PVC Weekly: Futures prices are close to the pre-09 contract low, but low profit-taking prompted a small rebound, and the spot was weak during the week

I. Analysis of China's PVC market

1. Summary of China's PVC market.

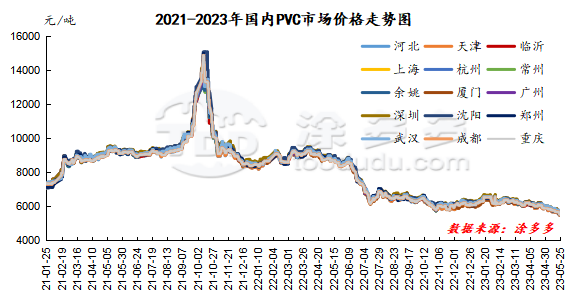

The overall comparison of spot market prices this week (2023.05.19-2023.05.25) is in a slight decline, although a small rebound in the two cities on Thursday recovered some of the decline, but failed to save the weak trend is still dominated by a comprehensive decline. The operating low of intraweek futures is no lower than the top 5577 of the 09 contract, and most people in the market are looking forward to the top low. The influencing factors of the week are as follows: 1. The futures position first exploded in the week, and the reduction of profit-taking began to appear one after another after the futures price ran to a low level, and some empty orders appeared for a short time. However, the overall operating trend is showing a continuous decline in the air. The main contract has been mainly short since its debut in 2009 after the completion of the change. Thursday's futures prices have a faint intention to hit bottom and rebound, but the high level once again faces the problem of suppression of hedging policies. 2. The price of Formosa Plastics in Taiwan was announced this week, which was lower than the rate of reduction expected by the market, but even so, the price of Formosa Plastics in Taiwan also showed a bearish trend. In June, Formosa Plastics PVC quoted a drop of US $20 / ton: CIF India CIF price US $800,000 / ton, CIF China CIF price US $785 / tonne, FOB Taiwan FOB price US $740USD / ton. 3. The macro downward pressure is great. The recent trend of most Chinese commodities, especially the coal source products, is basically weak, and the performance of real estate data is very poor. As a real estate commodity, the trend of PVC has been suppressed by funds as short positions. 4. The fundamentals of PVC due to the problem of cost and profit, although part of the production capacity has entered the maintenance period, and the maintenance period of individual enterprises is relatively long, the downturn in demand has become the main reason for restricting the prices of the two markets in the period, and has been a short bargaining chip. 5. The recessionary pressure on the outer disk persists, and under the high interest rates of the Federal Reserve, external demand does not boost much. Overall, the overall performance of the two cities during the week is weak until Thursday. From the comparison of valuation, it fell 150-165 yuan / ton in North China, 195-205 yuan / ton in East China, 150 yuan / ton in South China, 125 yuan / ton in Northeast China, 145 yuan / ton in Central China and 170 yuan / ton in Southwest China.

Futures: weekly PVC09 contract price low of 5614 is not lower than the previous low of 5577, since last Friday the futures price has been in a continuous decline, Thursday futures market has a bottoming rebound trend. Position changes during the week, including an increase of 57450 positions last Friday, 27056 positions on Monday, 29380 positions on Tuesday, and 31277 positions on Wednesday. On Thursday, futures as a whole showed a small rebound trend of bottoming out by 5614, and intraday selling prices rose. On Thursday, the position was reduced by 38430 lots, and the position in the PVC09 contract closed at 870142 lots, with the closing price of 5699.

|

Comparison of the lowest and highest prices for PVC09 contracts |

|||

|

Date |

Lowest price |

The highest price |

Rise and fall |

|

5.19 |

5766 |

5907 |

141 |

|

5.22 |

5653 |

5803 |

150 |

|

5.23 |

5685 |

5753 |

68 |

|

5.24 |

5627 |

5690 |

63 |

|

5.25 |

5614 |

5717 |

103 |

2. Market analysis of mainstream consumer areas in China.

North China: Hebei PVC market prices fell slightly in the week, spot trading terminal rigid demand-based, spot turnover improved on Thursday. As of Thursday, type 5 materials including tax 5450-5550 yuan / ton delivered, Inner Mongolia factory to 5250-5350 yuan / ton. Northern region basis offer 09 contract-(350-4000).

East China: Changzhou PVC market prices fell slightly in the week, the overall trading is general. There are both price and order quotations, the downstream demand is lukewarm, and the enthusiasm of inquiry and procurement is not high. As of Thursday, the reference for the current remittance of type 5 calcium carbide materials is 5540-5650 yuan / ton (excluding packing). East China basis offer 09 contract-(30-100).

South China: Guangzhou PVC market prices fell slightly in the week, the current spot offer in the market is limited, after the futures price down, there is a certain covering transaction, downstream products enterprises procurement enthusiasm is not high, some are still waiting and seeing. As of Thursday, ordinary type 5 calcium carbide spot pick-up mainstream transaction reference 5650-5720 yuan / ton. South China basis offer 09 contract-(0-50). The ethylene offer 1000 will be delivered to about 5720-5750 yuan / ton, and the spot stock of Dagu 1000 will be quoted at 5680-5700 yuan / ton.

Formosa Plastics of China announced the pre-sale price of PVC in June, which was 20 US dollars / ton lower than that in May. The preliminary understanding is that CIF India is at US $800 / ton, CFR China is at US $785 / tonne, and FOB China Taiwan is at US $740 / tonne.

Formosa Plastics, Taiwan Province, China, June shipping quotation: (USD / ton)

|

Region / time |

CFR India |

CFR China |

CFR Southeast Asia |

FOB Taiwan of China |

|

January |

840 |

805 |

800 |

770 |

|

February |

930 |

875-885 |

870-880 |

840 |

|

March |

970 |

925 |

920 |

880 |

|

April |

900 |

865 |

860 |

820 |

|

May |

820 |

805 |

800 |

760 |

|

June |

800 |

785 |

780 |

740 |

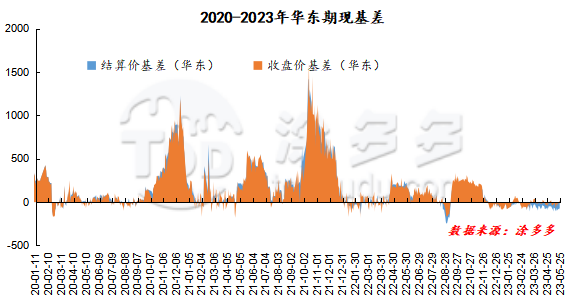

3. Comparison of cash base difference in PVC period

|

Arbitrage Analysis of PVC spread |

||||||

|

PVC |

Contract price difference |

5.19 |

5.22 |

5.23 |

5.24 |

5.25 |

|

V2309 collection |

5782 |

5682 |

5693 |

5638 |

5699 |

|

|

Average spot price in East China |

5735 |

5650 |

5650 |

5565 |

5595 |

|

|

Average spot price in South China |

5805 |

5715 |

5740 |

5655 |

5690 |

|

|

PVC2309 basis difference |

-47 |

-32 |

-43 |

-73 |

-104 |

|

|

V2401 collection |

5760 |

5670 |

5680 |

5623 |

5684 |

|

|

V2309-2401 closed |

22 |

12 |

13 |

15 |

15 |

|

|

PP2309 collection |

7032 |

6917 |

6886 |

6973 |

6982 |

|

|

Plastic L2309 collection |

7696 |

7589 |

7597 |

7658 |

7651 |

|

|

V--PP basis difference |

-1250 |

-1235 |

-1193 |

-1335 |

-1283 |

|

|

Vmure-L basis difference of plastics |

-1914 |

-1907 |

-1904 |

-2020 |

-1952 |

|

4. PVC warehouse receipt daily

|

Variety |

Warehouse / branch warehouse |

5.19 warehouse receipts |

5.22 warehouse orders |

5.23 warehouse orders |

5.24 warehouse orders |

5.25 warehouse orders |

|

Polyvinyl chloride |

Zhejiang International Trade |

986 |

986 |

926 |

801 |

801 |

|

Polyvinyl chloride |

Jiangyin Xiefeng |

609 |

609 |

609 |

609 |

609 |

|

Polyvinyl chloride |

Benniu Port, Changzhou |

1,374 |

1,374 |

1,042 |

1,042 |

1,042 |

|

Polyvinyl chloride |

Jiangsu Zhengsheng |

345 |

345 |

345 |

345 |

345 |

|

Polyvinyl chloride |

Jiangsu Yanjin |

1,701 |

1,701 |

1,701 |

1,701 |

1,701 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Benniu Port) |

900 |

900 |

900 |

900 |

900 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Railway Changxing) |

300 |

300 |

300 |

300 |

300 |

|

Polyvinyl chloride |

Yongan Capital (Benniu Port) |

798 |

798 |

798 |

798 |

798 |

|

Polyvinyl chloride |

Specialty petrochemical (Benniu Port) |

2,399 |

2,399 |

2,399 |

2,399 |

2,399 |

|

Polyvinyl chloride |

Specialty Petrochemical (Zhejiang International Trade) |

1,320 |

1,320 |

1,313 |

1,313 |

1,313 |

|

Polyvinyl chloride |

Sino-Thai Duojing (Zhejiang International Trade) |

1,238 |

1,238 |

1,238 |

1,238 |

1,238 |

|

PVC subtotal |

|

11,970 |

11,970 |

11,571 |

11,446 |

11,446 |

|

Total |

|

11,970 |

11,970 |

11,571 |

11,446 |

11,446 |

5. Future forecast

Futures: & when the futures price of the nbsp; PVC09 contract is running to 5614, which is close to 5577 before the 09 contract, there is a profit-taking trend of reducing positions, of which the air level is 26.9% higher than 24.2%. The unwinding of short positions led to a small rebound in futures prices, but there is a lack of momentum around 5700, and the higher the futures prices run, the more hedging demand will appear to match spot sales, and this demand is sufficient to lead to the hovering characteristics of relative highs. Therefore, from the trend of trading, on the one hand, the rebound of futures prices is faced with hedging considerations, on the other hand, how to return to the reduction of positions on Thursday? Therefore, we believe that the upward price of reducing positions can not be used as a judgment of improvement, but a phased departure and wait-and-see. Continue to observe the performance of the running trend between the middle tracks under the Bollinger belt from 5600 to 5750.

Spot: Thursday futures price rebound led to an improvement in trading, the spot market appeared a certain amount of delivery volume during the week. From the point of view of mentality, there is a certain rigid demand for some industrial chains in the two markets before the low time. Although it is not speculative demand, appropriate low-level replenishment also optimizes the purchasing cost of demand-side enterprises accordingly. Although the current futures market is also difficult to judge as the beginning of improvement, the rebound in the price of reducing positions only represents a wait-and-see mentality, so although there is volume, it is far from reaching a good state of normalization. From the perspective of PVC fundamentals, more and more people in the market begin to pay attention to the cost port, and the continuous downward price of the two cities is expected to increase gradually from the support of cost, so this is also the foundation for the market to pay attention to the previous low. However, the game at the supply and demand level is always based on the difficulty of improving demand, and there is not enough power for the price rebound of the two cities. On the outer disk, the market has been paying attention to the debt ceiling and interest rates. The deadline for raising the federal government's borrowing limit to avoid default is approaching, but the negotiations show no sign of progress, putting pressure on broader markets. On the whole, the price performance of PVC in the short term is still low and narrow.

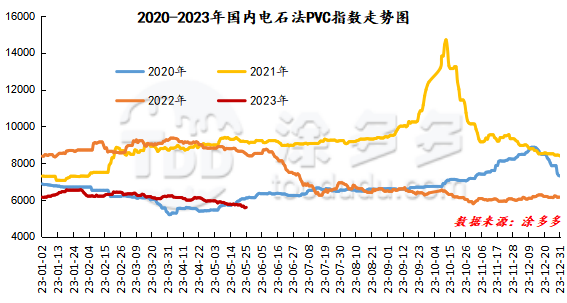

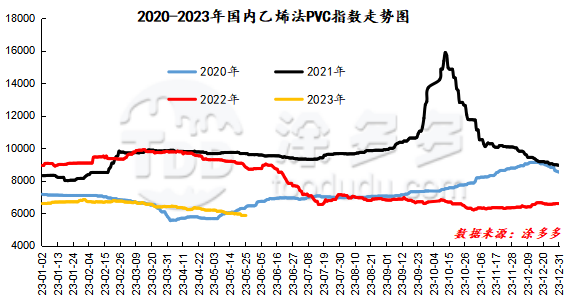

6. China PVC Index

According to Tuduoduo data, the PVC spot index of China's calcium carbide method rose 18.63, or 0.334%, to 5590.3 on May 25. The ethylene PVC spot index was 5853.66, down 2.14, with a range of 0.037%. The calcium carbide index rose, the ethylene index decreased, and the ethylene-calcium carbide index spread was 263.36.

7. The market price of PVC this week

Unit: yuan / ton

|

Region |

Date |

Price specification |

Price range |

2023/5/18 |

2023/5/25 |

Rise and fall |

|

North China |

Hebei |

Send to cash remittance |

5620-5700 |

5660 |

5510 |

-150 |

|

Tianjin |

Send to cash remittance |

5620-5700 |

5660 |

5510 |

-150 |

|

|

Linyi |

Send to cash remittance |

5700-5760 |

5730 |

5565 |

-165 |

|

|

East China |

Shanghai |

Cash out of the warehouse |

5690-5840 |

5765 |

5565 |

-200 |

|

Hangzhou |

Cash out of the warehouse |

5770-5860 |

5815 |

5610 |

-205 |

|

|

Changzhou |

Cash out of the warehouse |

5750-5830 |

5790 |

5595 |

-195 |

|

|

Yuyao |

Cash out of the warehouse |

5660-5830 |

5745 |

5545 |

-200 |

|

|

Xiamen |

Cash out of the warehouse |

5800-5880 |

5840 |

5650 |

-190 |

|

|

South China |

Guangzhou |

Cash out of the warehouse |

5800-5880 |

5840 |

5690 |

-150 |

|

Shenzhen |

Cash out of the warehouse |

5760-5960 |

5860 |

5710 |

-150 |

|

|

Northeast China |

Shenyang |

Send to cash remittance |

5650-5750 |

5700 |

5575 |

-125 |

|

Central China |

Zhengzhou |

Send to cash remittance |

5700-5800 |

5750 |

5605 |

-145 |

|

Wuhan |

Send to cash remittance |

5750-5800 |

5775 |

5630 |

-145 |

|

|

Southwest |

Chengdu |

Send to cash remittance |

5600-5750 |

5675 |

5505 |

-170 |

|

Chongqing |

Send to cash remittance |

5600-5750 |

5675 |

5505 |

-170 |

8. List of equipment in production enterprises this week

|

List of equipment maintenance in PVC Enterprises in China |

|||

|

Technics |

Enterprise name |

Production capacity |

Device change |

|

Calcium carbide method |

Yunnan southern phosphorus |

24 |

Parking on April 1, 2019, recovery time to be determined, currently in test run |

|

Salinization of Mount Tai |

10 |

Parking on September 29th, 2022, recovery time to be determined |

|

|

Henan Shenma |

30 |

Parking on August 12, 2022, recovery time to be determined |

|

|

Hengyang Kingboard |

22 |

Parking on March 1, 2023, recovery time to be determined |

|

|

Huojiagou, Shanxi |

16 |

The start of construction dropped to 20% on January 21, 2023, and the recovery time has yet to be determined. |

|

|

Lutai chemistry |

36 |

Parking on April 25, 2023 and expected to resume on May 26 |

|

|

Nangang, Yili |

12 |

Plan for parking maintenance from May 8 to 18 |

|

|

Shanxi Jintai |

30 |

Scheduled for overhaul in May |

|

|

Heilongjiang Haohua |

30 |

Expected to be overhauled in late May |

|

|

Yibin Tianyuan |

38 |

Plan to overhaul from May to June in 2023, cooperate with electric power |

|

|

Hubei Yihua |

5 |

Scheduled for overhaul on May 20, 2023 and expected to resume on May 24 |

|

|

Shanxi Yushe |

40 |

It is planned to overhaul for about three days in mid-June 2023. |

|

|

Medium salt Inner Mongolia |

40 |

Planned for 7-10 days of maintenance on June 25, 2023 |

|

|

Ordos |

40 |

The first factory is expected to be overhauled in June. |

|

|

Inner Mongolia is suitable for change. |

30 |

Scheduled for maintenance on June 10, 2023 |

|

|

Ethylene process |

Yangmei Hengtong |

30 |

It is expected to be overhauled for about a month on May 10, and it is scheduled to resume on June 9. |

|

Suzhou Huasu |

13 |

Temporary parking on April 27, 2023, scheduled to resume on May 6 |

|

|

Shanghai chlor-alkali |

6 |

Scheduled for maintenance in June 2023 |

|

2. PVC paste resin

1. Market analysis and forecast of PVC this week.

This week (2023.05.19-2023.05.25) the overall trend of the PVC paste resin market remains weak, the overall performance of corporate shipments is poor, the enthusiasm for receiving goods downstream is limited, the overall transaction performance of the market is light, the cost side of the calcium carbide market is mostly stable, and the paste resin market is not supported enough. Market price: PVC paste resin large plate price 6800-7100 yuan / ton, glove material sent to the price 7300-7700 yuan / ton, the actual transaction price negotiation. At present, the PVC paste resin market shipping pressure is not reduced, the downstream demand is not good, the overall market turnover is not ideal, the business mentality is more bearish to the future, it is expected that the short-term PVC paste resin market will maintain a weak situation.

2. Statistics on the start-up of PVC paste resin manufacturers this week

This week (2023.05.19-2023.05.25) the operating rate of PVC paste resin enterprise is 55.16%. Sichuan Xinjin Road Group Co., Ltd. PVC paste resin device (20 000 tons / year) has not been put into production; Jiyuan Fangsheng Chemical Co., Ltd. PVC paste resin device (60 000 tons / year) production process is micro-suspension method, paste resin device is still shut down. Binzhou Zhenghai Group-Wudi Xinchuang Ocean Technology Co., Ltd. PVC paste resin device (40, 000 tons / year) was stopped for maintenance on April 23, 2021, but not in production. Inner Mongolia Yidong Group Dongxing Chemical Co., Ltd. PVC paste resin device (100000 tons / year) stop and repair around March 27th, 2022. Qinghai Salt Lake Haina Chemical Co., Ltd. PVC paste resin device (35000 tons / year) parking maintenance, start-up time to be determined.

|

Manufacturer name |

Production capacity (10,000 tons / year) |

Maintenance plan |

|

Shenyang Chemical Industry |

20 |

Normal |

|

Shandong Langhui Oil |

14 |

Normal |

|

Anhui Tianchen |

13 |

Normal |

|

Inner Mongolia Junzheng |

10 |

Normal |

|

Yidong Dongxing, Inner Mongolia |

10 |

Overhaul on March 27, 2022, recovery time to be determined |

|

Jiangsu Corning Chemistry |

10 |

Normal |

|

Xinjiang Tianye |

10 |

Normal |

|

Medium salt Inner Mongolia |

9 |

Normal |

|

Xinjiang Zhongtai |

9 |

Normal |

|

Three friends of Tangshan |

8 |

Normal |

|

Inner Mongolia Chenghongli |

8 |

Normal |

|

Formosa Plastics Industry (Ningbo) |

7 |

Normal |

|

Ningxia Yinglite |

4 |

Normal |

|

Jining Bank of China |

4 |

Parking on March 29th, 2023, no recovery plan for the time being |

|

Landscape in Yichang, Hubei Province |

4 |

Normal |

|

Binzhou Zhenghai Group-Wudi newly created Ocean |

4 |

Maintenance on April 23, 2021, no recovery plan for the time being |

|

Qinghai Salt Lake Haina Chemical Industry |

3.5 |

Overhauled in mid-April 2022, no recovery plan for the time being |

|

Sichuan Xinjin Road Group |

2 |

Normal |

III. Key analysis of related chlor-alkali products

1. Calcium carbide

This week (2023.05.19-2023.05.25) China's calcium carbide market as a whole showed a trend of rising first and then stable, with mainstream factory quotations and downstream receiving prices rising regionally, with factory quotations in Wuhai and Ningxia rising by 25-50 yuan / ton. Wumeng regional prices have not been significantly adjusted, downstream receiving prices in Shanxi have increased by 50 yuan / ton, and markets in most other regions have maintained a stable trend and prices have not been significantly adjusted. First of all, the supply of calcium carbide market remained tight during the week, and the supply was supported by manufacturers' quotations, and then there was limited electricity in individual areas on Tuesday, but the downstream demand performance did not improve, so there was no obvious rise in the market, mainly in stability. the situation of power cuts in the middle of the week has been alleviated, the overall downstream demand is still poor, maintaining rigid demand procurement-based, the industry more to maintain a wait-and-see mentality. On the whole, the supply of goods during the week is unstable and the performance is tight to support the market. Although the lower reaches maintain rigid demand procurement, because the supply of goods is relatively tight, the purchasing enthusiasm of individual areas is OK. However, most areas are limited by poor downstream demand, and the power to rise prices is insufficient, so after the price rise at the beginning of the week, most operators are more cautious and maintain a wait-and-see mentality.

2. Crude oil

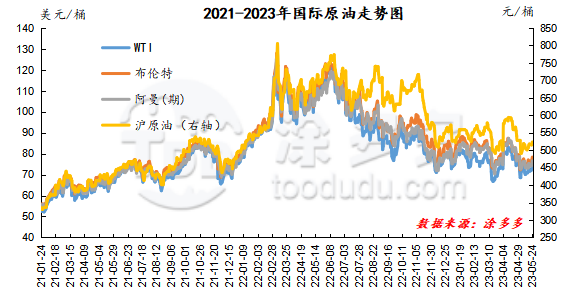

As of May 24, the price of WTI was $74.34 per barrel, up $1.51 from the same period last week; Brent was $78.36 per barrel, up $1.40 from the same period last week; Oman (period) was $76.61 per barrel, up $3.42 from the same period last week; Shanghai crude oil was 523.6 yuan per barrel, up 16.8 yuan per barrel from the same period last week.

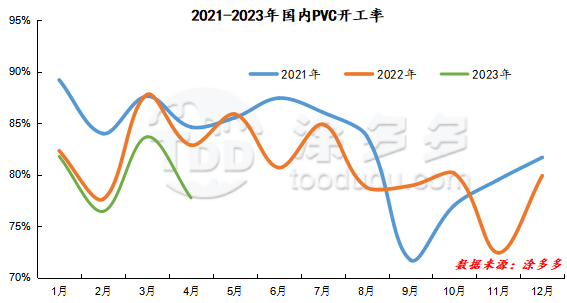

Statistics on the operating rate of the PVC plant this week

This week (2023.05.19-2023.05.25) the capacity utilization rate of PVC production enterprises was 73.47%, and the month-on-month ratio was 0.7% lower; of which, the calcium carbide method was 71.53%, the month-on-month decrease was 0.73%, and the ethylene method was 79.93%, and the month-on-month ratio was 0.58%.

V. International market price analysis

1. This week's international VCM market price

International VCM: may 18: CFR far East, CFR Southeast Asia stable, FOB Northwest Europe down 10%, FAS Houston stable.

|

VCM/ area |

2023/5/11 |

2023/5/18 |

Rise and fall |

Unit |

|

CFR far East |

639-641 |

639-641 |

0 |

$/mt |

|

CFR Southeast Asia |

689-691 |

689-691 |

0 |

$/mt |

|

FOB Northwest Europe |

768-772 |

758-762 |

-10 |

$/mt |

|

FAS Houston |

485-495 |

485-495 |

0 |

$/mt |

2. International PVC market price this week

International PVC: may 24th: CFR far East is down 20, CFR Southeast Asia is down 10, CFR India is down 20, FD Northwest Europe is stable, FD Northwest Europe (futures) is down 65, Fas Houston is down 10, Germany, the Netherlands, Italy, France, Spain and the United Kingdom are down 55.

|

Country |

2023/5/17 |

2023/5/24 |

Rise and fall |

Unit |

|

CFR far East |

789-791 |

769-771 |

-20 |

Eur/mt |

|

CFR Southeast Asia |

789-791 |

779-781 |

-10 |

Eur/mt |

|

FD Northwest Europe (Futures) |

1618-1622 |

1553-1557 |

-65 |

Eur/mt |

|

FOB Northwest Europe |

818-822 |

818-822 |

0 |

Eur/mt |

|

FAS Houston |

715-725 |

705-715 |

-10 |

GBP/mt |

|

CFR India |

809-811 |

789-791 |

-20 |

Eur/mt |

|

Germany |

1499-1502 |

1444-1447 |

-55 |

$/mt |

|

Netherlands |

1499-1502 |

1444-1447 |

-55 |

cts/lb |

|

Italy |

1508-1512 |

1453-1457 |

-55 |

$/mt |

|

France |

1492-1507 |

1437-1452 |

-55 |

$/mt |

|

The United Kingdom |

1299-1301 |

1244-1246 |

-55 |

$/mt |

|

Spain |

1488-1492 |

1433-1437 |

-55 |

$/mt |

3. List of unit prices this week

|

Product Name |

Area |

5.18 |

5.19 |

5.22 |

5.23 |

5.24 |

|

Propylene monomer |

CFR China |

867.00 |

872.00 |

858.00 |

858.00 |

833.00 |

|

Propylene monomer |

FOB Korea |

847.00 |

852.00 |

838.00 |

838.00 |

813.00 |

|

Ethylene monomer |

CFR Northeast Asia |

847.00 |

863.00 |

838.00 |

838.00 |

828.00 |

|

Ethylene monomer |

CFR Southeast Asia |

907.00 |

917.00 |

907.00 |

897.00 |

888.00 |

|

Styrene |

Asia |

976.00 |

991.00 |

973.00 |

953.50 |

949.00 |

|

Butadiene |

CFR Taiwan |

855.00 |

895.00 |

855.00 |

855.00 |

855.00 |

4. Ethylene price list this week

|

The country |

Price type |

5.18 |

5.19 |

5.22 |

5.23 |

5.24 |

|

Northeast Asia |

CIF (USD / t) |

865 |

850 |

840 |

840 |

830 |

|

Southeast Asia |

CIF (USD / t) |

920 |

910 |

910 |

900 |

890 |

|

Taiwan of China |

CIF (USD / t) |

850 |

840 |

840 |

840 |

840 |

|

Japan |

FOB (USD / t) |

920 |

910 |

910 |

900 |

890 |

|

Northwest Europe |

CIF (USD / t) |

830 |

793 |

787 |

784 |

782 |

|

FD futures price (EUR / ton) |

794 |

769 |

764 |

763 |

762 |

|

|

America |

FD (cents / lb) |

17.5 |

17.3 |

17.5 |

17.5 |

16.8 |

|

South Korea |

FOB (USD / t) |

850 |

840 |

840 |

840 |

840 |

VI. Holding the list of dragons and tigers (May 25)