cost port has a certain support. On the basis of yesterday, the operation of the futures price showed a trend of continuous breakthrough. In the current time period, the process of changing positions and changing months of 09-01 contracts has been accelerated. The number of positions in 01 contracts has increased by 35171, of which 26.3% have been opened empty. The continuous upward trend of the futures price reverses part of the trend line trend of the daily line level, in which the three-track opening of the Bollinger belt (13, 13, 2) opens the trend, the distance between the daily line level KD and MACD lines narrows, and the operating high point of the futures price exceeds the middle rail position. In the short term, the operation of the futures price may still be on the strong side, but be on guard against the performance of the pressure above, and continue to observe around 01 contract 6300 near 09 contract 6250.

Spot: Taiwan Formosa Plastics of China's quotation impact is still in the market, resulting in prices in the two cities still have a small rise in follow-up, and strong operation, but the export quotation increase is not synchronized. It is learned from manufacturers and traders that yesterday's upward price led to an improvement in export orders, but the performance of domestic trade orders was relatively weak, Chinese merchants did not accept orders, and most of them still considered hedging at high prices. In terms of PVC fundamentals, the price of calcium carbide has generally increased by 50 yuan per ton. in addition, it has been heard that the government requires incomplete rectification in non-coal mines in Inner Mongolia, including limestone, but limestone accounts for less of the cost of calcium carbide, and many variables have not been heard at other levels. After consecutive days of upward adjustment in the two cities, in terms of current prices, too high prices may dampen some demand, and China's downstream demand is still dominated by rigid demand. The constraints of the real estate sector can not be removed. On the whole, we still believe that the PVC spot market continues to fluctuate in a high and narrow range.

PVC spread arbitrage analysis:

|

Arbitrage Analysis of PVC spread |

||||

|

PVC |

Contract price difference |

8.8 |

8.9 |

Rate of change |

|

V2309 collection |

6172 |

6227 |

55 |

|

|

Average spot price in East China |

6035 |

6120 |

85 |

|

|

Average spot price in South China |

6130 |

6225 |

95 |

|

|

PVC2309 basis difference |

-137 |

-107 |

30 |

|

|

V2401 collection |

6222 |

6275 |

53 |

|

|

V2309-2401 closed |

-50 |

-48 |

2 |

|

|

PP2309 collection |

7346 |

7410 |

64 |

|

|

Plastic L2309 collection |

8115 |

8183 |

68 |

|

|

V--PP basis difference |

-1174 |

-1183 |

-9 |

|

|

Vmure-L basis difference of plastics |

-1943 |

-1956 |

-13 |

|

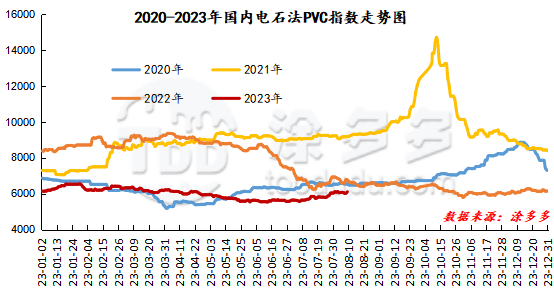

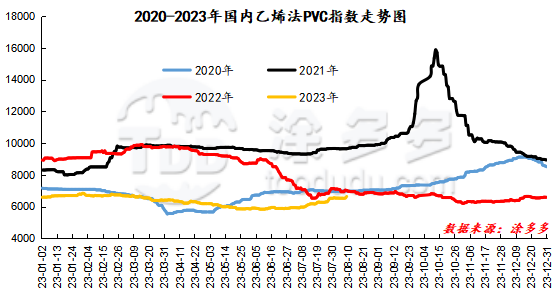

China PVC Index: according to Tuduoduo data, the spot index of China's calcium carbide PVC rose 75.3% or 1.248% to 6107.39 on Aug. 9. The ethylene method PVC spot index was 6636.04, up 97.98%, with a range of 1.499%. The calcium carbide method index rose, the ethylene method index rose, and the ethylene-calcium carbide index spread was 528.65.

PVC warehouse receipt daily:

|

Variety |

Warehouse / branch warehouse |

8.8 warehouse orders |

8.9 warehouse orders |

change |

|

Polyvinyl chloride |

China Reserve shares |

360 |

360 |

0 |

|

|

China Central Reserve Nanjing |

360 |

360 |

0 |

|

Polyvinyl chloride |

Zhejiang International Trade |

2,162 |

2,562 |

400 |

|

Polyvinyl chloride |

Peak supply chain |

1,000 |

1,000 |

0 |

|

Polyvinyl chloride |

Jiangyin Xiefeng |

810 |

880 |

70 |

|

Polyvinyl chloride |

Benniu Port, Changzhou |

3,393 |

3,753 |

360 |

|

Polyvinyl chloride |

Jiangsu Zhengsheng |

1,821 |

1,821 |

0 |

|

Polyvinyl chloride |

Changxing, Zhejiang |

120 |

120 |

0 |

|

Polyvinyl chloride |

Jiangsu Yanjin |

2,467 |

2,467 |

0 |

|

Polyvinyl chloride |

Chuanhua mandarin |

0 |

50 |

50 |

|

Polyvinyl chloride |

Xiamen Xiangyu (Shanghai Xiangyu) |

0 |

100 |

100 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Benniu Port) |

298 |

298 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Zhejiang International Trade) |

149 |

149 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Benniu Port) |

900 |

900 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Railway Changxing) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Yongan Capital (Benniu Port) |

1,200 |

1,200 |

0 |

|

Polyvinyl chloride |

Specialty petrochemical (Benniu Port) |

2,399 |

2,399 |

0 |

|

Polyvinyl chloride |

Specialty Petrochemical (Zhejiang International Trade) |

1,800 |

1,800 |

0 |

|

Polyvinyl chloride |

Sino-Thai Duojing (Zhejiang International Trade) |

1,238 |

1,238 |

0 |

|

Polyvinyl chloride |

Tiantai International Trade (Benniu Port) |

260 |

260 |

0 |

|

PVC subtotal |

|

20,677 |

21,657 |

980 |

|

Total |

|

20,677 |

21,657 |

980 |

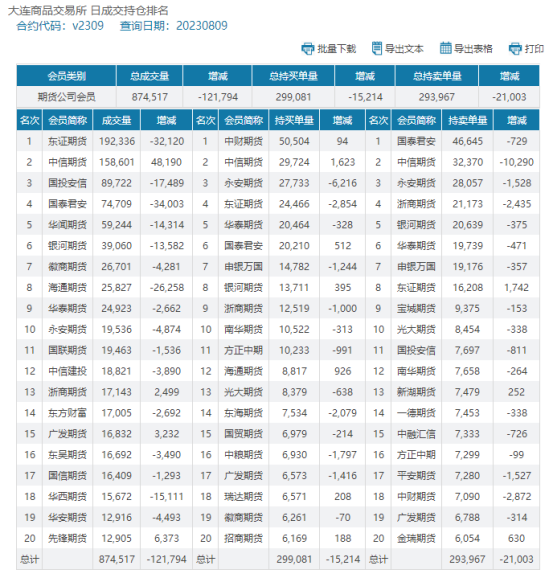

PVC long bears hold positions in Dragon and Tiger list

The information provided in this report is for reference only.