Polyethylene Weekly: There is no obvious drive, and the two cities are waiting for directional choices

The core point of the week

China's PE market has generally fallen this week, ranging from 30 to 200 yuan per ton. At present, the fundamentals of plastics have not changed significantly. On the supply side, Shanghai Petrochemical, Guangzhou Petrochemical, Qilu Petrochemical and China Sea Shell Phase II have started one after another, and the supply of goods in the field has increased. Petrochemical inventory to maintain a high level in the middle, destorming pressure, lower ex-factory prices, on-site cost support is no longer. In terms of demand, the demand for plastic film and greenhouse film is off-season, and the market consumption is reduced; the demand for packaging film, hollow and pipe is still OK, pay attention to the bidding situation of their summer orders, and the overall demand shows continuous differentiation. Linear demand is expected to weaken further. However, after the continuous decline in prices, there is a periodic low suction demand. And at present, several major coal enterprises have delayed delivery in spot factories, forming support to a certain extent. Under the comprehensive influence, short-term concussion is the main operation.

Chapter one, Review of Polyethylene Market this week

1. Analysis of the market trend of polyethylene in China

Unit: yuan / ton

|

Brand number |

Region |

May 12th |

May eighteenth |

Rise and fall |

|

Linear |

North China |

7940-8050 |

7820-7980 |

-120/-70 |

|

East China |

8100-8150 |

7950-8050 |

-150/-100 |

|

|

South China |

7980-8000 |

7900-8000 |

-80/0 |

|

|

high pressure |

North China |

8280-8400 |

8180-8330 |

-100/-70 |

|

East China |

8250-8500 |

8150-8400 |

-100/-100 |

|

|

South China |

8350-8450 |

8350-8400 |

0/-50 |

|

|

Low pressure membrane material |

North China |

8150-8800 |

7950-8600 |

-200/-200 |

|

East China |

8200-8750 |

8200-8550 |

0/-200 |

|

|

South China |

8150-8800 |

8150-8800 |

0/0 |

|

|

Low pressure wire drawing |

North China |

7900-9500 |

7870-9330 |

-30/-170 |

|

East China |

8000-9150 |

8050-9150 |

50/0 |

|

|

South China |

9450-10000 |

9350-9950 |

-100/-50 |

China's PE market has generally fallen this week, ranging from 30 to 200 yuan per ton. Fears of recession persist, international oil prices have fallen for days, while coal prices continue to fall, making costs bad for the market. While the process of petrochemical destocking is slow, the inventory of the two oil remains at a high level, with 800000 tons in the warehouse as of Thursday. In the market upside down, futures fell continuously, sales and inventory pressure, petrochemical, coal enterprises factory prices fell continuously, on-site supply cost support further loosened. Traders wait and see shipments, following the daily price adjustment slightly, the center of gravity continues to decline. Downstream recently to take more goods to maintain rigid demand, so in addition to the need to pick up goods, wait for lower prices. As of Thursday, China's linear prices were 7820-8050 yuan / ton; high-voltage film prices were 8150-8400 yuan / ton; low-voltage film prices were 7950-8800 yuan / ton; and low-voltage wiredrawing prices were 7870-9950 yuan / ton.

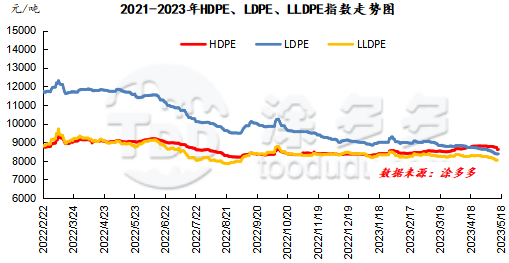

Figure 1 polyethylene sub-variety index trend chart

2. Analysis of the market trend of polyethylene dollar

This week, the decline of China's US dollar PE market slowed, high pressure, linear decline in 10-20 US dollars / ton, low pressure held steady. The market is in ample supply and demand is hardly boosted. Superposition for the macro concerns unabated, international oil prices fell, foreign offers lack of support, some fell back slightly. From the perspective of the price difference between inside and outside, the performance of high pressure and hollow is weak. From an expected point of view, imports in May will be expected to increase.

Table 2 & changes of nbsp; polyethylene market price in US dollars

Unit: United States dollars / ton

|

Variety |

May 12th |

May eighteenth |

Rise and fall |

|

Linear |

970-990 |

950-980 |

-20/-10 |

|

high pressure |

980-1010 |

980-990 |

0/-20 |

|

Low pressure membrane material |

1030-1045 |

1030-1045 |

0/0 |

3. Analysis of the trend of polyethylene futures market

This week the main area of plastic finishing. The L2309 contract opened at 7720 on May 12, with a weekly high of 7816, a weekly low of 7681, and closed at 7772 on Thursday. In terms of Wednesday's transaction: 19.5% more open 23.3%, Duoping at 20.1% empty 24.2%. At present, the L09 contract has briefly stopped falling, and the short-term focus is on the long-short performance of 7800.

Chapter II Analysis of the supply of Polyethylene in China

The capacity utilization rate of China's PE production enterprises was 81.15%, down 3.23% from the previous cycle. During this cycle, Zhejiang Sinopec Phase II low voltage plant, Sinochem Quanzhou low voltage plant, Dushanzi petrochemical old full density line 2 plant and some devices were shut down for maintenance, resulting in a decrease in capacity utilization.

Table 3 overhaul statistics of polyethylene plants in China

Unit: ten thousand tons

|

Enterprise name |

Inspection and repair device |

Maintenance capacity |

Parking Duration |

departure time |

|

North China brocade |

Old HDPE first line / second line |

15 |

June 12, 2014 |

Long-term parking |

|

Shenyang Chemical Industry |

LLDPE |

10 |

October 15, 2021 |

Uncertain for the time being |

|

Zhenhai Refining and Chemical Industry |

HDPE |

30 |

March 5, 2022 |

Uncertain for the time being |

|

Haiguolong oil |

Full density |

40 |

April 3, 2022 |

Uncertain for the time being |

|

Wanhua chemistry |

HDPE |

35 |

November 12, 2022 |

Uncertain for the time being |

|

Liaoyang Petrochemical Company |

HDPE A line |

3.5 |

April 1, 2023 |

May 31, 2023 |

|

Liaoyang Petrochemical Company |

HDPE B line |

3.5 |

April 1, 2023 |

May 31, 2023 |

|

Fushun petrochemical |

Full density |

8 |

April 6, 2023 |

May 31, 2023 |

|

Shenhua Ning coal |

Full density |

45 |

April 19, 2023 |

May 19, 2023 |

|

Daqing Petrochemical |

HDPE B line |

8 |

April 27, 2023 |

May 31, 2023 |

|

Wanhua chemistry |

Full density |

45 |

April 29, 2023 |

June 13, 2023 |

|

Ningxia Baofeng Phase I |

Full density |

30 |

May 4, 2023 |

May 31, 2023 |

|

Zhejiang Petrochemical Phase II |

Full density |

45 |

May 10, 2023 |

May 24, 2023 |

|

Quanzhou, Sinochem |

HDPE |

40 |

May 15, 2023 |

June 2, 2023 |

|

Dushanzi petrification |

Old full density 2 line |

15 |

May 15, 2023 |

May 19, 2023 |

|

Zhejiang Petrochemical Phase II |

HDPE |

35 |

May 15, 2023 |

May 28, 2023 |

|

Tianjin Petrochemical Company |

LLDPE |

12 |

May 17, 2023 |

May 24, 2023 |

|

Qilu Petrochemical |

HDPE B line |

7 |

May 17, 2023 |

May 29, 2023 |

Chapter III demand Analysis of Polyethylene in China

3.1 downstream market analysis of polyethylene

The agricultural film market is running smoothly this week. As of Thursday, the mainstream price of double-protective film in North China was 9600-10600 yuan / ton, the mainstream price in East China was 9700-10700 yuan / ton, and the mainstream price in South China was 9700-10800 yuan / ton. Agricultural film into the off-season demand, downtime maintenance enterprises increased, agricultural film enterprises are expected to reduce the demand for PE raw materials in the later stage.

3.2 Statistics on the operating rate of downstream polyethylene enterprises

capacity utilization in downstream industries this week is-1.37% higher than last week. The utilization rate of agricultural film production capacity is-3.58% higher than that of last week. The utilization rate of pipe capacity is 2.37% higher than that of last week. The utilization rate of hollow capacity is-1.56% higher than last week. The utilization rate of injection molding capacity is-1.71% higher than last week. The utilization rate of packaging film capacity is 0.56% higher than that of last week.

Chapter IV Analysis of the upstream market of polyethylene

4.1 crude oil trend analysis

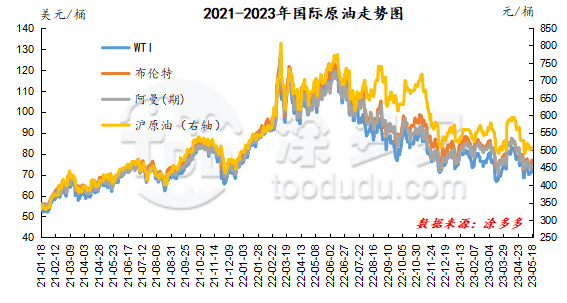

As of May 17, the price of WTI was 72.83 US dollars per barrel, up 27 cents from the same period last week; Brent was 76.96 US dollars per barrel, up 55 cents from the same period last week; Oman price was 73.19 US dollars per barrel, down 2.44 US dollars from the same period last week; Shanghai crude oil was 506.8 yuan per barrel, down 9.8 yuan per barrel from the same period last week.

Figure 2 international crude oil trend chart

4.2 methanol trend analysis

recently, the local trading atmosphere in China has improved slightly, but the macro mood is weak, the cost support is limited, and the marginal change between supply and demand is small. Some operators in the lower reaches of the market are still dominated by rigid demand, and the rebound in trading atmosphere is still weak. In the port market, the volatility of the futures market is strong, the spot transaction is slightly poor, and the basis stabilizes weakly. up to now, the inventory performance in the port area is different, and the East China region is steadily supported by the consumption of rigid demand downstream, and the market pick-up speed is relatively high. however, the arrival speed of imported goods in South China is relatively concentrated during the week, resulting in a slight increase in the total inventory. At present, the fundamental fluctuation of the methanol market is limited, the supply and demand structure may be maintained in the short term, and the market is cautious. It is expected that the spot price of methanol will remain stable and weak in the short term. In the later stage, attention should be paid to the prices of crude oil, coal and the operation of the plant in the field.

Chapter 5 & Forecast of the trend of nbsp; Polyethylene

At present, the fundamentals of plastics have not changed significantly. On the supply side, Shanghai Petrochemical, Guangzhou Petrochemical, Qilu Petrochemical and China Sea Shell Phase II have started one after another, and the supply of goods in the field has increased. Petrochemical inventory to maintain a high level in the middle, destorming pressure, lower ex-factory prices, on-site cost support is no longer. In terms of demand, the demand for plastic film and greenhouse film is off-season, and the market consumption is reduced; the demand for packaging film, hollow and pipe is still OK, pay attention to the bidding situation of their summer orders, and the overall demand shows continuous differentiation. Linear demand is expected to weaken further. However, after the continuous decline in prices, there is a periodic low suction demand. And at present, several major coal enterprises have delayed delivery in spot factories, forming support to a certain extent. Under the comprehensive influence, short-term concussion is the main operation.