Phosphate fertilizer daily review: Good support remains the ammonium phosphate market continues to rise (August 7)

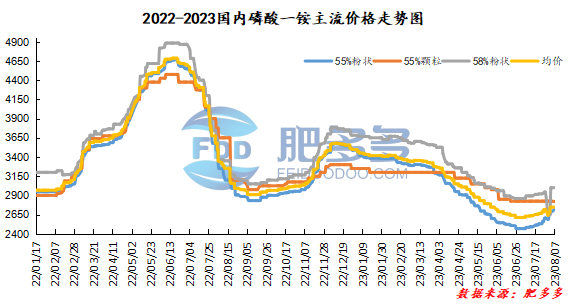

Monoammonium phosphate price index:

According to Feiduo data, on August 7, the 55% powder index of China's monoammonium phosphate was 2,717.17, rising; the 55% particle index was 2,825.00, stable; the 58% powder index was 3000, stable.

Monoammonium phosphate market analysis and forecast:

Today, the market price of monoammonium phosphate in China continues to increase, and the quotation price in the Chinese market has been increased by 40-80 yuan/ton. The price of raw material sulfur remains high. The support given to the market from the cost side still exists. At present, most factories in the Chinese market still have many pending orders. The factory is still in a state of suspension of orders. Supported by tight market supply circulation, manufacturers 'quotations continue to increase, and a small number of new orders have been sold at high prices. At present, cost-side support remains the same, and manufacturers have a certain amount of orders to be issued, which makes the mentality of the industry support. It is expected that the market price of monoammonium phosphate will continue to rise in the short term, but it is also necessary to pay attention to the downstream market receipt after the price continues to increase.

Specific market prices in each region are as follows:

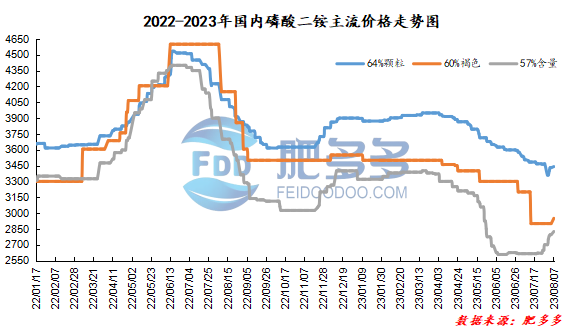

Diammonium phosphate price index:

According to Feiduo data, on August 7, the 64% particle index of China's mainstream diammonium phosphate was 3,440.00, rising; the 60% brown index was 2,950.00, rising; and the 57% content index was 2,825.00, rising.

Diammonium phosphate market analysis and forecast:

Today, the mainstream quotation prices in China's diammonium phosphate market continue to increase. Supported by strong cost support and abundant orders from companies, manufacturers 'quotations are obviously pushed up. Currently, most companies are waiting until early September. Spot circulation in the Chinese market is tight. Some traders in the market are obviously reluctant to sell and support prices, and downstream consumption still exists, and the mentality of the industry is positive. At present, market quotations are scarce and goods are difficult to find, and traders are obviously reluctant to sell. It is expected that the market price of diammonium phosphate may continue to rise in the short term.

Specific market prices in each region are as follows: