Phosphate fertilizer daily review: Costs continue to fall, ammonium phosphate market prices fall again! (June 5)

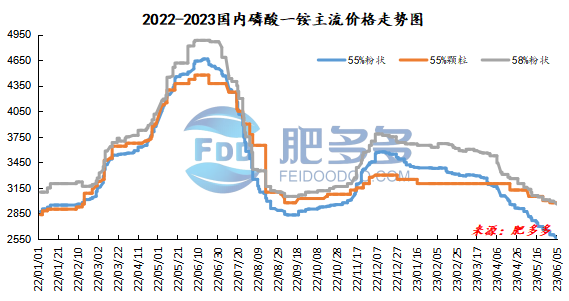

Monoammonium phosphate price index:

According to Feiduo data, on June 5, the 55% powder index of China's monoammonium phosphate was 2,550.63, down; the 55% particle index was 2,975.00, stable; and the 58% powder index was 2,960.00, down.

Monoammonium phosphate market analysis and forecast:

At the beginning of the week, prices in some areas of China's monoammonium phosphate market fell, and the market center of gravity once again moved down by 50-100 yuan/ton. The upstream synthetic ammonia market was mixed at the beginning of the week, with a wait-and-see mentality. The market price of sulfur ports fell mainly due to the strong downstream pressure on prices, the mentality of cargo holders was under pressure, and the market fluctuated downward. The phosphate ore market is still bearish, and there is no significant fluctuation in prices today. Overall, cost support continues to weaken. Today, the price of nitrogen fertilizer and urea has soared, and market trading sentiment remains online. However, observing the phosphate fertilizer market, downstream procurement is still not active due to less demand. The factory continued to operate at a low level, and the market price of monoammonium continued to decline in the short term.

Specific market prices in each region are as follows:

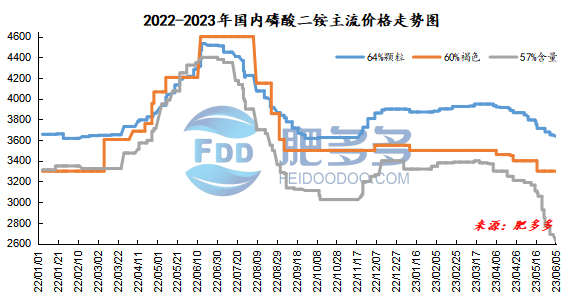

Diammonium phosphate price index:

According to Feiduo data, on June 5, the 64% particle index of China's mainstream diammonium phosphate was 3,636.67, down; the 60% brown index was 3,300.00, stable; and the 57% content index was 2,625.00, down.

Diammonium phosphate market analysis and forecast:

At the beginning of the week, the market price of diammonium phosphate in China made up for the sporadic decline. Quotes in most regions remained stable, and the price difference between products with different content was gradually widening. Taking Shandong as an example, 64% of the grains are quoted at 3,550 - 3,700 yuan/ton, while 57% of the primary colors are quoted at 2,550 - 2,700 yuan/ton. The main reason is that after the early spring plowing market ended, the construction of the diammonium industry gradually shrank. 64% of the factory's products were mostly exported or mainly collected in ports for export, while 57% of China's main supply sources maintained a small amount of demand. Due to the low production cost of 57% content products and the increased supply plans of various companies for low-content products this year, the supply of low-content products is sufficient and the delivery of goods is limited. Therefore, the price has gradually declined, opening the gap with high-content products. Recently, downstream companies have mainly made up small amounts of diammonium, and follow-up on new orders is still limited. It is expected that the diammonium market will continue its current downward trend.

Specific market prices in each region are as follows: