Urea Daily Review: Falling?! Downstream boycotted high-priced goods, market supply continued to be high (June 8)

China Urea Price Index:

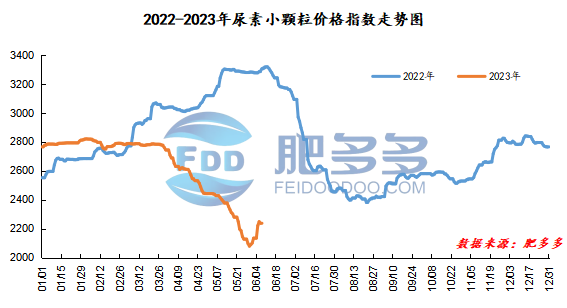

According to Feiduo data, the urea small pellet price index on June 8 was 2,234.32, down 3.41 from yesterday, down 0.15% month-on-month, and down 32.38% year-on-year.

Urea futures market:

The Urea UR2309 contract rose to the intraday high of 1702 after the opening of early trading today and fell. In the afternoon, futures prices continued to fluctuate at low levels, closing at 1672 in late trading, and futures prices continued to decline during the week. The opening price of the Urea UR2309 contract: 1675, the highest price: 1702, the lowest price: 1656, the settlement price: 1678, the closing price fell by 7 compared with the settlement price of the previous trading day, a decrease of 0.42%. The fluctuation range of the day is 1656-1702, and the spread is 46; the 09 contract has increased its position by 6537 lots today, and the position held so far is 422444 lots.

Spot market analysis:

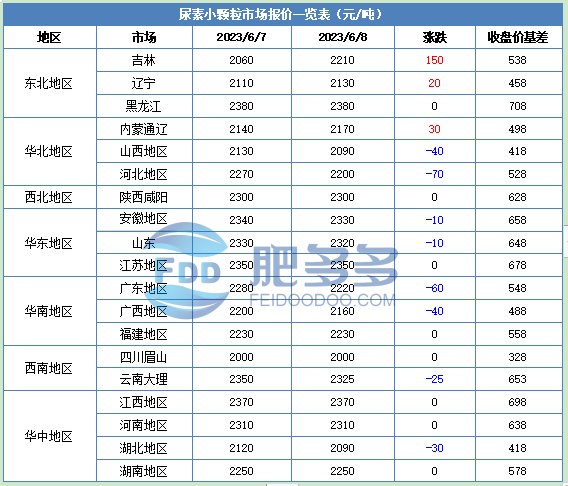

Today, China's urea spot market prices are mixed, with prices in Northeast China rising by 20-150 yuan/ton, and prices in North, South and East China falling by 10-70 yuan/ton. Today, China's urea spot market is stable and weak. After concentrated downstream replenishment in the past few days, downstream purchases have a weakening trend today. The urea factory is obviously de-stocked and still needs to be supported by orders. Therefore, although the market price has begun to decline, the company's quotation is still maintaining stability. Specifically, prices in Northeast China rose to 2,120 - 2,400 yuan/ton. Prices in North China fell to 2,090 - 2,310 yuan/ton. Prices in the northwest region are stable at 2,300 - 2,310 yuan/ton. Prices in Southwest China fell to 2,000 - 2,450 yuan/ton. Prices in East China fell to 2,300 - 2,360 yuan/ton. The price of small and medium-sized particles in Central China fell to 2,090 - 2,400 yuan/ton, and the price of large particles stabilized at 2,350 - 2,370 yuan/ton. Prices in South China fell to 2,150 - 2,230 yuan/ton.

Market outlook forecast:

In terms of futures, futures prices fluctuated and corrected during the week, and today's increased positions have been greatly weakened. High short orders may choose an opportunity to take profits at bargain hunting. Futures may still operate weakly in the later period, which provides good guidance for spot goods. The forecast for fundamentals is basically maintained in the previous period: in terms of supply, as the early maintenance equipment is put into production, the market supply has gradually rebounded to around 170,000 tons. In the long run, new urea production capacity will be released in the later period, and supply may continue to grow. The urea industry is facing Oversupply problem; on the demand side, after concentrated replenishment in the past few days, factories have obviously gone to warehouses, and downstream demand has been basically met. Nowadays, most of them are resisting high-priced supply sources and mainly purchasing small quantities. Overall, the spot price of urea may decline steadily in the short term, and the futures price fluctuates and falls; in the long run, waiting for autumn fertilization and good guidance for exports, the spot market may turn for the better.