PVC: Futures were short and fell significantly and repaired. The turmoil was adjusted first, and the spot price range was adjusted.

PVC futures analysis: August 4 V2309 contract opening price: 6192, highest price: 6236, lowest price: 6162, position: 532514, settlement price: 6199, yesterday settlement: 6219, down: 20, daily trading volume: 692399 lots, precipitated capital: 2.306 billion, capital outflow: 74.08 million.

List of comprehensive prices by region: yuan / ton

|

Area |

Price 8.3 |

Price 8.4 |

Rise and fall |

Remarks |

|

North China |

5960-6100 |

5990-6100 |

30/0 |

Send to cash remittance |

|

East China |

6000-6110 |

6020-6120 |

20/10 |

Cash out of the warehouse |

|

South China |

6090-6140 |

6130-6200 |

40/60 |

Cash out of the warehouse |

|

Northeast China |

5900-6100 |

5900-6100 |

0/0 |

Send to cash remittance |

|

Central China |

6040-6090 |

6010-6070 |

-30/-20 |

Send to cash remittance |

|

Southwest |

5900-6100 |

5900-6050 |

0/-50 |

Send to cash remittance |

PVC spot market: China PVC market mainstream transaction price range collation, spot market flexible adjustment. Compared with the valuation, North China rose 30 yuan / ton, East China rose 10-20 yuan / ton, South China rose 40-60 yuan / ton, Northeast China was stable, Central China fell 20-30 yuan / ton, Southwest China fell 50 yuan / ton. The ex-factory prices of upstream PVC production enterprises are mostly stable, and there is no obvious adjustment trend, but the merchants feedback that the number of contracts signed is less. Futures price volatility slightly weaker, morning traders in the morning price offer was higher than yesterday, but with the weakening of afternoon prices, the market merchants gave up their gains. Both spot price offer and spot price offer are available, with little change in basis, including East China basis offer 01 contract-(150-180), South China 01 contract-(30-50-80), North 09 contract-520jue 01 contract-450, Southwest 09 contract-(200-280). 01 contract offer is on the high side, but the downstream demand is general, the downstream purchasing enthusiasm is lower than yesterday, and the trading atmosphere in the spot market is weak.

From a futures point of view: & the opening price of the nbsp; PVC2309 contract rose at night, but by a small margin and then lowered. After the start of morning trading, futures prices rose straight to the highest point of 6236 and then weakened, but the decline was small, and afternoon prices fell slightly in late afternoon trading. 2309 contracts range from 6162 to 6236 throughout the day, with a price difference of 74. 09 contracts reduced by 20863 positions and 532514 positions so far. The 2401 contract closed at 6235, with 274446 positions.

PVC Future Forecast:

Futures: & the operation of nbsp; PVC09 contract prices as we expected, on the basis of yesterday's sharp fall appeared to adjust the trend of a small rebound, and the trend of early futures prices showed a certain degree of resilience, but the rebound was not strong enough and encountered a downward trend. First of all, with the passage of time to continue to change positions, 09 contract is still significantly reduced positions left, 01 contract positions did not synchronize with the current futures prices under the funds to wait and see more. Therefore, this is also the reason why speculative positions are not recommended despite recent market fluctuations, and leaving the market is very risky. The technical level shows that the Bollinger belt (13, 13, 2) narrows, and the trend of dead forks of KD (9, 3, 3) lines at the daily level is more obvious. In the short term, we expect the futures price to continue to run in a narrow range, 09 mid-rail support to observe position 6125, 01 to observe position around 6160.

Spot: & the weakening of the nbsp; futures price did not lead to an improvement in the spot market transaction. On the contrary, today's inquiry enthusiasm has declined, and the low offer transaction is also poor. Traders feedback that the pace of shipment is slow, and the current hedging policy begins to gradually turn to 2401 contracts, under the current futures price operation trend, consider some 09 sets of insurance policies to stop and move positions. The current news is full of essays, of which the National Development and Reform Commission held a press conference at 10:00 today, August 4, to timely implement a batch of more targeted and stronger reserve policies in batches according to changes in the situation. We will strengthen policy reserves in such areas as better meeting the rigid and improved housing needs of residents, and actively expanding effective investment. There is no practical landing policy, early has been expected to have an impact on commodities, so there is no strong stimulus to the trend of commodities. In addition, Morgan Stanley downgraded the Chinese stock market, advising investors to take profits. Then the Shanghai Securities Regulatory Bureau will inspect Morgan Stanley Securities and other securities. On the whole, the current PVC spot or in the short term is still a narrow adjustment.

PVC spread arbitrage analysis:

|

Arbitrage Analysis of PVC spread |

||||

|

PVC |

Contract price difference |

8.3 days |

8.4 |

Rate of change |

|

V2309 collection |

6145 |

6187 |

42 |

|

|

Average spot price in East China |

6055 |

6070 |

15 |

|

|

Average spot price in South China |

6115 |

6165 |

50 |

|

|

PVC2309 basis difference |

-90 |

-117 |

-27 |

|

|

V2401 collection |

6188 |

6235 |

47 |

|

|

V2309-2401 closed |

-43 |

-48 |

-5 |

|

|

PP2309 collection |

7362 |

7416 |

54 |

|

|

Plastic L2309 collection |

8138 |

8206 |

68 |

|

|

V--PP basis difference |

-1217 |

-1229 |

-12 |

|

|

Vmure-L basis difference of plastics |

-1993 |

-2019 |

-26 |

|

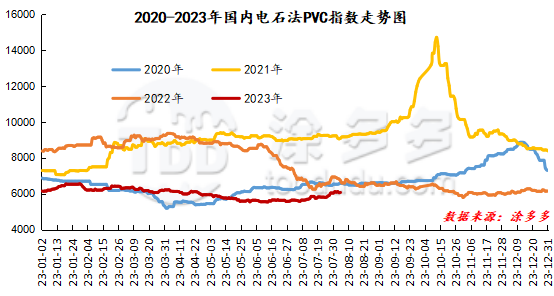

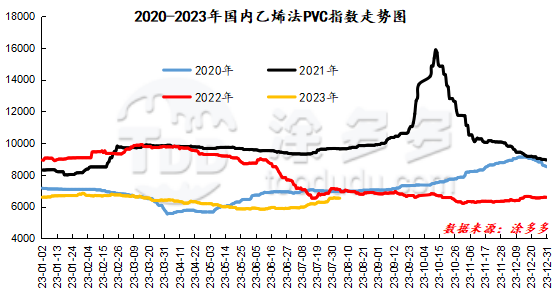

China PVC Index: according to Tudoduo data, the spot index of China's calcium carbide PVC rose 13.3% to 6069.28, or 0.22%. The ethylene method PVC spot index was 6526.28, down 4.91, with a range of 0.075%. The calcium carbide method index rose, the ethylene method index decreased, and the ethylene-calcium carbide index spread was 457%.

PVC warehouse receipt daily:

|

Variety |

Warehouse / branch warehouse |

8.3 warehouse orders |

8.4 warehouse orders |

change |

|

Polyvinyl chloride |

China Reserve shares |

360 |

360 |

0 |

|

Polyvinyl chloride |

China Central Reserve Nanjing |

360 |

360 |

0 |

|

Polyvinyl chloride |

Zhejiang International Trade |

2,162 |

2,162 |

0 |

|

Polyvinyl chloride |

Peak supply chain |

1,000 |

1,000 |

0 |

|

Polyvinyl chloride |

Jiangyin Xiefeng |

609 |

768 |

159 |

|

Polyvinyl chloride |

Benniu Port, Changzhou |

2,647 |

2,767 |

120 |

|

Polyvinyl chloride |

Jiangsu Zhengsheng |

1,521 |

1,521 |

0 |

|

Polyvinyl chloride |

Jiangsu Yanjin |

1,755 |

1,854 |

99 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Benniu Port) |

298 |

298 |

0 |

|

Polyvinyl chloride |

Zhejiang tomorrow (Zhejiang International Trade) |

149 |

149 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Benniu Port) |

900 |

900 |

0 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Railway Changxing) |

300 |

300 |

0 |

|

Polyvinyl chloride |

Yongan Capital (Benniu Port) |

1,200 |

1,200 |

0 |

|

Polyvinyl chloride |

Specialty petrochemical (Benniu Port) |

2,399 |

2,399 |

0 |

|

Polyvinyl chloride |

Specialty Petrochemical (Zhejiang International Trade) |

1,302 |

1,302 |

0 |

|

Polyvinyl chloride |

Sino-Thai Duojing (Zhejiang International Trade) |

1,238 |

1,238 |

0 |

|

Polyvinyl chloride |

Tiantai International Trade (Benniu Port) |

260 |

260 |

0 |

|

PVC subtotal |

|

18,100 |

18,478 |

378 |

|

Total |

|

18,100 |

18,478 |

378 |

PVC long bears hold the list of bulls: