Phosphate fertilizer daily review: Diammonium exports hit new highs, prices were declining, and profits were low (July 26)

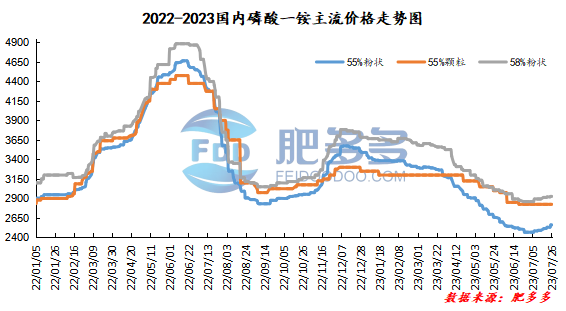

Monoammonium phosphate price index:

According to Feiduo data, on July 26, the 55% powder index of China's monoammonium phosphate was 2,561.25, stable; the 55% particle index was 2,825.00, stable; and the 58% powder index was 2,926.67, stable.

Monoammonium phosphate market analysis and forecast:

Today, China's monoammonium phosphate market is stable. At present, most companies can execute advance orders until the end of July or late August, and a few can place orders until early September. As large-scale compound fertilizer factories complete the first round of raw material procurement, the needs of small and medium-sized enterprises are now gradually reflected. During the week, the capacity utilization rate in Hubei and Yunnan continued to increase slightly. Most devices in Hubei have also been put into production, and the supply of the industry has improved. On the demand side, the start-up of compound fertilizer companies has gradually increased, but the progress has been slow and market prices have stabilized. On the whole, the supply and demand in the monoammonium phosphate market have been gradually increasing recently, and prices have mostly shown signs of steady growth.

Specific market prices in each region are as follows:

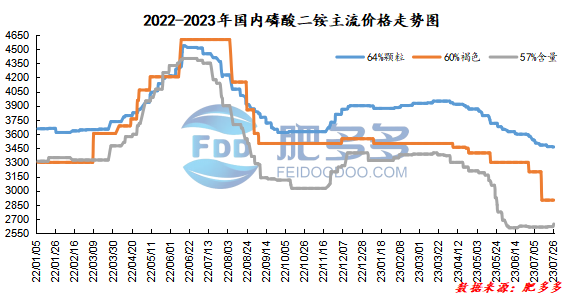

Diammonium phosphate price index:

According to Feiduo data, on July 26, the 64% particle index of China's mainstream diammonium phosphate was 3,463.33, stable; the 60% brown index was 2,900.00, stable; and the 57% content index was 2,647.50, rising.

Diammonium phosphate market analysis and forecast:

Today, the mainstream quotations in China's diammonium phosphate market have increased sporadically. Driven by the monoammonium market, the diammonium market has also seen a rising atmosphere. According to customs data, the total export volume of diammonium in June reached 928,800 tons, a record high at the end of the month since 2022. June and July are also peak periods for phosphate fertilizer consumption in India and China. From this, international demand for diammonium in July is also very good, which is still the peak season for global diammonium suppliers. The only thing to worry about is the problem of low international prices. Export orders are increasing, but corporate profits are limited. China's autumn market demand is still cautiously following up, and downstream purchases remain in urgent need. In the short term, the price of diammonium will basically remain stable at least until the official fertilizer preparation begins in the autumn at the end of August, or the price will increase due to supply shortages in some areas due to equipment failures.

Specific market prices in each region are as follows: