Daily review of phosphate fertilizer: cost-end prices rise, phosphate fertilizer prices rise (August 9)

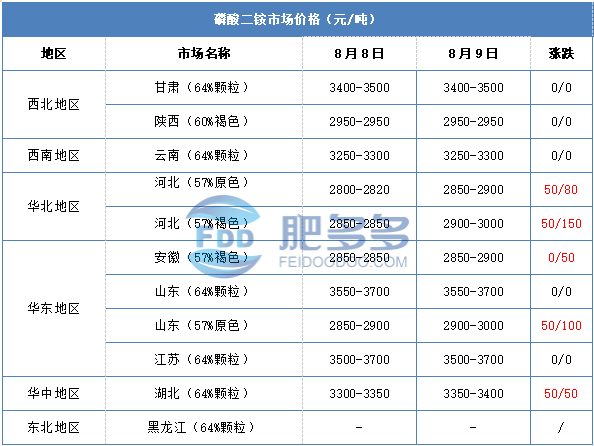

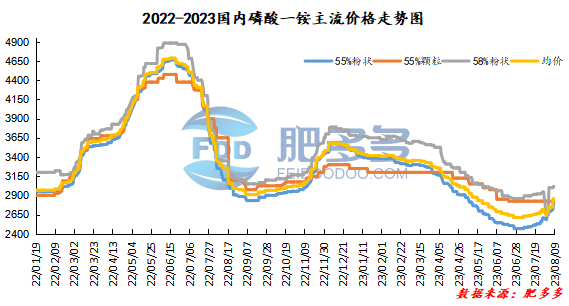

Monoammonium phosphate price index:

According to Feiduo data, on August 9, the 55% powder index of China's monoammonium phosphate was 2,797.14, rising; the 55% particle index was 2,820.00, stable; and the 58% powder index was 3,016.67, stable.

Monoammonium phosphate market analysis and forecast:

Today, the market price of monoammonium phosphate in China still maintains an upward trend. Today, many factories have suspended quotations or even stopped selling. Some manufacturers have received orders in limited quantities. Currently, they mainly carry out the delivery of orders received in advance in the early stage. In addition, affected by the continuous increase in the prices of various raw materials such as urea, factory costs continue to rise. In addition, the stamp label is about to be implemented. The urea market price is expected to run at a high level, which will also affect the price trend of monoammonium. Therefore, it is expected that there will still be room for upward growth in the market price of monoammonium in a short period of time.

Specifically, the market prices in each region are as follows:

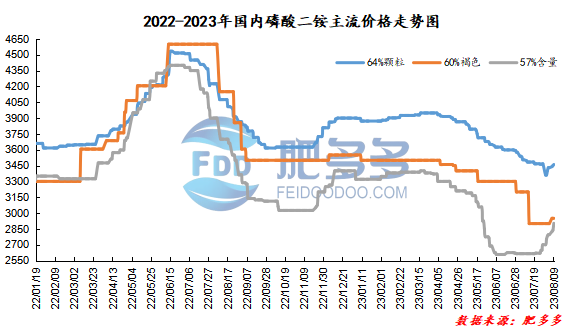

Diammonium phosphate price index:

According to Feiduo data, on August 9, the 64% particle index of China's mainstream diammonium phosphate was 3460, rising; the 60% brown index was 2,950.00, stable; and the 57% content index was 2,902.5, rising.

Diammonium phosphate market analysis and forecast:

Today, the mainstream quotation in China's diammonium phosphate market continues to increase. China's market is firm. Downstream traders in the mainstream market just need to purchase, and factories have orders for more than a month. Traders are seriously reluctant to sell, and supply is tight, and quotations continue to rise. In addition, the supply of urea at the raw material side is relatively tight, resulting in continued price increases and increasing cost pressures. In addition, the autumn fertilizer preparation time for diammonium is approaching, and favorable demand continues to be released. It is expected that the price of diammonium will operate at a high level in a short period of time.

Specifically, the market prices in each region are as follows: