Polyester: High-cost pressed polyester is mired in losses

Introduction: the recent polyester raw material prices have been relatively strong, and the polyester market has been dragged down by weak demand, and the market has greater resistance to rising, so the profits of polyester enterprises continue to squeeze, and most varieties begin to fall into the plight of losses.

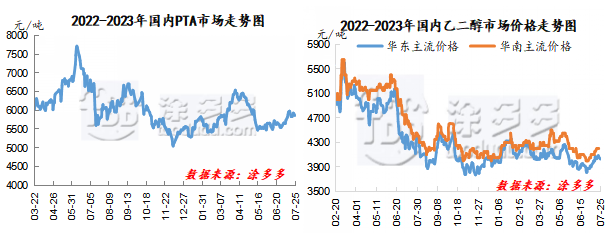

Since the first ten days of July, the PTA futures market has risen sharply, and as of 14, the main contract of PTA has risen as high as 6016 yuan, a new high in nearly 3 months. The spot market of PTA rose from 5650 yuan / ton on the 6th to 5980 yuan / ton on the 14th, up 330yuan / ton, or 5.84%. Although PTA futures fell sharply on the 17th, but from the 18th, boosted by the rise of international crude oil, the PTA spot market maintained a high and strong pattern, and PTA spot market prices fluctuated in the range of 5830-5930 yuan / ton. Since the end of June, the spot market in East China has been in a volatile pattern. The spot price in East China has risen from a low of 3810 yuan / ton at the end of June to a maximum of 4085 yuan / ton in late July, an increase of 7.22%.

As the polyester raw material PTA and ethylene glycol market prices continue to rise, polyester production cost pressure continues to increase, while the polyester market is dragged down by weak demand, market pull resistance is greater, polyester market increases are less than raw material market increases, so the overall profitability of Chinese polyester enterprises continues to decline, most products begin to fall into the plight of losses. Since the middle of July, the production of polyester bottle chips and polyester enterprises have been in a state of loss, only the profit of polyester chips has maintained a state of thin profit. Up to now, the profit of polyester chip product is 60 yuan / ton, polyester bottle chip product profit is-136 yuan / ton, polyester filament product profit is-61 yuan / ton, polyester staple fiber product profit is-11 yuan / ton.

At present, the start-up load of Chinese polyester enterprises is still at a high level of more than 90%, and there is no short-term production reduction or maintenance expectation, so the start-up of the industry will be maintained. The inventory of Chinese polyester enterprises began to enter the accumulation stage, although the polyester market fluctuated higher, but the downstream replenishment enthusiasm was low, only the production and sales of polyester enterprises improved significantly on the day of promotion, and most of the time, the production and marketing of polyester enterprises is still in a light situation, so the inventory pressure of polyester enterprises is greater. By the end of last week, the inventory of polyester chip enterprises was about 5-7 days, polyester POY library was about 13-15 days, polyester DTY library was about 23-25 days, polyester FDY library was about 18-20 days, and polyester staple storage was about 8-10 days. Subject to the in-depth influence of high temperature and off-season atmosphere, the start of the terminal weaving industry began to decline slightly, demand is expected to continue to weaken, downstream replenishment enthusiasm is low, polyester factory inventory will show a concussive and high trend, the entire polyester market mentality will be suppressed.

International crude oil high fluctuations, polyester raw materials PTA and ethylene glycol market cost end support is still in, the short-term market will maintain a narrow adjustment, the cost side to promote the market. Polyester market is mainly cautious wait-and-see, market offer with the small adjustment of the raw material market, downstream demand weakening, market production and marketing downturn. Short-term polyester market prices are expected to maintain a narrow range of fluctuations. Pay close attention to the changes of raw material market and demand side in the later stage.