Daily Review of Urea: No positive impact on the implementation of the stamp label supports loose supply and demand and weak prices (June 14)

China Urea Price Index:

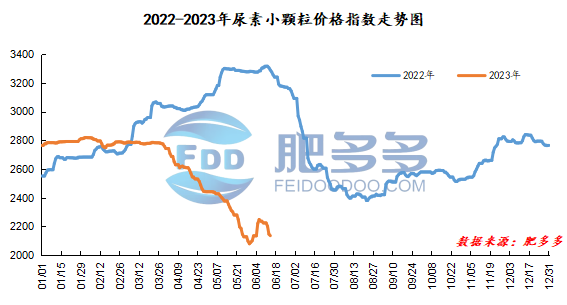

According to Feiduo data, the urea small pellet price index on June 14 was 2,136.14, down 10.45 from yesterday, down 0.49% month-on-month, and down 35.08% year-on-year.

Urea futures market:

The price of the urea UR2309 contract rose first and then fell today, with little overall change. After the opening of early trading, futures prices fluctuated and mainly rose. In the afternoon, the market reached a high of 1711 and then fell again, closing at 1671 in the late session. The opening price of the Urea UR2309 contract: 1670, the highest price: 1711, the lowest price: 1660, the settlement price: 1682, and the closing price: 1671. Compared with the settlement price of the previous trading day, the closing price increased by 21, or 1.27%. The daily fluctuation range is 1660-1711, and the price difference is 51; The 09 contract has reduced its position by 2890 lots today, and has held 439029 lots so far.

Spot market analysis:

Today, China's urea spot market prices have been adjusted sporadically, with mainstream quotations in Central, South and East China slightly lowered by 20-40 yuan/ton. Affected by the implementation of the stamp label, most markets believe that prices in the Chinese market are rising and it is difficult to align with international prices. Therefore, expectations for China's spot prices will decline, and downstream purchasing sentiment is not high. Specifically, prices in Northeast China have stabilized at 2,080 - 2,260 yuan/ton. Prices in North China range from 1,900 to 2,200 yuan/ton. Prices in Northwest China fell to 2,060 - 2,170 yuan/ton. Prices in Southwest China are stable at 2,000 - 2,450 yuan/ton. Prices in East China fell to 2,060 - 2,160 yuan/ton. The price of small and medium-sized particles in Central China fell to 1,970 - 2,380 yuan/ton, and the price of large particles stabilized at 2,250 - 2,370 yuan/ton. Prices in South China fell to 2,150 - 2,200 yuan/ton.

Market outlook forecast:

In terms of futures, today's futures prices rose first and then fell. The rebound in disk prices brought good benefits to the spot, but they weakened again in the afternoon, and the impact was of little significance. However, there is still a large amount of arbitrage space in the market, and the market is cautiously waiting and seeing. Fundamentally speaking, the early judgment is basically maintained. First of all, the pressure on the supply side is on the high side. In the past few days, when the demand for hoarding surged, there was no significant pressure. However, with the increase in urea production capacity in the later period and the demand for hoarding decreased, the pressure on urea supply has restrained the market. And this wave of urea has soared and plunged, and the actual removal of warehouse is not ideal. Secondly, looking at the demand side, the current market for corn base fertilizer in North China and topdressing in northwest and northeast China has ended. Industrial demand is light. The compound fertilizer industry has started to decline, and demand has gradually declined. In terms of cost, port coal remains low and cost support is insufficient. In terms of exports, the price quoted on the East Coast has declined compared with the Chinese market price when the stamp is implemented, which has put pressure on the Chinese market. On the whole, as the positive factors in the market disappear and the negative factors increase, spot prices will continue to decline in the later period.