Gasoline Special Issue-20230706

Gasoline Special issue-20230706 issue

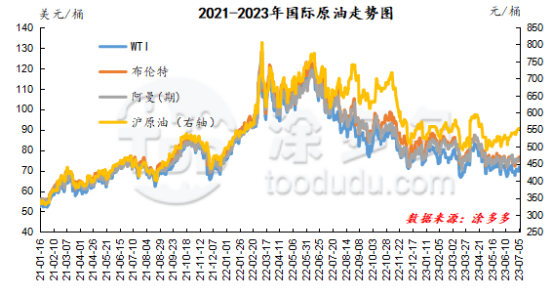

I. International crude oil futures price

|

Date |

WTI |

Brent |

Muerban |

DME Oman |

Shanghai crude oil |

WTI/ Brent spread |

Brent / DME Oman spread |

|

20230629 |

69.86 |

74.34 |

75.37 |

74.6 |

538.5 |

-4.48 |

-0.26 |

|

20230705 |

71.79 |

76.65 |

77.32 |

75.52 |

553.7 |

-4.86 |

1.13 |

|

The rate of change compared with last week |

2.76% |

3.11% |

2.59% |

1.23% |

2.82% |

8.48% |

-534.62% |

|

Remarks: 1. Except for Shanghai crude oil, the price units of other oil products in the price list are US dollars per barrel. |

|||||||

II. Summary of gasoline market

This week (20230629-20230706), the wholesale price of gasoline in China was raised as a whole, with a range of 50-300 yuan per ton. The ex-factory price of georefining in various regions also showed an upward trend, with an increase of 100-280 yuan per ton. West. The main factors of the gasoline market this week: 1, in terms of international crude oil, the production reduction plan of Saudi Arabia and other oil exporting countries is nearing landing and postponed to August, while Russia also announced production reduction plans in August, the international crude oil market fluctuated upward; 2, the State Administration of Taxation issued a consumption tax announcement on a variety of raw materials this week, greatly boosting market enthusiasm, and the gasoline market rose continuously. 3. On the demand side, boosted by the macro policy news, the bullish sentiment in the market is high, and the enthusiasm of operators to enter the market increases, but the transaction of large orders is less than expected. 4. In the new round of performance calculation cycle, the shipping pressure of each unit is small, and the price-raising mentality is heavier.

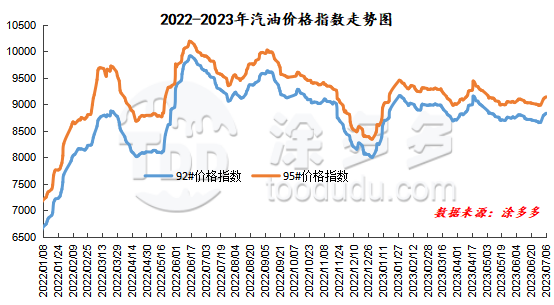

III. Gasoline price index

According to Tudor data, as of July 6, China's gasoline price index was 8832.37, up 169.41 from last week, an increase of 1.92%. The gasoline price index was 9141.93, up 153.06 or 1.68 per cent from last week. The 9-month and 9-month gasoline indices were both raised, and the price difference between the 9-month gasoline index and the 9-month gasoline index was 309.56.

IV. Spot market for gasoline

1. Price comparison of gasoline Market in China

|

Comparison of main wholesale price of gasoline (yuan / ton) |

|||||

|

Area |

Gasoline model |

Price 6.29 |

Price 7.6 |

Rise and fall |

Amplitude |

|

North China region |

92# |

8500-8900 |

8800-9150 |

300/250 |

3.53%/2.81% |

|

95# |

8700-9100 |

8850-9400 |

150/300 |

1.72%/3.30% |

|

|

South China |

92# |

8650-9100 |

8800-9150 |

150/50 |

1.73%/0.55% |

|

95# |

8900-9400 |

9050-9450 |

150/50 |

1.69%/0.53% |

|

|

Central China |

92# |

8550-8800 |

8700-9000 |

150/200 |

1.75%/2.27% |

|

95# |

8750-9000 |

8850-9300 |

100/300 |

1.14%/3.33% |

|

|

East China region |

92# |

8500-8850 |

8650-9100 |

150/250 |

1.76%/2.82% |

|

95# |

8700-9050 |

8850-9450 |

150/400 |

1.72%/4.42% |

|

|

Northwestern region |

92# |

8500-9620 |

8700-9620 |

200/0 |

2.35%/0.00% |

|

95# |

8700-10180 |

8900-10180 |

200/0 |

2.30%/0.00% |

|

|

Southwest China |

92# |

8750-9100 |

8900-9150 |

150/50 |

1.71%/0.55% |

|

95# |

9000-9550 |

9150-9600 |

150/50 |

1.67%/0.52% |

|

|

Northeast China |

92# |

8500-8750 |

8600-9130 |

100/380 |

1.18%/4.34% |

|

95# |

8800-9250 |

8950-9640 |

150/390 |

1.70%/4.22% |

|

|

Comparison of ex-factory price of gasoline refinery (yuan / ton) |

|||||

|

Area |

Gasoline model |

Price 6.29 |

Price 7.6 |

Rise and fall |

Amplitude |

|

Shandong area |

92# |

8300-8560 |

8500-8780 |

200/220 |

2.41%/2.57% |

|

95# |

8400-8800 |

8650-8900 |

250/100 |

2.98%/1.14% |

|

|

North China region |

92# |

8420-8460 |

8550-8890 |

130/430 |

1.54%/5.08% |

|

95# |

8520-8560 |

8650-8990 |

130/430 |

1.53%/5.02% |

|

|

Central China |

92# |

8550-8550 |

8740-8740 |

190/190 |

2.22%/2.22% |

|

95# |

8750-8750 |

8940-8940 |

190/190 |

2.17%/2.17% |

|

|

East China region |

92# |

8360-8500 |

8580-8730 |

220/230 |

2.63%/2.71% |

|

95# |

8520-8650 |

8730-8880 |

210/230 |

2.46%/2.66% |

|

|

Northwestern region |

92# |

8370-8500 |

8650-8700 |

280/200 |

3.35%/2.35% |

|

95# |

8650-8700 |

8850-8900 |

200/200 |

2.31%/2.30% |

|

|

Northeast China |

92# |

8500-8500 |

8600-8600 |

100/100 |

1.18%/1.18% |

|

95# |

8700-8700 |

8800-8800 |

100/100 |

1.15%/1.15% |

|

2. Gasoline market price comparison in different regions

(1) Northeast China

|

Province / city |

Model |

Price 6.29 |

Price 7.6 |

Rise and fall |

Amplitude |

|

Jilin |

92# |

8700-8720 |

8800-8850 |

100/130 |

1.15%/1.49% |

|

95# |

9160-9160 |

9100-9300 |

-60/140 |

-0.66%/1.53% |

|

|

Liaoning |

92# |

8500-8750 |

8600-9130 |

100/380 |

1.18%/4.34% |

|

95# |

8800-9250 |

8850-9250 |

50/0 |

0.57%/0.00% |

|

|

Heilongjiang Province |

92# |

8600-8600 |

8700-8700 |

100/100 |

1.16%/1.16% |

|

95# |

- |

- |

- |

- |

(2) East China

|

Province / city |

Model |

Price 6.29 |

Price 7.6 |

Rise and fall |

Amplitude |

|

Shanghai |

92# |

8500-8600 |

8650-8700 |

150/100 |

1.76%/1.16% |

|

95# |

8700-8800 |

8850-8950 |

150/150 |

1.72%/1.70% |

|

|

Shandong |

92# |

8900-8900 |

9100-9100 |

200/200 |

2.25%/2.25% |

|

95# |

9050-9250 |

9250-9450 |

200/200 |

2.21%/2.16% |

|

|

Jiangsu Province |

92# |

8650-8650 |

8800-8830 |

150/180 |

1.73%/2.08% |

|

95# |

8900-8950 |

9080-9100 |

180/150 |

2.02%/1.68% |

|

|

Zhejiang |

92# |

8600-8800 |

8750-8950 |

150/150 |

1.74%/1.70% |

|

95# |

8800-9050 |

8950-9200 |

150/150 |

1.70%/1.66% |

(3) Central China

|

Province / city |

Model |

Price 6.29 |

Price 7.6 |

Rise and fall |

Amplitude |

|

Anhui Province |

92# |

8800-8800 |

8900-8900 |

100/100 |

1.14%/1.14% |

|

95# |

9000-9000 |

9100-9100 |

100/100 |

1.11%/1.11% |

|

|

Jiangxi Province |

92# |

8700-8800 |

8850-8900 |

150/100 |

1.72%/1.14% |

|

95# |

8900-9000 |

9050-9100 |

150/100 |

1.69%/1.11% |

|

|

Hubei province |

92# |

8550-8750 |

8750-8900 |

200/150 |

2.34%/1.71% |

|

95# |

8750-9100 |

8950-9250 |

200/150 |

2.29%/1.65% |

|

|

Hunan |

92# |

8800-8800 |

8900-9000 |

100/200 |

1.14%/2.27% |

|

95# |

9050-9100 |

9150-9300 |

100/200 |

1.10%/2.20% |

(4) North China

|

Province / city |

Model |

Price 6.29 |

Price 7.6 |

Rise and fall |

Amplitude |

|

Inner Mongolia Autonomous region |

92# |

8600-8600 |

8750-8800 |

150/200 |

1.74%/2.33% |

|

95# |

8800-8800 |

8950-9000 |

150/200 |

1.70%/2.27% |

|

|

Beijing |

92# |

9050-9100 |

9100-9150 |

50/50 |

0.55%/0.55% |

|

95# |

9250-9300 |

9300-9350 |

50/50 |

0.54%/0.54% |

|

|

Tianjin |

92# |

8500-8650 |

8500-8750 |

0/100 |

0.00%/1.16% |

|

95# |

8700-8850 |

8700-9000 |

0/150 |

0.00%/1.69% |

|

|

Shanxi Province |

92# |

8650-8740 |

8910-9068 |

260/328 |

3.01%/3.75% |

|

95# |

8860-9120 |

9060-9430 |

200/310 |

2.26%/3.40% |

|

|

Hebei |

92# |

8700-8750 |

8870-9045 |

170/295 |

1.95%/3.37% |

|

95# |

8905-9100 |

9090-9245 |

185/145 |

2.08%/1.59% |

|

|

Henan |

92# |

8600-8650 |

8920-8950 |

320/300 |

3.72%/3.47% |

|

95# |

8800-8950 |

9170-9230 |

370/280 |

4.20%/3.13% |

(5) South China

|

Province / city |

Model |

Price 6.29 |

Price 7.6 |

Rise and fall |

Amplitude |

|

Guangdong |

92# |

8750-9100 |

8950-9150 |

200/50 |

2.29%/0.55% |

|

95# |

9000-9400 |

9200-9450 |

200/50 |

2.22%/0.53% |

|

|

Hainan |

92# |

8750-8800 |

8850-8950 |

100/150 |

1.14%/1.70% |

|

95# |

8950-9000 |

9050-9150 |

100/150 |

1.12%/1.67% |

|

|

Fujian |

92# |

8650-8700 |

8800-8850 |

150/150 |

1.73%/1.72% |

|

95# |

8900-8950 |

9050-9100 |

150/150 |

1.69%/1.68% |

(6) Northwest China

|

Province / city |

Model |

Price 6.29 |

Price 7.6 |

Rise and fall |

Amplitude |

|

Ningxia Hui Autonomous region |

92# |

8600-8600 |

8750-8750 |

150/150 |

1.74%/1.74% |

|

95# |

8800-8800 |

8950-8950 |

150/150 |

1.70%/1.70% |

|

|

Xinjiang Uygur Autonomous region |

92# |

9365-9365 |

9365-9365 |

0/0 |

0.00%/0.00% |

|

95# |

9895-9895 |

9895-9895 |

0/0 |

0.00%/0.00% |

|

|

Gansu |

92# |

8600-9620 |

8800-9620 |

200/0 |

2.33%/0.00% |

|

95# |

10160-10160 |

10160-10160 |

0/0 |

0.00%/0.00% |

|

|

Xizang Autonomous region |

92# |

9320-9370 |

9370-9370 |

50/0 |

0.54%/0.00% |

|

95# |

9770-10130 |

10200-10200 |

430/70 |

4.40%/0.69% |

|

|

Shaanxi |

92# |

8500-8600 |

8800-9020 |

300/420 |

3.53%/4.88% |

|

95# |

8700-9400 |

8900-9400 |

200/0 |

2.30%/0.00% |

|

|

Qinghai |

92# |

8950-8950 |

9000-9000 |

50/50 |

0.56%/0.56% |

|

95# |

9350-9350 |

9400-9400 |

50/50 |

0.53%/0.53% |

(7) Southwest China

|

Province / city |

Model |

Price 6.29 |

Price 7.6 |

Rise and fall |

Amplitude |

|

Yunnan |

92# |

9000-9100 |

9050-9150 |

50/50 |

0.56%/0.55% |

|

95# |

9330-9550 |

9400-9600 |

70/50 |

0.75%/0.52% |

|

|

Sichuan |

92# |

8750-8830 |

9000-9050 |

250/220 |

2.86%/2.49% |

|

95# |

9000-9100 |

9200-9300 |

200/200 |

2.22%/2.20% |

|

|

Guangxi Zhuang Autonomous region |

92# |

8800-8800 |

8900-8950 |

100/150 |

1.14%/1.70% |

|

95# |

9050-9100 |

9150-9250 |

100/150 |

1.10%/1.65% |

|

|

Guizhou |

92# |

8900-8950 |

9050-9100 |

150/150 |

1.69%/1.68% |

|

95# |

9200-9250 |

9350-9400 |

150/150 |

1.63%/1.62% |

|

|

Chongqing |

92# |

8750-8800 |

8850-8950 |

100/150 |

1.14%/1.70% |

|

95# |

9000-9200 |

9100-9300 |

100/100 |

1.11%/1.09% |

(8) Northeast geochemistry

|

Province / city |

Model |

Price 6.29 |

Price 7.6 |

Rise and fall |

Amplitude |

|

Jilin |

92# |

8500-8500 |

8600-8600 |

100/100 |

1.18%/1.18% |

|

95# |

8700-8700 |

8800-8800 |

100/100 |

1.15%/1.15% |

|

|

Liaoning |

92# |

- |

- |

- |

- |

|

95# |

- |

- |

- |

- |

(9) East China geochemistry

|

Province / city |

Model |

Price 6.29 |

Price 7.6 |

Rise and fall |

Amplitude |

|

Jiangsu Province |

92# |

8360-8500 |

8580-8730 |

220/230 |

2.63%/2.71% |

|

95# |

8520-8650 |

8730-8880 |

210/230 |

2.46%/2.66% |

(10) Central China Refinery

|

Province / city |

Model |

Price 6.29 |

Price 7.6 |

Rise and fall |

Amplitude |

|

Hubei province |

92# |

8550-8550 |

8740-8740 |

190/190 |

2.22%/2.22% |

|

95# |

8750-8750 |

8940-8940 |

190/190 |

2.17%/2.17% |

(11) geochemistry in North China

|

Province / city |

Model |

Price 6.29 |

Price 7.6 |

Rise and fall |

Amplitude |

|

Henan |

92# |

8420-8460 |

8550-8890 |

130/430 |

1.54%/5.08% |

|

95# |

8520-8560 |

8650-8990 |

130/430 |

1.53%/5.02% |

(12) Shandong Geolian

|

Province / city |

Model |

Price 6.29 |

Price 7.6 |

Rise and fall |

Amplitude |

|

Shandong |

92# |

8300-8560 |

8500-8780 |

200/220 |

2.41%/2.57% |

|

95# |

8400-8800 |

8650-8900 |

250/100 |

2.98%/1.14% |

(13) Northwest Refinery

|

Province / city |

Model |

Price 6.29 |

Price 7.6 |

Rise and fall |

Amplitude |

|

Ningxia Hui Autonomous region |

92# |

8350-8450 |

8700-8900 |

350/450 |

4.19%/5.33% |

|

95# |

8500-8600 |

8850-9050 |

350/450 |

4.12%/5.23% |

|

|

Shaanxi |

92# |

8500-8500 |

8700-8700 |

200/200 |

2.35%/2.35% |

|

95# |

8700-8700 |

8900-8900 |

200/200 |

2.30%/2.30% |

|

|

Xinjiang Uygur Autonomous region |

92# |

8750-8750 |

8900-8900 |

150/150 |

1.71%/1.71% |

V. Future forecast

From the perspective of international crude oil, the peak season of oil consumption in the United States is OK, coupled with the Saudi production reduction plan to boost the market mentality. By the end of June, US crude oil stocks had fallen by about 4.4 million barrels. There are many positive factors in international crude oil, and more attention should be paid to Russia's political instability. From the demand point of view, many places issued summer holiday notices, the number of tourists may increase the demand for fuel consumption of vehicle air conditioners, forming a certain bottom support for oil prices. From the point of view of refinery shipments, with the weakening of the impact of macro news, refinery production and marketing is not balanced, slightly burdened with storage. In addition, at present, the number of maintenance refineries is relatively small, at the same time, the processing load of heavy refineries is increased, and the supply of spot gasoline resources is relatively abundant. Taken together, it is expected that there is room for upward adjustment in China's gasoline market in the short term.

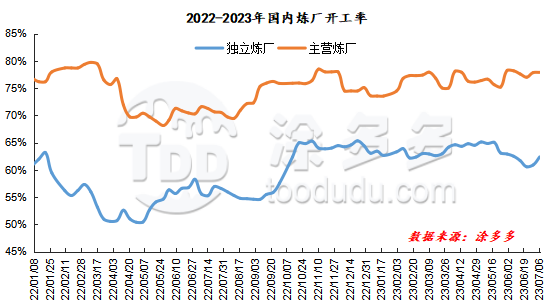

VI. Operating rate

This week (20230629-20230706) China's main operating rate was 77.9%, up 0.05% from last week, and local refinery operating rate was 62.37%, up 1.47% from last week. The start-up of the main refinery is relatively stable, and the operating rate of the local refinery has increased.

Supply and demand & profit

Supply and demand: this week, China's oil product output is 3.1806 million tons, China's main output is 2.2918 million tons, China's independent refineries output 888800 tons, China's independent refinery gasoline sales of 917800 tons, China's commercial inventory of 13.1414 million tons.

Profit: main comprehensive oil refining weekly production gross profit 787.32 yuan / ton, georefining comprehensive oil refining weekly production gross profit 903.26 yuan / ton, atmospheric and vacuum weekly production gross profit 519 yuan / ton, FCC weekly production gross profit-66 yuan / ton, delayed coking weekly production gross profit 741 yuan / ton.

VIII. Plant maintenance schedule

|

Maintenance schedule of main refineries in China |

||||

|

Refinery |

Inspection and repair device |

Maintenance capacity (10,000 tons) |

Start time |

End time |

|

Beihai Refining and Chemical Industry |

Catalytic cracking |

210 |

March 1, 2023 |

March 31, 2023 |

|

Daqing Refining and Chemical Industry |

Whole plant overhaul |

550 |

August 3, 2023 |

September 23, 2023 |

|

Daqing Petrochemical |

Whole plant overhaul |

1000 |

June 15, 2023 |

July 24, 2023 |

|

Guangzhou Petrochemical Corporation |

Atmospheric and vacuum decompression |

500 |

October 15, 2023 |

December 5, 2023 |

|

Harbin Petrochemical |

Whole plant overhaul |

435 |

May 5, 2023 |

June 23, 2023 |

|

Huizhou Refining and Chemical Industry |

The first phase of the whole plant |

1200 |

March 15, 2023 |

Mid-May 2023 |

|

Jinling Petrochemical |

Atmospheric and vacuum decompression |

600 |

April 10, 2023 |

May 26, 2023 |

|

Lanzhou Petrochemical |

Whole plant overhaul |

1050 |

June 11, 2023 |

August 9, 2023 |

|

Liaoyang Petrochemical Company |

Whole plant overhaul |

900 |

April 10, 2023 |

May 24, 2023 |

|

Luoyang Refining and Chemical Industry |

Whole plant overhaul |

1000 |

May 15, 2023 |

July 8, 2023 |

|

Qingdao Refining and Chemical Industry |

Whole plant overhaul |

1200 |

May 16, 2023 |

July 9, 2023 |

|

Sichuan Petrochemical Company |

Whole plant overhaul |

1000 |

September 15, 2023 |

November 20, 2023 |

|

Tahe petrochemical |

Diesel oil hydrogenation |

/ |

March 19, 2023 |

March 31, 2023 |

|

Tianjin Petrochemical Company |

Atmospheric and vacuum decompression |

250 |

September 5, 2023 |

October 31, 2023 |

|

Urumqi petrochemical |

Whole plant overhaul |

850 |

April 15, 2023 |

June 18, 2023 |

|

Dongxing in Zhanjiang |

Whole plant overhaul |

500 |

October 5, 2023 |

December 5, 2023 |

|

Changqing Petrochemical Company |

Whole plant overhaul |

500 |

April 1, 2023 |

May 25, 2023 |

|

Zhenhai Refining and Chemical Industry |

Atmospheric and vacuum decompression |

1000 |

March 10, 2023 |

May 5, 2023 |

|

China National Oil and Gas Taizhou |

Whole plant overhaul |

600 |

May 12, 2023 |

End of June 2023 |

|

Maintenance schedule of local refinery plant |

||||

|

Refinery |

Inspection and repair device |

Maintenance capacity (10,000 tons) |

Start time |

End time |

|

Dalian Hengli |

Hydrogenation of wax oil and residue |

/ |

May 20, 2023 |

To be determined |

|

Dalian Jinyuan |

Whole plant overhaul |

220 |

July 2023 |

August 2023 |

|

Dongying Petrochemical Company |

Whole plant overhaul |

350 |

March 12, 2023 |

May 10, 2023 |

|

Fengli petrochemical |

Whole plant overhaul |

260 |

Early June 2023 |

To be determined |

|

Kenli Petrochemical |

Whole plant overhaul |

300 |

May 20, 2023 |

June 20, 2023 |

|

Lanqiao Petrochemical |

Coking, atmospheric and vacuum |

470 |

June 15, 2023 |

July 15, 2023 |

|

Lijin refining and chemical industry |

Whole plant overhaul |

350 |

August 2023 |

To be determined |

|

United petrochemical |

Whole plant overhaul |

420 |

April 9, 2023 |

May 19, 2023 |

|

Liaoning Baolai |

Catalysis, hydrogenation, etc. |

/ |

January 30, 2023 |

February 23, 2023 |

|

Liaoning Huajin |

Whole plant overhaul |

2400 |

August 2023 |

September 2023 |

|

Diesel oil hydrogenation |

/ |

March 8, 2023 |

March 15, 2023 |

|

|

Panjin Haoye |

Fault shutdown |

650 |

January 15, 2023 |

June 15, 2023 |

|

Qicheng petrochemical |

Rotation inspection |

350 |

August 2023 |

To be determined |

|

Shenchi chemical industry |

Catalytic cracking |

120 |

January 22, 2023 |

February 20, 2023 |

|

Wantong Petrochemical |

Whole plant overhaul |

650 |

Early July 2023 |

To be determined |

|

Xinhai Sinopec |

Whole plant overhaul |

600 |

April 26, 2023 |

July 26, 2023 |

|

Xintai Petrochemical |

Rotation inspection |

220 |

End of February 2023 |

End of June 2023 |

|

Yatong Petrochemical |

Hydrocracking |

200 |

May 27, 2023 |

July 2, 2023 |

|

Yan'an Refinery |

Whole plant overhaul |

560 |

May 20, 2023 |

July 5, 2023 |

|

Zhonghe petrochemical |

Catalysis |

100 |

March 31, 2023 |

April 15, 2023 |

|

China and overseas |

Whole plant overhaul |

300 |

February 28, 2023 |

April 20, 2023 |

|

Wudi Xinyue |

Whole plant overhaul |

240 |

June 20, 2023 |

To be determined |