Phosphate Fertilizer Daily Review: Orders pending support quotations sporadically dropped (July 19)

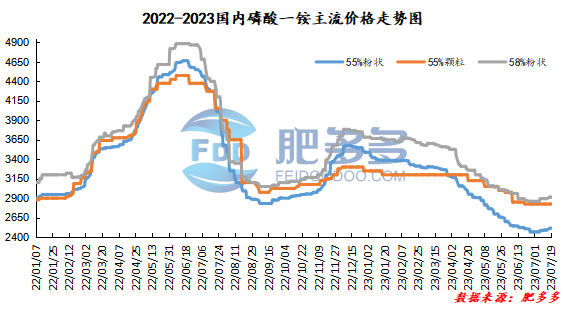

Monoammonium phosphate price index:

According to Feiduo data, on July 19, the 55% powder index of China's monoammonium phosphate was 2,515.00, stable; the 55% particle index was 2,825.00, stable; and the 58% powder index was 2,913.33, stable.

Monoammonium phosphate market analysis and forecast:

Today, China's monoammonium phosphate market remains stable, and quotations from various places are firm. The prices of synthetic ammonia and sulfur on the raw material side are firm, but the supply of synthetic ammonia market is abundant and market transactions are not active. The price center of gravity may decline in the future, and there is also a risk of falling costs. Downstream compound fertilizer factories continue to purchase raw materials, and most factories suspend receiving orders and execute more pending orders. Factory inventory pressure has slowed down, industry start-ups are still relatively low, and companies are mainly wait-and-see. Combined with the recent situation of sufficient orders from monoammonium companies, it is expected that the monoammonium market will continue to be strong in the short term, and some regions will still show signs of rising.

Specific market prices in each region are as follows:

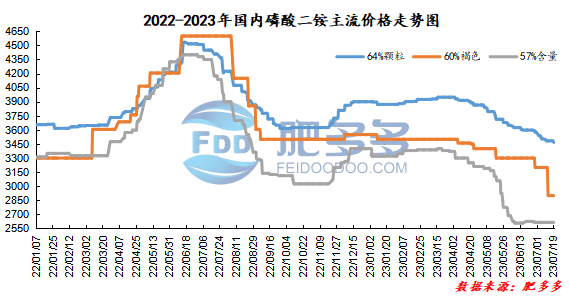

Diammonium phosphate price index:

According to Feiduo data, on July 19, the 64% particle index of China's mainstream diammonium phosphate was 3,466.67, down; the 60% brown index was 2,900.00, stable; and the 57% content index was 2615, stable.

Diammonium phosphate market analysis and forecast:

Today, the mainstream quotation in China's diammonium phosphate market is basically stable. Only the price of 64% of the granules in Yunnan has dropped by 50-100 yuan/ton to 3,200 - 3,250 yuan/ton, which is the same as the price of 64% of the granules in Hubei. The market has a strong wait-and-see attitude. After early fertilizer preparation, there is currently very little demand for diammonium in the market. The company continues to produce to ensure exports and advance orders, and there is little change in start-up. The support of raw materials is bearish and the combined bearish demand is bearish. Overall, the diammonium market is dominated by bearish conditions, and it is difficult to show any positive results in the short term. The market continues to be deadlocked, accompanied by sporadic declines in some regions.

Specific market prices in each region are as follows: