PVC Weekly: Futures reduced positions on Thursday and rebounded upward, breaking through the low and sideways pattern, and spot rose slightly during the week

I. Analysis of China's PVC market

1. Summary of China's PVC market.

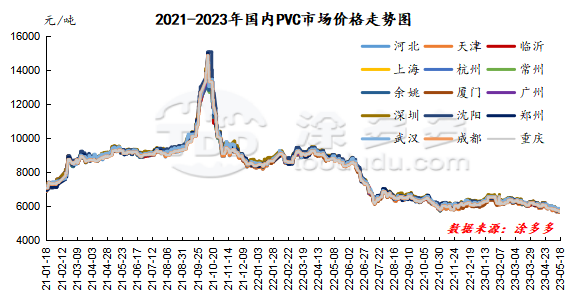

This week (2023.05.12-2023.05.18) the spot market prices are mainly low and narrow, no matter the rise or fall has been adjusted slightly, but the performance of the two markets can still rebound slightly on Thursday. The low cost of futures during the week was 5795, the lowest so far this year for the main contract, and the spot market also fell to a new low, followed by a time low. The influencing factors of the week are as follows: 1. Futures positions are mostly reduced in the week, and short orders have begun to take profits since the lowest point on Monday, but the emergence of short positions did not make the futures prices close upwards. on the contrary, there are new retail short positions to supplement, resulting in the appearance of low horizontal positions for most of the week. But the deadlock was broken on Thursday, and prices in both markets rebounded and rose. 2. The fundamental variables of PVC during the week are wrong, only the price port of calcium carbide rises to a certain extent during the week, and the range is mostly concentrated in 25-50 yuan / ton. The impact of calcium carbide adjustment on the overall PVC period of the two cities is almost negligible, so although the rise and fall of the two cities is based on the fundamentals of supply and demand, it is difficult to shake the weak overall pattern with smaller positive cost support. 3. With regard to China News, the Shanghai Stock Exchange will hold a special forum on the financial industry in Shanghai on Monday 15th to discuss promoting the valuation of the financial industry. The commodity atmosphere rebounded slightly, but it was beaten back to its original form of weakness in the afternoon. Another 16 real estate data the National Bureau of Statistics from January to April, the national real estate development investment of 3.5514 trillion yuan, down 6.2% from the same period last year (investment fell 5.8% from January to March). 4. The weekly factor for the outer disk is that consumer confidence in the United States was low and inflation remained high in May, causing fears of a slowdown in the US economy. The prospect of tightening crude oil supplies in Canada and elsewhere has boosted crude oil, but recession fears have been weighing on the market Economic data from China and the United States were weaker than expected. 5. Taiwan Formosa Plastics plans to overhaul the PVC plant from June to July, and the shipping price in June has been postponed, but most of the market expects it to be reduced by 40-50 US dollars per ton. On the whole, the performance of the two cities is weak at first and then slightly stronger during the week. From the comparison of valuation, it fell 60-75 yuan / ton in North China, 10 yuan / ton in East China, 5-10 yuan / ton in part, 10 yuan / ton in South China, 75 yuan / ton in Northeast China, 50-100 yuan / ton in Central China and 100 yuan / ton in Southwest China.

Futures: weekly PVC09 contract price lowest 5795, since last Friday basically in a low sideways state, Thursday futures performance can still rebound. Position changes during the week, including an increase of 4958 positions last Friday, a reduction of 18081 positions on Monday, an increase of 1851 positions on Tuesday and an increase of 4971 positions on Wednesday. Thursday futures as a whole showed a horizontal breakthrough upward situation, and the late rally did not stop, but also have to admit that the rebound in futures prices with the help of flat more. On Thursday, the position was reduced by 18971 lots, and the position in the PVC09 contract closed at 822169 lots, with the closing price of 5910.

|

Comparison of the lowest and highest prices for PVC09 contracts |

|||

|

Date |

Lowest price |

The highest price |

Rise and fall |

|

5.12 |

5809 |

5852 |

43 |

|

5.15 |

5795 |

5888 |

93 |

|

5.16 |

5830 |

5894 |

64 |

|

5.17 |

5813 |

5865 |

52 |

|

5.18 |

5858 |

5916 |

58 |

2. Market analysis of mainstream consumer areas in China.

North China: Hebei PVC market prices rose slightly within the week, spot trading in general, terminal rigid demand-based, Thursday trading is OK. As of Thursday, type 5 materials including tax 5630-5700 yuan / ton delivered, Inner Mongolia factory to 5430-5500 yuan / ton. North China underoffer 09 contract (380,400).

East China: Changzhou PVC market price week slightly move up the center of gravity, but trading in general, the market price and point price offer, downstream demand is lukewarm. As of Thursday, the reference for the current remittance of type 5 calcium carbide materials is 5770-5840 yuan / ton (excluding packing). East China basis offer 09 contract-(30-100).

South China: Guangzhou PVC market prices rose slightly during the week, with a slight increase in the price offer, but it is still difficult to close the transaction with a high offer, and the purchasing enthusiasm of downstream products enterprises is not high. As of Thursday, ordinary type 5 calcium carbide spot pick-up mainstream transaction reference 5800-5860 yuan / ton. South China basis offer 09 contract-(0-50). The ethylene offer 1000 will be delivered to about 5900-5910 yuan / ton, and the spot stock of Dagu 1000 will be quoted at 5850-5870 yuan / ton.

Taiwan Plastics of China announced its quotation in May. In May, the pre-sale quotation of CIF India was lowered by 80 US dollars / ton, CFR China by 60 US dollars / ton, CIF Southeast Asia by 60 US dollars / ton, and FOB China Taiwan by 60 US dollars / ton. Due to weak market demand and lower prices in Asia, it is expected that there is still room for a reduction in the pre-sale price in June.

Quotation for May shipment of Formosa Plastics in Taiwan Province of China: (USD / ton)

|

Region / time |

CFR India |

CFR China |

CFR Southeast Asia |

FOB Taiwan of China |

|

January |

840 |

805 |

800 |

770 |

|

February |

930 |

875-885 |

870-880 |

840 |

|

March |

970 |

925 |

920 |

880 |

|

April |

900 |

865 |

860 |

820 |

|

May |

820 |

805 |

800 |

760 |

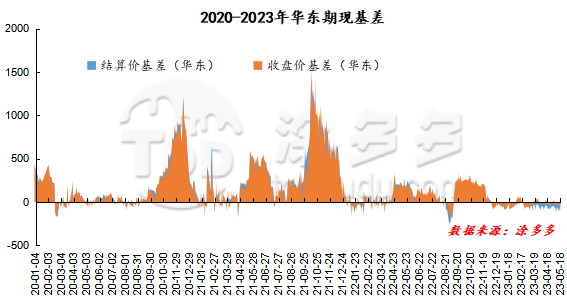

3. Comparison of cash base difference in PVC period

|

Arbitrage Analysis of PVC spread |

||||||

|

PVC |

Contract price difference |

5.12 |

5.15 |

5.16 |

5.17 |

5.18 |

|

V2309 collection |

2818 |

5871 |

5841 |

5858 |

5910 |

|

|

Average spot price in East China |

5760 |

5740 |

5790 |

5740 |

5790 |

|

|

Average spot price in South China |

5825 |

5775 |

5825 |

5820 |

5840 |

|

|

PVC2309 basis difference |

2942 |

-131 |

-51 |

-118 |

-120 |

|

|

V2401 collection |

5782 |

5837 |

5809 |

5829 |

5876 |

|

|

V2309-2401 closed |

-2964 |

34 |

32 |

29 |

34 |

|

|

PP2309 collection |

7125 |

7131 |

7127 |

7142 |

7135 |

|

|

Plastic L2309 collection |

7696 |

7746 |

7752 |

7783 |

7772 |

|

|

V--PP basis difference |

-4307 |

-1260 |

-1286 |

-1284 |

-1225 |

|

|

Vmure-L basis difference of plastics |

-4878 |

-1875 |

-1911 |

-1925 |

-1862 |

|

4. PVC warehouse receipt daily

|

Variety |

Warehouse / branch warehouse |

5.12 warehouse orders |

5.15 warehouse orders |

5.16 warehouse orders |

5.17 warehouse orders |

5.18 warehouse orders |

|

Polyvinyl chloride |

Zhejiang International Trade |

846 |

846 |

986 |

986 |

986 |

|

Polyvinyl chloride |

Jiangyin Xiefeng |

224 |

294 |

294 |

294 |

609 |

|

Polyvinyl chloride |

Benniu Port, Changzhou |

990 |

1,374 |

1,374 |

1,374 |

1,374 |

|

Polyvinyl chloride |

Jiangsu Zhengsheng |

345 |

345 |

345 |

345 |

345 |

|

Polyvinyl chloride |

Jiangsu Yanjin |

1,701 |

1,701 |

1,701 |

1,701 |

1,701 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Benniu Port) |

501 |

501 |

900 |

900 |

900 |

|

Polyvinyl chloride |

Products Zhongda Chemical Industry (Railway Changxing) |

0 |

0 |

300 |

300 |

300 |

|

Polyvinyl chloride |

Yongan Capital (Benniu Port) |

798 |

798 |

798 |

798 |

798 |

|

Polyvinyl chloride |

Specialty petrochemical (Benniu Port) |

507 |

2,399 |

2,399 |

2,399 |

2,399 |

|

Polyvinyl chloride |

Specialty Petrochemical (Zhejiang International Trade) |

0 |

1,320 |

1,320 |

1,320 |

1,320 |

|

Polyvinyl chloride |

Sino-Thai Duojing (Zhejiang International Trade) |

1,238 |

1,238 |

1,238 |

1,238 |

1,238 |

|

PVC subtotal |

|

7,150 |

10,816 |

11,655 |

11,655 |

11,970 |

|

Total |

|

7,150 |

10,816 |

11,655 |

11,655 |

11,970 |

5. Future forecast

Futures: PVC09 contract price in the opening price of the night market, that is, there is a small high jump meaning, the trend is relatively strong, during the day after a long horizontal finishing state, the end of the day to reappear upward. However, the operation of the futures price shows a trend of reducing positions and rebounding, and most of them tend to consider the results of periodic short order profit-taking. After the recent low point, futures did not effectively fall below the 5800 mark again, showing a situation of low sideways. The technical level shows that (13, 13, 2) the opening of the third rail narrows, and the opening of the lower rail turns upward. The narrowing of the opening at the technical level indicates the emergence of a new round of market, but the range between the low three tracks is narrowed, which limits the fluctuation range to a certain extent. Therefore, the short-term price operation continues to observe the performance of 5870-5960 above and below 5920 in the middle track.

Spot: first of all from the overall commodity sentiment point of view, the pattern of continued weakness at this point, PVC began to stabilize from the low point of the horizontal trend, and the horizontal brought the profit-taking of short orders. It also indicates that the funds in the futures market are unwilling to bear too much downward pressure because of the consideration of the risk below. And the spot also gets a little respite in the long-lost low market, but what needs to be vigilant is that the iterative small rise in the spot market rebound from the market can not be regarded as a turning point for the better, but more tend to consider that the current weak pattern begins to enter a certain wait-and-see period, and traders who take goods in the spot market in the early stage after the rebound in futures prices have hedging considerations, so they are cautious and rational. On the outer disk, the US president and congressional Republican leaders stressed on Wednesday that they are determined to reach an agreement as soon as possible to raise the federal government's $31.4 trillion debt ceiling and avoid a catastrophic economic default. In addition, the market is closely watching any new measures taken by the leaders of the Group of Seven countries to expand sanctions against Russia when they meet in Japan on May 19-21. On the whole, the spot price of PVC in the short term is under the joint action of the internal and external market, or there is a certain performance of repair and finishing.

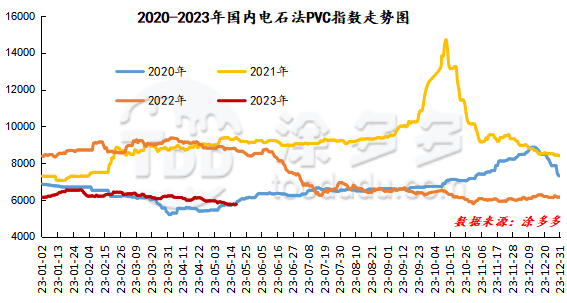

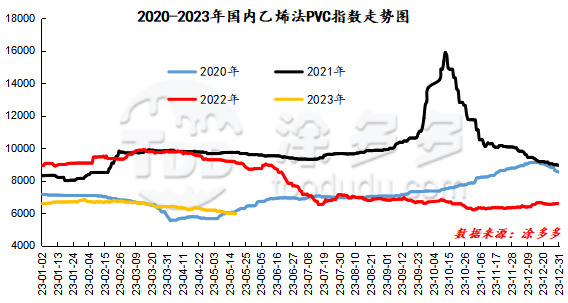

6. China PVC Index

According to Tuduoduo data, the PVC spot index of China's calcium carbide method rose 25.01, or 0.437%, to 5753.37 on May 18. The ethylene method PVC spot index was 5968.57, up 16.44, or 0.276%. The calcium carbide index rose, the ethylene index rose, and the ethylene-calcium carbide index spread was 215.2.

7. The market price of PVC this week

Unit: yuan / ton

|

Region |

Date |

Price specification |

Price range |

2023/5/11 |

2023/5/18 |

Rise and fall |

|

North China |

Hebei |

Send to cash remittance |

5840-5920 |

5720 |

5660 |

-60 |

|

Tianjin |

Send to cash remittance |

5840-5920 |

5720 |

5660 |

-60 |

|

|

Linyi |

Send to cash remittance |

5900-5900 |

5805 |

5730 |

-75 |

|

|

East China |

Shanghai |

Cash out of the warehouse |

5910-6030 |

5760 |

5765 |

5 |

|

Hangzhou |

Cash out of the warehouse |

5940-6010 |

5805 |

5815 |

10 |

|

|

Changzhou |

Cash out of the warehouse |

5900-6020 |

5800 |

5790 |

-10 |

|

|

Yuyao |

Cash out of the warehouse |

5880-6020 |

5740 |

5745 |

5 |

|

|

Xiamen |

Cash out of the warehouse |

5980-6040 |

5850 |

5840 |

-10 |

|

|

South China |

Guangzhou |

Cash out of the warehouse |

5970-6030 |

5850 |

5840 |

-10 |

|

Shenzhen |

Cash out of the warehouse |

5930-6110 |

5870 |

5860 |

-10 |

|

|

Northeast China |

Shenyang |

Send to cash remittance |

5900-6000 |

5775 |

5700 |

-75 |

|

Central China |

Zhengzhou |

Send to cash remittance |

5910-6010 |

5800 |

5750 |

-50 |

|

Wuhan |

Send to cash remittance |

6000-6050 |

5875 |

5775 |

-100 |

|

|

Southwest |

Chengdu |

Send to cash remittance |

5800-5950 |

5775 |

5675 |

-100 |

|

Chongqing |

Send to cash remittance |

5800-5950 |

5775 |

5675 |

-100 |

8. List of equipment in production enterprises this week

|

List of equipment maintenance in PVC Enterprises in China |

|||

|

Technics |

Enterprise name |

Production capacity |

Device change |

|

Calcium carbide method |

Yunnan southern phosphorus |

24 |

Parking on April 1, 2019, recovery time to be determined, currently in test run |

|

Salinization of Mount Tai |

10 |

Parking on September 29th, 2022, recovery time to be determined |

|

|

Henan Shenma |

30 |

Parking on August 12, 2022, recovery time to be determined |

|

|

Hengyang Kingboard |

22 |

Parking on March 1, 2023, recovery time to be determined |

|

|

Huojiagou, Shanxi |

16 |

The start of construction dropped to 20% on January 21, 2023, and the recovery time has yet to be determined. |

|

|

Lutai chemistry |

36 |

Parking on April 25, 2023 and expected to resume on May 26 |

|

|

Nangang, Yili |

12 |

Plan for parking maintenance from May 8 to 18 |

|

|

Shanxi Jintai |

30 |

Scheduled for overhaul in May |

|

|

Heilongjiang Haohua |

30 |

Expected to be overhauled in late May |

|

|

Yibin Tianyuan |

38 |

Plan to overhaul from May to June in 2023, cooperate with electric power |

|

|

Hubei Yihua |

5 |

Scheduled for overhaul on May 20, 2023 and expected to resume on May 24 |

|

|

Shanxi Yushe |

40 |

It is planned to overhaul for about three days in mid-June 2023. |

|

|

Medium salt Inner Mongolia |

40 |

Planned for 7-10 days of maintenance on June 25, 2023 |

|

|

Ordos |

40 |

The first factory is expected to be overhauled in June. |

|

|

Inner Mongolia is suitable for change. |

30 |

Scheduled for maintenance on June 10, 2023 |

|

|

Ethylene process |

Yangmei Hengtong |

30 |

It is expected to be overhauled for about a month on May 10, and it is scheduled to resume on June 9. |

|

Suzhou Huasu |

13 |

Temporary parking on April 27, 2023, scheduled to resume on May 6 |

|

|

Shanghai chlor-alkali |

6 |

Scheduled for maintenance in June 2023 |

|

2. PVC paste resin

1. Market analysis and forecast of PVC this week.

This week (2023.05.12-2023.05.18) the overall trend of PVC paste resin market is weak, the inventory of upstream manufacturers is at a relatively reasonable level, but the overall shipping situation is poor, the enthusiasm of receiving goods downstream is limited, the overall transaction situation of the market is relatively light, and the rising price of calcium carbide on the cost side does not form obvious support to the paste resin market. Market price: PVC paste resin large plate price 6800-7300 yuan / ton, glove material sent to the price 7300-7700 yuan / ton, the actual transaction price negotiation. At present, the PVC paste resin market is affected by the high inventory, the overall weak operation of the market, the enterprise shipping pressure is not reduced, the downstream demand is not good, the overall market transaction situation is not ideal, the business mentality is more bearish to the future, it is expected that the short-term PVC paste resin market will maintain a weak situation.

2. Statistics on the start-up of PVC paste resin manufacturers this week

This week (2023.05.12-2023.05.18) the operating rate of PVC paste resin enterprise is 54.87%. Sichuan Xinjin Road Group Co., Ltd. PVC paste resin device (20 000 tons / year) has not been put into production; Jiyuan Fangsheng Chemical Co., Ltd. PVC paste resin device (60 000 tons / year) production process is micro-suspension method, paste resin device is still shut down. Binzhou Zhenghai Group-Wudi Xinchuang Ocean Technology Co., Ltd. PVC paste resin device (40, 000 tons / year) was stopped for maintenance on April 23, 2021, but not in production. Inner Mongolia Yidong Group Dongxing Chemical Co., Ltd. PVC paste resin device (100000 tons / year) stop and repair around March 27th, 2022. Qinghai Salt Lake Haina Chemical Co., Ltd. PVC paste resin device (35000 tons / year) parking maintenance, start-up time to be determined.

|

Manufacturer name |

Production capacity (10,000 tons / year) |

Maintenance plan |

|

Shenyang Chemical Industry |

20 |

Normal |

|

Shandong Langhui Oil |

14 |

Normal |

|

Anhui Tianchen |

13 |

Normal |

|

Inner Mongolia Junzheng |

10 |

Normal |

|

Yidong Dongxing, Inner Mongolia |

10 |

Overhaul on March 27, 2022, recovery time to be determined |

|

Jiangsu Corning Chemistry |

10 |

Normal |

|

Xinjiang Tianye |

10 |

Normal |

|

Medium salt Inner Mongolia |

9 |

Normal |

|

Xinjiang Zhongtai |

9 |

Normal |

|

Three friends of Tangshan |

8 |

Normal |

|

Inner Mongolia Chenghongli |

8 |

Normal |

|

Formosa Plastics Industry (Ningbo) |

7 |

Normal |

|

Ningxia Yinglite |

4 |

Normal |

|

Jining Bank of China |

4 |

Parking on March 29th, 2023, no recovery plan for the time being |

|

Landscape in Yichang, Hubei Province |

4 |

Normal |

|

Binzhou Zhenghai Group-Wudi newly created Ocean |

4 |

Maintenance on April 23, 2021, no recovery plan for the time being |

|

Qinghai Salt Lake Haina Chemical Industry |

3.5 |

Overhauled in mid-April 2022, no recovery plan for the time being |

|

Sichuan Xinjin Road Group |

2 |

Normal |

III. Key analysis of related chlor-alkali products

1. Calcium carbide

This week (2023.05.12-2023.05.18) the overall trend of China's calcium carbide market showed a steady upward trend, the mainstream ex-factory quotations and downstream receiving prices showed a regional increase, and the mainstream ex-factory quotations in Wumeng and Ningxia were raised by 25-50 yuan per ton. Wuhai prices have not been significantly adjusted for the time being, downstream receiving prices have risen 23-50 yuan / ton in most areas, and prices in some areas are mainly stable. First of all, during the week, the supply side support price rose, the enterprise plant started to maintain a low level, the supply supply on the market was relatively tight, and the factory quotation was raised to support the factory. On the downstream demand side, the downstream inventory consumption was faster than that in the previous period. And the arrival of goods showed a regional shortage, which led to a certain increase in the downstream purchasing price, so the downstream receiving price was increased, but the downstream cost pressure was greater, and the demand maintained rigid demand procurement. Therefore, the rising resistance of calcium carbide is large, and the price increase in each region is limited. As of May 18, the calcium carbide receiving price: Hebei area receiving price is 3490-3500 yuan / ton, Henan area receiving price is 3400 yuan / ton, Shandong area receiving price is 3480-3650 yuan / ton, northeast region receiving price is 3570-3630 yuan / ton, Sichuan intra-Sichuan price is 3550-3650 yuan / ton, Shanxi self-raised price is 3050-3100 yuan / ton, Shaanxi purchase Fugu / Inner Mongolia calcium carbide to the factory to implement 3, 200-3, 215 yuan / ton.

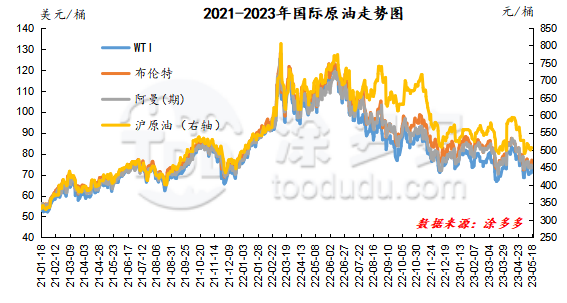

2. Crude oil

As of May 17, the price of WTI was 72.83 US dollars per barrel, up 27 cents from the same period last week; Brent was 76.96 US dollars per barrel, up 55 cents from the same period last week; Oman price was 73.19 US dollars per barrel, down 2.44 US dollars from the same period last week; Shanghai crude oil was 506.8 yuan per barrel, down 9.8 yuan per barrel from the same period last week.

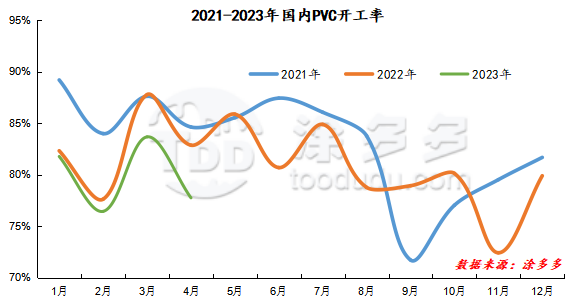

Statistics on the operating rate of the PVC plant this week

This week (2023.05.12-2023.05.18) the capacity utilization rate of PVC production enterprises was 74.17%, which was 1.7% lower than the previous month; of which, the calcium carbide method was 72.26%, 1.37% lower than the previous period, and the ethylene method was 80.5%, and the latter was 2.98% lower.

V. International market price analysis

1. This week's international VCM market price

International VCM: may 11: CFR far East, CFR Southeast Asia stable, FOB Northwest Europe down 10%, FAS Houston stable.

|

VCM/ area |

2023/5/5 |

2023/5/11 |

Rise and fall |

Unit |

|

CFR far East |

639-641 |

639-641 |

0 |

$/mt |

|

CFR Southeast Asia |

689-691 |

689-691 |

0 |

$/mt |

|

FOB Northwest Europe |

778-782 |

768-772 |

-10 |

$/mt |

|

FAS Houston |

485-495 |

485-495 |

0 |

$/mt |

2. International PVC market price this week

International PVC: may 17th: CFR far East, CFR Southeast Asia, CFR India fell 10, FD Northwest Europe (futures) fell 50, FD Houston fell 25, Germany, the Netherlands, Italy, France, Spain fell 15, and the United Kingdom fell 10.

|

Country |

2023/5/10 |

2023/5/17 |

Rise and fall |

Unit |

|

CFR far East |

799-801 |

789-791 |

-10 |

Eur/mt |

|

CFR Southeast Asia |

799-801 |

789-791 |

-10 |

Eur/mt |

|

FD Northwest Europe (Futures) |

1668-1672 |

1618-1622 |

-50 |

Eur/mt |

|

FOB Northwest Europe |

818-822 |

818-822 |

0 |

Eur/mt |

|

FAS Houston |

740-750 |

715-725 |

-25 |

GBP/mt |

|

CFR India |

819-821 |

809-811 |

-10 |

Eur/mt |

|

Germany |

1514-1517 |

1499-1502 |

-15 |

$/mt |

|

Netherlands |

1514-1517 |

1499-1502 |

-15 |

cts/lb |

|

Italy |

1523-1527 |

1508-1512 |

-15 |

$/mt |

|

France |

1507-1522 |

1492-1507 |

-15 |

$/mt |

|

The United Kingdom |

1309-1311 |

1299-1301 |

-10 |

$/mt |

|

Spain |

1503-1507 |

1488-1492 |

-15 |

$/mt |

3. List of unit prices this week

|

Product Name |

Area |

5.11 |

5.12 |

5.15 |

5.16 |

5.17 |

|

Propylene monomer |

CFR China |

887.00 |

878.00 |

878.00 |

872.00 |

872.00 |

|

Propylene monomer |

FOB Korea |

867.00 |

858.00 |

858.00 |

852.00 |

852.00 |

|

Ethylene monomer |

CFR Northeast Asia |

867.00 |

863.00 |

863.00 |

863.00 |

863.00 |

|

Ethylene monomer |

CFR Southeast Asia |

917.00 |

917.00 |

917.00 |

917.00 |

917.00 |

|

Styrene |

Asia |

1023.00 |

1006.00 |

988.00 |

977.50 |

981.50 |

|

Butadiene |

CFR Taiwan |

955.00 |

895.00 |

895.00 |

895.00 |

895.00 |

4. Ethylene price list this week

|

The country |

Price type |

5.11 |

5.12 |

5.15 |

5.16 |

5.17 |

|

Northeast Asia |

CIF (USD / t) |

870 |

865 |

865 |

865 |

865 |

|

Southeast Asia |

CIF (USD / t) |

920 |

920 |

920 |

920 |

920 |

|

Taiwan of China |

CIF (USD / t) |

870 |

850 |

850 |

850 |

850 |

|

Japan |

FOB (USD / t) |

920 |

920 |

920 |

920 |

920 |

|

Northwest Europe |

CIF (USD / t) |

864 |

856 |

848 |

843 |

836 |

|

FD futures price (EUR / ton) |

816 |

812 |

804 |

800 |

796 |

|

|

America |

FD (cents / lb) |

17.3 |

17.3 |

17.1 |

17 |

17 |

|

South Korea |

FOB (USD / t) |

870 |

850 |

850 |

850 |

850 |

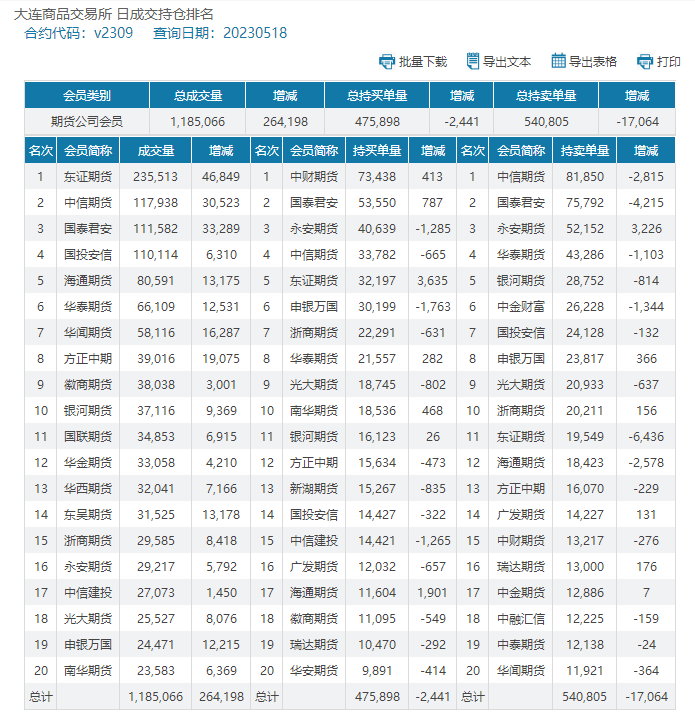

VI. Holding the list of dragons and tigers (May 18)