Phosphate fertilizer daily review: Cost supports recovery, ammonium phosphate market waits for demand to be released (July 11)

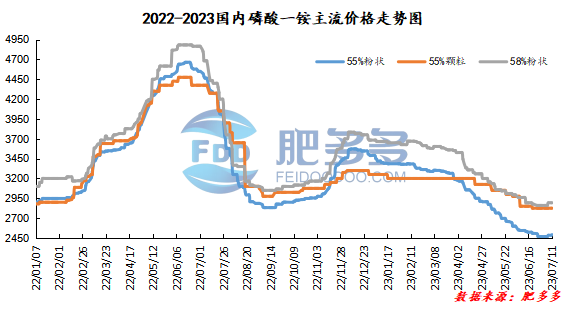

Monoammonium phosphate price index:

According to Feiduo data, on July 11, the 55% powder index of China's monoammonium phosphate was 2,491.25, rising; the 55% particle index was 2,825.00, stable; and the 58% powder index was 2,893.33, stable.

Monoammonium phosphate market analysis and forecast:

Today, China's monoammonium phosphate market is basically operating stably. Market transactions have not improved significantly, and the atmosphere is gradually entering a wait-and-see situation. The raw material synthetic ammonia market was mixed, with the overall decline in the northern market and the southern market stable and continued to rise. Although cost support is unlikely to be positive, it no longer continues to decline, and there may be a better atmosphere in the later period. The ammonium monoamine factory relies on early orders, and industry starts have increased slightly, and inventory pressure has weakened. On the demand side, as the progress of fertilizer preparation in autumn slowly begins, the construction of downstream compound fertilizer factories has shown slight improvement. In the short term, the monoammonium market will still stabilize and wait and see, paying attention to downstream start-ups.

Specific market prices in each region are as follows:

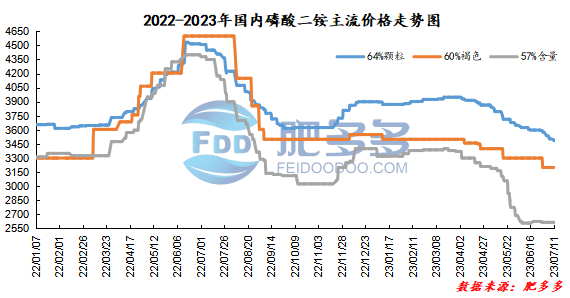

Diammonium phosphate price index:

According to Feiduo data, on July 11, the 64% particle index of China's mainstream diammonium phosphate was 3,483.33, down; the 60% brown index was 3,200.00, stable; and the 57% content index was 2615, stable.

Diammonium phosphate market analysis and forecast:

Today, China's diammonium phosphate market price center has shifted sporadically. Among them, the price of 64% pellets in Gansu has been lowered by 100 yuan/ton to 3,400 - 3,500 yuan/ton, and the price of 64% pellets in Yunnan has dropped by 50 yuan/ton to 3,250 - 3,350 yuan/ton. There has been no significant fluctuations in the price of other models. The rise in raw material market prices has brought some good news to the diammonium market, but the diammonium market has not improved significantly in terms of demand, and the trading atmosphere in the monoammonium market is even more depressed. At present, diammonium companies do not have many orders in China and mainly rely on export orders. However, export prices are still low and corporate profits are limited. The diammonium market is expected to operate weakly and stably in the short term.

Specific market prices in each region are as follows: