Daily review of urea: Market quotes were lowered one after another at the beginning of the week, pushing up resistance (July 17)

China Urea Price Index:

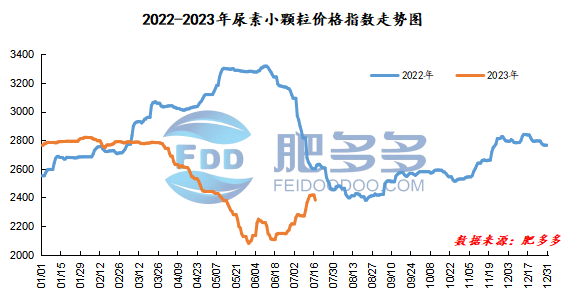

According to Feiduo data, the urea small pellet price index on July 17 was 2,381.82, down 35.45 from last Friday, down 1.47% month-on-month, and down 8.42% year-on-year.

Urea futures market:

Opening price of the Urea UR2309 contract: 2016, highest price: 2026, lowest price: 1966, settlement price: 1992, closing price: 1980, the closing price fell 89 compared with the settlement price of the previous trading day, down 4.30% month-on-month. The daily fluctuation range is 1966-2026, and the spread is 60; The 09 contract has reduced its position by 40176 lots today, and has held 326895 lots so far.

Spot market analysis:

Specifically, prices in Northeast China have stabilized at 2,170 - 2,250 yuan/ton. Prices in North China fell to 2,170 - 2,350 yuan/ton. Prices in the northwest region are stable at 2,450 - 2,460 yuan/ton. Prices in Southwest China are stable at 2,300 - 3,000 yuan/ton. Prices in East China fell to 2,310 - 2,380 yuan/ton. The price of small and medium-sized particles in Central China fell to 2,330 - 2,500 yuan/ton, and the price of large particles fell to 2,300 - 2,330 yuan/ton. Prices in South China fell to 2,550 - 2,630 yuan/ton.

Market outlook forecast:

From the perspective of futures, futures prices are down in a narrow range today. Currently, both markets are falling downward. Futures have an emotional negative for spot prices to rise. Fundamentally speaking, agricultural demand in some areas has not yet ended, urea plant failures occur frequently, and Nissan is declining again. Coupled with the current support of low inventory and high demand in the spot market, the factory's willingness to transfer profits is not obvious. The current urea market sentiment is becoming more cautious, and resistance to high-priced transactions is increasing. In terms of industrial demand, plywood factories continue to focus on purchasing, compound fertilizers are still at a relatively low level, and urea is maintained for purchasing a small amount of raw materials. The price of raw material synthetic ammonia is steadily adjusted. In terms of inventories, China's inventories are low, and it is speculated that stocks will gradually accumulate in the later period as demand decreases. To sum up, it is expected that the urea spot market will stabilize and decline in the short term.