Phosphate fertilizer daily review: The ammonium phosphate market was in a stalemate at the beginning of the week (July 24)

Monoammonium phosphate price index:

According to Feiduo data, on July 24, the 55% powder index of China's monoammonium phosphate was 2,531.25, stable; the 55% particle index was 2,825.00, stable; and the 58% powder index was 2920, stable.

Monoammonium phosphate market analysis and forecast:

At the beginning of the week, China's monoammonium phosphate market remained stable. At present, the factory has a large number of shipments, and most of them have suspended quotations and orders. On the demand side, the downstream autumn fertilizer preparation market continues to pick up. In terms of supply, factories have been well prepared in the near future, with nearly 60% of the industry starting operations. Some manufacturers in central and southwest China have resumed production one after another, and the manufacturers have a good mentality to start operations. In terms of raw materials, the market price of synthetic ammonia has risen sharply today, and cost support is also recovering. On the whole, it is expected that the inquiry atmosphere in the monoammonium market will be good in the short term, and the market will continue to operate strongly.

Specific market prices in each region are as follows:

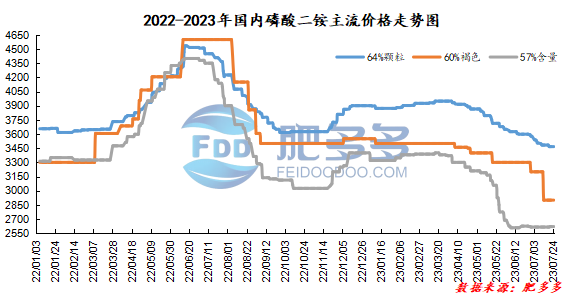

Diammonium phosphate price index:

According to Feiduo data, on July 24, the 64% particle index of China's mainstream diammonium phosphate was 3,466.67, stable; the 60% brown index was 2,900.00, stable; and the 57% content index was 2620, stable.

Diammonium phosphate market analysis and forecast:

At the beginning of the week, the mainstream quotations in China's diammonium phosphate market were basically stable, and the market had a heavy wait-and-see attitude. After the early preparation of fertilizer, there is currently very little demand for diammonium in the market. The company continues to produce export and advance orders, and the start-up has not changed much. Looking at the export data for June, we can see that the sentiment in the export market is good and demand is still supported. Compared with the Chinese market, raw material support has increased and Chinese demand has been bearish. Overall, the diammonium market may continue to be deadlocked in the short term, with most regions holding prices on the sidelines, accompanied by sporadic declines in the price center of some regions.

Specific market prices in each region are as follows: