Phosphate fertilizer daily review: Strong cost support and increased domestic orders (July 18)

Monoammonium phosphate price index:

According to Feiduo data, on July 18, the 55% powder index of China's monoammonium phosphate was 2,515.00, rising; the 55% particle index was 2,825.00, stable; and the 58% powder index was 2,913.33, stable.

Monoammonium phosphate market analysis and forecast:

Today, China's monoammonium phosphate market is temporarily stable, and prices from various places are firm. The price of 55% powder in Henan has been raised within a narrow range to 2,530 - 2,570 yuan/ton. The prices of synthetic ammonia and sulfur on the raw material side are firm, and cost support will no longer move downward. Downstream compound fertilizer factories have gradually started production of autumn fertilizers, so their willingness to purchase raw material monoammonium has gradually increased, and market confidence has been boosted, so the quotation has been able to operate firmly. Considering the recent situation of sufficient orders from monoammonium companies, it is expected that the monoammonium market will continue to be strong in the short term.

Specific market prices in each region are as follows:

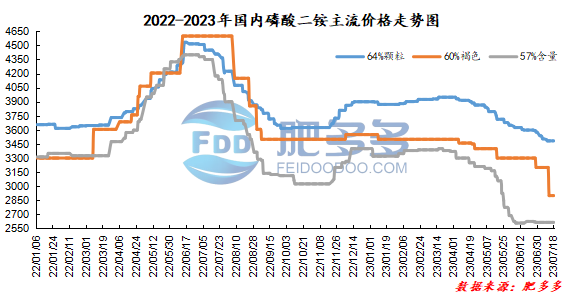

Diammonium phosphate price index:

According to Feiduo data, on July 18, the 64% particle index of China's mainstream diammonium phosphate was 3,483.33, stable; the 60% brown index was 2,900.00, stable; and the 57% content index was 2615, stable.

Diammonium phosphate market analysis and forecast:

Today, the mainstream market for diammonium phosphate in China is still deadlocked. As mentioned above, the cost support is acceptable, and boosted by the monoammonium market, the trading atmosphere in the diammonium market has improved slightly, and a small number of domestic orders have followed up. At the same time, there are still export orders to support, and the mentality of diammonium manufacturers will remain firm in the short term. However, due to the weak start-up of downstream demand, the diammonium industry has not yet had high expectations for the future outlook, and autumn pricing is still unclear. In the short term, diammonium prices will be adjusted in a narrow range at least until the official fertilizer preparation begins in the autumn at the end of August.

Specific market prices in each region are as follows: