Daily review of phosphate fertilizer: Jiangsu region makes up for the decline in diammonium, the market atmosphere is mainly wait-and-see (July 3)

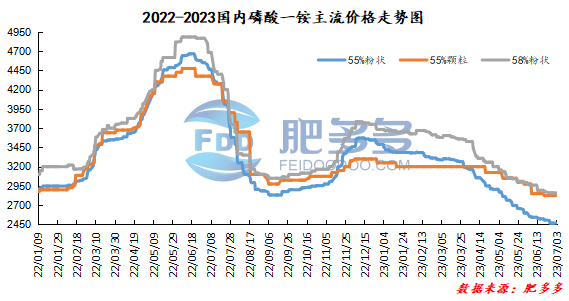

Monoammonium phosphate price index:

According to Feiduo data, on July 3, the 55% powder index of China's monoammonium phosphate was 2467.50, stable; the 55% particle index was 2825.00, stable; and the 58% powder index was 2860, stable.

Monoammonium phosphate market analysis and forecast:

At the beginning of the week, China's monoammonium phosphate market was in a stalemate, and mainstream market prices had no fluctuations. In summer, the production end of compound fertilizers is basically over, and downstream shipments turn weak. Affected by the low demand and price center of gravity, the operating load of factory equipment continued to decrease within a narrow range. The raw material synthetic ammonia market has risen within a narrow range. Prices of sulfur and phosphate rock have stabilized at low levels so far over the weekend, and cost support continues to be weak. Overall, the monoammonium market was dragged down by demand in the summer and was still some way from the peak autumn sales season. The market conditions were temporarily stable.

Specific market prices in each region are as follows:

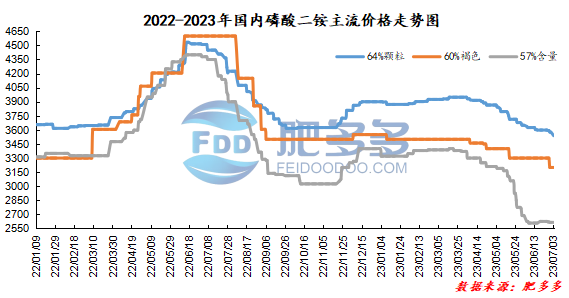

Diammonium phosphate price index:

According to Feiduo data, on July 3, the 64% particle index of China's mainstream diammonium phosphate was 3,538.33, down; the 60% brown index was 3,200.00, stable; and the 57% content index was 2615, stable.

Diammonium phosphate market analysis and forecast:

Today, the focus of China's diammonium phosphate market has been adjusted sporadically, mainly reflected in the sharp drop in the price of 64% of grains in Jiangsu by 150-300 yuan/ton. Support at the raw material side is weak, and prices are temporarily stable. The start-up of diammonium companies has declined within a narrow range, and China's new orders have not been followed up. The company's focus is currently on export sources and shipments. As the heat of topdressing in summer dissipates, downstream demand weakens, diammonium has entered the off-season sales, and there is still some time for autumn fertilization. Therefore, downstream parties are not eager to centrally purchase autumn fertilizer raw materials and adopt a wait-and-see attitude. On the whole, the short-term diammonium market is mainly consolidating, and it is not ruled out that some regions will make up for sporadic losses.

Specific market prices in each region are as follows: