Phosphate fertilizer daily review: The monoammonium market is partially rising and the diammonium market is still deadlocked (July 17)

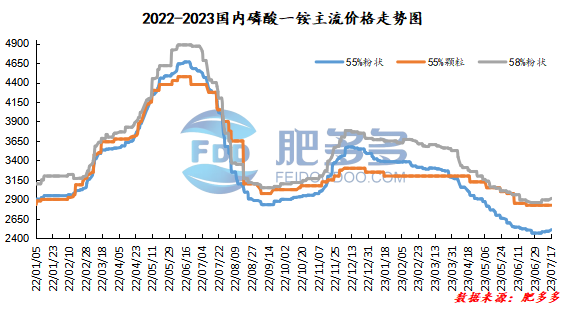

Monoammonium phosphate price index:

According to Feiduo data, on July 17, China's 55% powder index of monoammonium phosphate was 2,511.25, rising; the 55% particle index was 2,825.00, stable; and the 58% powder index was 2,913.33, rising.

Monoammonium phosphate market analysis and forecast:

At the beginning of the week and on the weekend, China's monoammonium phosphate market remained stable. As the rising atmosphere surged, mainstream quotations were increased within a narrow range, mainly around 50-100 yuan/ton. Autumn fertilizer preparation continues to enter the market slowly, the minimum guarantee policy is gradually eliminated, the price of raw material synthetic ammonia has been stable and rising so far over the weekend, and the market mentality is stable and optimistic. At present, there is an increase in the number of orders received by ammonium monoamine factories. As inventory pressure weakens and orders to be issued increase, the market atmosphere is still strong, and we continue to pay attention to the start progress of the downstream compound fertilizer factories of ammonium monoamine. In the short term, the monoammonium phosphate market is stable and mainly expected to increase.

Specific market prices in each region are as follows:

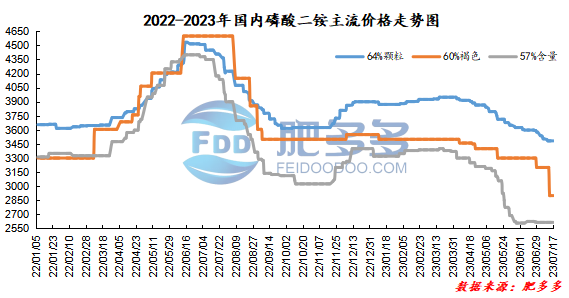

Diammonium phosphate price index:

According to Feiduo data, on July 17, the 64% particle index of China's mainstream diammonium phosphate was 3,483.33, stable; the 60% brown index was 2,900.00, stable; and the 57% content index was 2615, stable.

Diammonium phosphate market analysis and forecast:

Today, there has been no significant fluctuations in the mainstream market of diammonium phosphate in China. The diammonium market has a strong wait-and-see attitude, and the supply side has increased within a narrow range compared with the previous period. Driven by the previous wave of downstream stocking, factory inventory pressure is not great; on the demand side, diammonium companies do not have many orders in China and mainly rely on export orders, but export prices are still low and corporate profits are limited. Overall, the industry's upstream and downstream operations are not enthusiastic, there are no high expectations for the future outlook, and autumn pricing is still unclear. In the short term, diammonium prices will remain stable at least until the official fertilizer preparation begins in the autumn at the end of August. Later, the market will take into account the operating rate of the diammonium industry and changes in export demand.

Specific market prices in each region are as follows: