Urea Daily Review: Falling again! Price cuts are not ideal and demand is not strong, which is a drag (May 18)

China Urea Price Index:

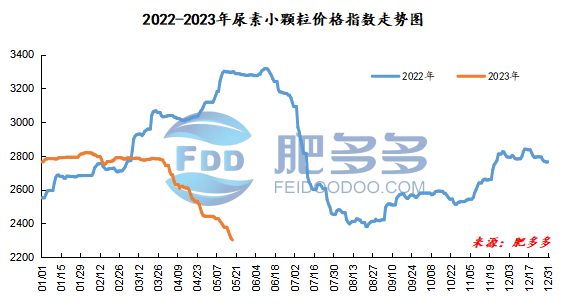

According to Feiduo data, the urea small pellet price index on May 18 was 2,302.27, down 9.55 from yesterday, down 0.41% month-on-month, and down 30.23% year-on-year.

Urea futures market:

The price of the urea UR2309 contract quickly reached a peak of 1884 in early trading today, and then fell, and was volatile at the end. In the afternoon, futures prices fluctuated mainly at low levels, falling to the lowest point of 1832 in late session, and closing at 1838. The opening price of the Urea UR2309 contract: 1880, the highest price: 1884, the lowest price: 1832, the settlement price: 1852, the closing price: 1838, the closing price dropped 29, or 1.55% compared with the settlement price of the previous trading day. The daily fluctuation range is 1832-1884, and the spread is 52; the 09 contract has increased its positions by 19331 lots today, and so far, it has held 297511 lots.

Spot market analysis:

The center of gravity of China's urea spot market price is still falling today. Some regions took the initiative to lower their quotations, but market transaction conditions still performed poorly. With the resumption of early parking equipment in Henan, Shaanxi and other regions, the national production began to rise again. When supply was loose, inventory pressure continued to increase due to poor factory orders. Specifically, prices in Northeast China fell to 2,250 - 2,260 yuan/ton. Prices in North China fell to 2,090 - 2,300 yuan/ton. Prices in the northwest region are stable at 2,260 - 2,270 yuan/ton. Prices in Southwest China are stable at 2,200 - 2,600 yuan/ton. Prices in East China fell to 2,260 - 2,320 yuan/ton. The price of small and medium-sized particles in Central China has stabilized at 2,230 - 2,480 yuan/ton, and the price of large particles has risen to 2,390 - 2,440 yuan/ton. Prices in South China fell to 2,370 - 2,420 yuan/ton.

Market outlook forecast:

In terms of futures, today's futures trend is flat, and the guidance for spot prices is not high. In terms of supply, due to the current resumption of maintenance equipment in Henan and other places, the national supply may increase in the later period. Nissan will fluctuate around 170,000 tons, and the overall market supply is sufficient. In terms of inventory, as factories continue to reduce prices and collect orders, inventory has gradually accumulated, and inventory pressure has increased in the later period. On the demand side, the delivery of corn manure in East and Central China is slow, agricultural demand is relatively deadlocked, plywood factories are generally enthusiastic about purchasing, and overall demand is not ideal. In terms of exports, India's second tender has been delayed, and India's urea production in China has increased compared with previous years, and export demand has also performed poorly. On the whole, the urea market will still be dominated by negative trends in the short term, spot prices will show a weak downward trend, and it is unlikely that the market will rebound and rise.