Daily Review of Urea: The northern region is still in a firm operation (June 27)

China Urea Price Index:

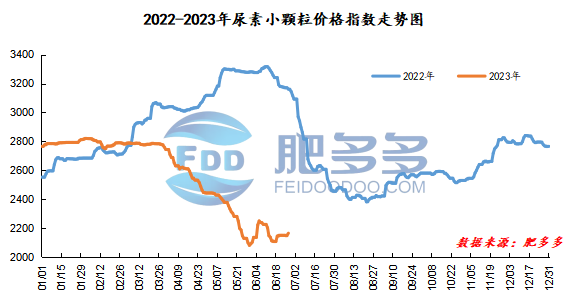

According to Feiduo data, the urea small pellet price index on June 27 was 2,163.86, up 13.64 from yesterday, up 0.63% month-on-month, and down 31.55% year-on-year.

Urea futures market:

The price of the urea UR2309 contract remained high and volatile today, closing at 1761 in late trading. The opening price of the Urea UR2309 contract: 1760, the highest price: 1774, the lowest price: 1748, the settlement price: 1762, the closing price: 1761, the closing price increased by 27, or 1.56% compared with the settlement price of the previous trading day. The daily fluctuation range is 1748-1774, and the spread is 26; The 09 contract has increased its positions by 9215 lots today, and has held 423820 lots so far.

Spot market analysis:

China's spot market prices increased sporadically today, with prices rising significantly in South China, while other regions mostly maintained a narrow adjustment of 10-40 yuan/ton. At present, supply in the Chinese market is relatively stable. Although there are some parking in the Northeast and Southwest regions, the overall start-up has not fluctuated. On the cost side, although coal prices have rebounded slightly recently, the basic market supply and demand have not changed much, and cost support is limited. Specifically, prices in Northeast China have stabilized at 2,110 - 2,300 yuan/ton. Prices in North China rose to 1,960 - 2,160 yuan/ton. Prices in the northwest region are stable at 2,090 - 2,100 yuan/ton. Prices in Southwest China have stabilized to 2,000 - 2,250 yuan/ton. Prices in East China rose to 2,090 - 2,190 yuan/ton. The price of small and medium-sized particles in Central China has stabilized at 2,050 - 2,350 yuan/ton, and the price of large particles has risen to 2,100 - 2,140 yuan/ton. Prices in South China rose to 2,270 - 2,350 yuan/ton.

Market outlook forecast:

In terms of futures, futures prices have fluctuated at high levels in recent days, which has actively supported the spot market. At the same time, there is still room for arbitrage on the basis. Simply put, although there were equipment overhauls during the week, equipment resumed production at the same time, and the overall market supply did not change much. At present, the inventory of large factories is low, and stocks will be accumulated later or as demand decreases. On the demand side, agricultural corn topdressing is underway in some northern regions, and the demand for rice fertilizer in the south is gradually starting, so agricultural demand may be stable and improving. However, in terms of industrial demand, plywood factories often use them as they please, and traders purchase cautiously. Overall, in the short term, the urea market may be mainly stable as agricultural demand improves.