Polyester: Where will the high-load + low-demand market go?

Lead: Since late May, the overall operating load of Chinese polyester companies has risen to a high of around 90%. However, as the weather gets hotter, the terminal weaving operating rate has begun to turn downward, dragging down the off-season demand, and polyester companies 'inventories will face greater pressure.

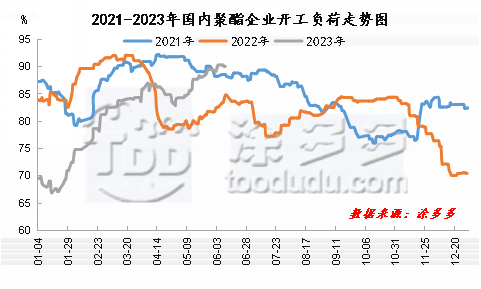

Since May, as the pressure on polyester production costs has eased, the production efficiency of polyester companies has gradually improved, and the company's production profits have steadily rebounded. By the end of May, all polyester products have achieved small profits. With the improvement of profits, polyester companies 'enthusiasm for production has increased, and units that have been overhauled or reduced production have gradually recovered. By late May, the overall operating load of Chinese polyester companies has risen to a high of around 90%, higher than the same period in previous years. level.

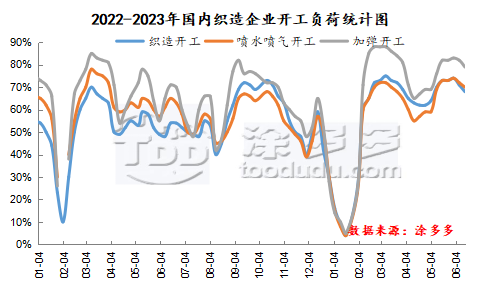

As the weather gets hotter, the terminal weaving operating rate is facing a gradual downward trend. Weaving demand has entered the off-season of traditional demand. Starting in June, the starting load of Chinese weaving companies has turned to decline. As of last weekend, the starting load of weaving companies has dropped by 3% to 70%, the starting load of companies with additional elasticity dropped to 80%, the inventory of weaving companies remains at a high level around 32-33 days, and the number of orders received by companies has gradually slowed down.

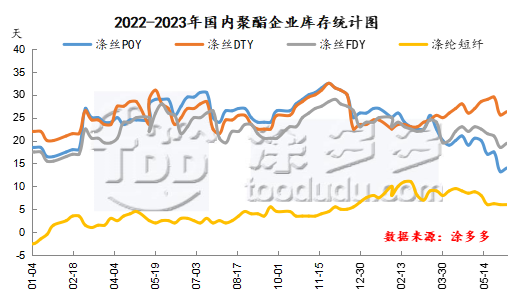

With the recovery of polyester companies 'start-ups and the impact of the off-season of terminal demand, downstream buying has slowed down, production and sales of companies have been sluggish, and the inventory level of polyester companies has begun to increase. As of the end of last week, China's polyester POY factory inventory was 13-15 days, an increase of 0.8 days from last week;FDY factory inventory was 18-20 days, an increase of 1 day from last week;DTY inventory was 26-28 days, an increase of 0.5 days from last week. The polyester staple fiber enterprise bank exists for about 5-7 days.

Concerns that the slowdown in global economic growth may curb demand continue, and the cycle of interest rate hikes by the European and American central banks has not ended. The international crude oil market has fallen, macro expectations have weakened, and the supply of polyester raw materials PTA and ethylene glycol market is expected to increase. However, downstream polyester companies are under high load. With just needed support, the market will tend to consolidate, and costs will push the market. The market is mainly cautious and wait-and-see, and terminal weaving has turned into the off-season. Demand follow-up is poor, and market production and sales are sluggish. It is expected that short-term polyester market prices may fluctuate low with costs. In the later period, we will pay close attention to changes in the raw material market and demand side.