Polyester bottle chips: What has the market experienced from high-profit to loss-making?

Lead: After experiencing high profits last year, the production profits of Chinese polyester bottle sheet companies have dropped sharply this year, and have dropped to a small loss so far. In less than a year, China's polyester bottle sheet market has reversed?

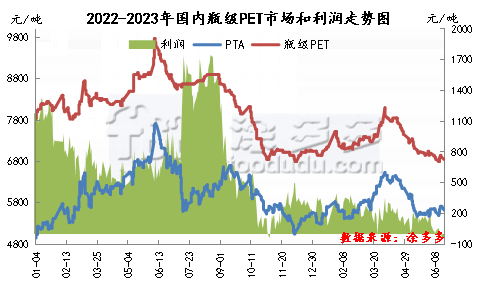

In 2022, the overall profitability of Chinese polyester bottle and chip companies will increase significantly. The average profit of Chinese companies will be 733.33 yuan/ton, while the average profit of Chinese companies in 2021 will be 304.29 yuan/ton, an increase of 141%. In 2022, international crude oil prices will rise, and the polyester raw materials PTA and ethylene glycol markets will remain high and volatile, and costs will promote the market. Due to downstream advance stocking and the significant increase in foreign trade export volume, bottle and tablet manufacturers 'sales have been collectively oversold. Manufacturers have concentrated on selling long-term supplies, which has intensified the market spot tension. The market spot price remains high, so the company's production profits have doubled. growth. The highest profit in 2022 will be around 1750 yuan/ton in August. From July to August, the profit of bottle and chip companies will continue to remain at a high level of more than 1000 yuan/ton.

However, since the fourth quarter of last year, as the spot resources of polyester bottles and chips have become more relaxed and the lack of cost support, the decline in the spot market of polyester bottles and chips has accelerated. By the beginning of November, the profits of polyester bottles and chips companies have fallen to the profit and loss line. level near. 11-12 In June, the polyester bottle sheet market gradually tended to be low and volatile, while the polyester raw material market trend was still weak. Therefore, the profits of polyester bottle sheet companies began to rebound slightly, but the overall profit level was still low. In the first half of this year, China's polyester bottle slices followed closely the polyester raw material PTA market and fluctuated within a narrow range. Therefore, corporate profits have been hovering at a low level between 100-400 yuan/ton, of which the average production profit of polyester bottle slices in the first half of the year was 200.91 yuan/ton. After June, as the polyester bottle sheet market continued to weaken, the company's profit situation shrank sharply. So far, the company's production has begun to enter a small loss situation.

The main reason for the long-term low corporate profits this year is the large amount of new production capacity. In the first half of the year, China's new production capacity of polyester bottles and chips reached 1.95 million tons, with a production capacity growth rate of 16%. Spot resources in the market tend to be loose. This year, due to the impact of the overall global economic situation, the number of export orders from bottle and chip companies has decreased and foreign trade orders have been poor. Therefore, China's sales pressure has increased. However, China's terminal demand continues to be weak, and downstream procurement enthusiasm is low., the market supply and demand side has weakened, so the polyester bottle and chip market has been in a low range for a long time, and corporate inventories will gradually enter the accumulation channel, making it difficult for corporate profits to change.

Although China's polyester bottle sheet has once again entered a period of rapid production capacity growth, the production capacity of major bottle sheet manufacturers such as Sanfangxiang and Yisheng will continue to expand. Coupled with the active investment of new companies such as Fujian Baihong, Anhui Haoyuan, Xinjiang Yipu, and Fuhai, polyester bottle sheet production capacity is facing new excess pressure. Therefore, during the redistribution of industry supply and demand, China's polyester bottle sheet profits may remain low and hovering for some time.