Daily review of urea: Spot prices partially rose at the moment of ups and downs (July 19)

China Urea Price Index:

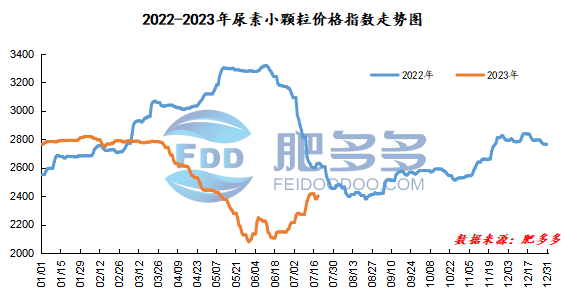

According to Feiduo data, the urea small pellet price index on July 19 was 2,401.36, up 20 from yesterday, up 0.84% month-on-month, and down 8.78% year-on-year.

Urea futures market:

The opening price of the Urea UR2309 contract: 2125, the highest price: 2128, the lowest price: 2092, the settlement price: 2107, the closing price increased by 44 compared with the settlement price of the previous trading day, and the month-on-month increase by 2.13%. The daily fluctuation range is 2092-2128, and the spread is 36; The 09 contract has reduced its position by 28843 lots today, and its position so far has been 365968 lots.

Spot market analysis:

Specifically, prices in Northeast China have stabilized at 2,170 - 2,250 yuan/ton. Prices in North China rose to 2,210 - 2,380 yuan/ton. Prices in the northwest region are stable at 2,350 - 2,460 yuan/ton. Prices in Southwest China are stable at 2,350 - 3,000 yuan/ton. Prices in East China rose to 2,330 - 2,410 yuan/ton. The price of small and medium-sized particles in Central China rose to 2,340 - 2,500 yuan/ton, and the price of large particles rose to 2,330 - 2,390 yuan/ton. Prices in South China rose to 2,550 - 2,650 yuan/ton.

Market outlook forecast:

From the perspective of futures, today's futures prices fluctuated at a high level, driving the spot trading atmosphere. Fundamentally speaking, the supply side industry has maintained a high level of start-ups, with a daily output of nearly 170,000 tons. However, manufacturers are ready to support, stocks are tight, and there is little pressure to go to the warehouse in a short period of time. Driven by the surge in international prices today, China's trading enthusiasm has increased and prices have risen again. On the downstream side, China's needs still exist. Affected by the mentality of buying up but not buying down, the market price fell in the previous two days has now risen, and purchasing enthusiasm has increased again. In terms of synthetic ammonia, the market is open, supply continues to be abundant, and the transaction atmosphere has weakened. In terms of compound fertilizers, downstream dealers are still cautious and the market is consolidating in a short period of time. Overall, short-term urea prices remain high.