Urea Daily Review on August 3rd: Uncertainty Persists as Indian Tender Outcome Is Still Pending, Market Remains Cautious

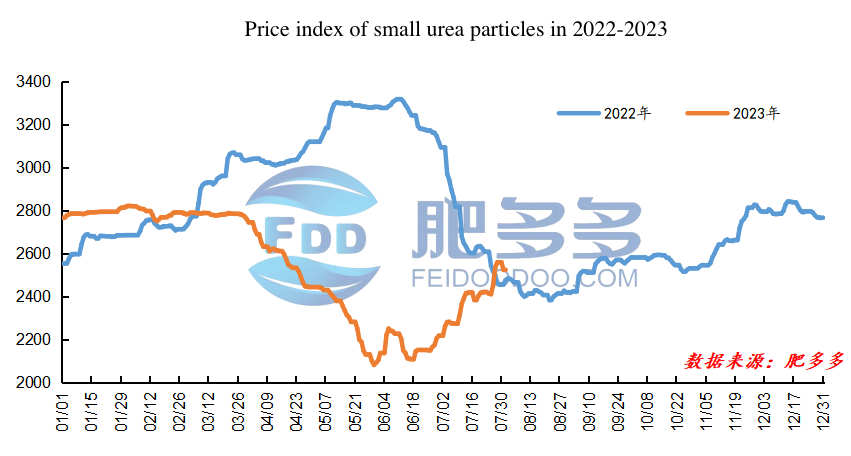

Domestic Urea Price Index:

According to data from Fei Duoduo, on August 3rd, the price index for small granular urea was 2500.91, a decrease of 4.09 compared to the previous day, a decrease of 0.16% compared to the previous period, and an increase of 0.83% compared to the same period last year.

Urea Futures Market:

Urea UR2309 contract opened at 2240, with the highest price at 2291, the lowest price at 2211, the settlement price at 2252, and the closing price at 2254. The closing price decreased by 82 compared to the previous trading day's settlement price, a decrease of 3.51% compared to the previous period. The price fluctuated between 2211 and 2291 throughout the day, with a spread of 80. The contract 09 reduced its positions by 17812 hands today, with a current holding of 201699 hands.

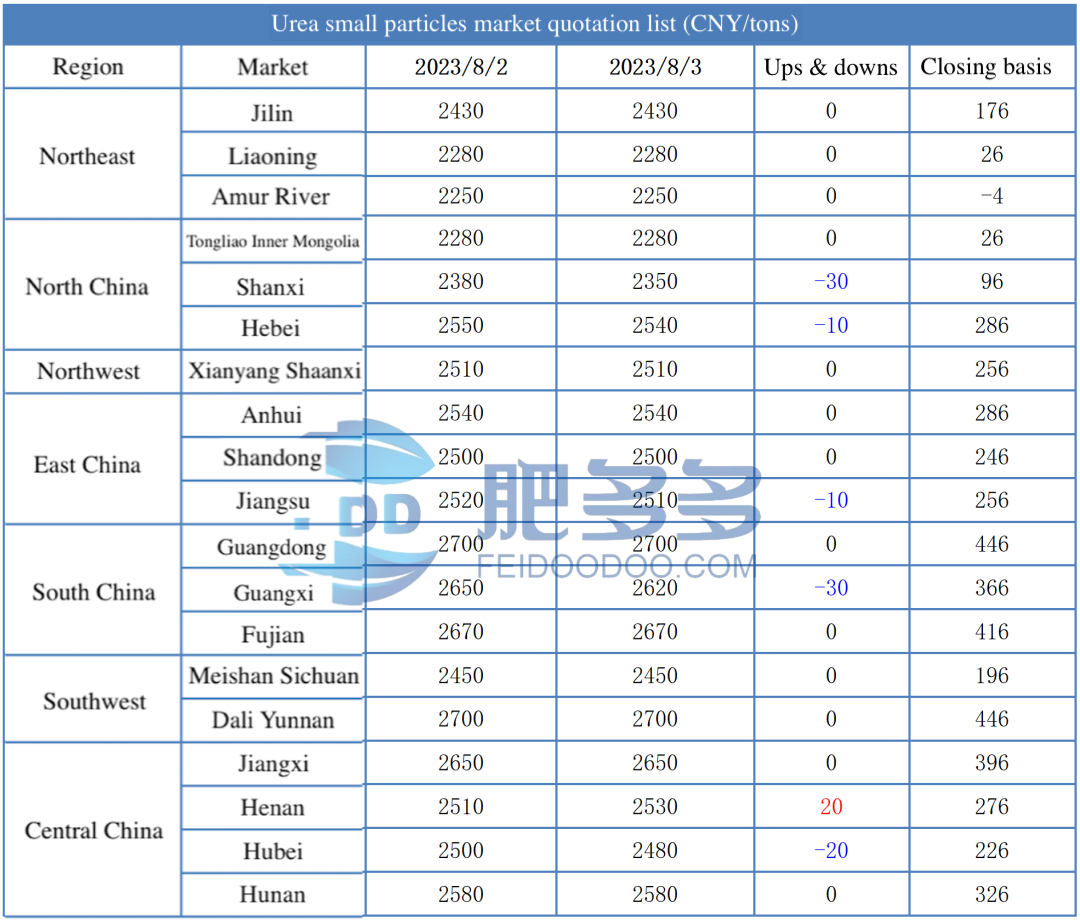

Spot Market Analysis:

Today, the domestic urea market showed stability with some downward movement. Prices had previously surged to high levels, leading to strong resistance in the market. Mainly driven by essential restocking, the market was negatively affected by the bearish impact of export news, resulting in a decline in urea prices.

Specifically, prices in the Northeast region remained stable at 2230-2450 yuan/ton. Prices in North China fell by 20 to 2280-2590 yuan/ton. Prices in Northwest China remained stable at 2510-2520 yuan/ton. Prices in Southwest China remained stable at 2450-2700 yuan/ton. Prices in East China remained stable at 2470-2550 yuan/ton. Prices in Central China fell by 20 for small granular urea to 2470-2700 yuan/ton and fell by 10 for large granules to 2550-2630 yuan/ton. Prices in South China fell by 20 to 2600-2700 yuan/ton.

Future Forecast:

It is expected that urea production will increase next week, negatively impacting the supply side. As for demand, the current domestic agriculture is in an off-season for fertilizer application, leading to a decline in urea usage. Many companies are fulfilling their previous export orders, resulting in relatively low inventory. On the international front, the Indian tender for importing urea is still pending, causing significant uncertainty. Most people adopt a wait-and-see attitude, and it is expected that the announcement of the Indian tender prices will have a substantial impact on the domestic market. In terms of futures, urea futures trading prices are weakening, and it is predicted that the slight decline in futures prices will also affect the synchronous decline in urea market prices.

In summary, the current urea market is experiencing increased supply and moderate demand, leading to weaker prices. However, the limited decline is supported by relatively low enterprise inventories, and the market is also awaiting the outcome of the Indian tender.

- International Fertilizer Market - Potash Giants Report First Quarter: Signs of Recovery in Potash Demand! Meanwhile, Russian Fertilizer Exports to the US Reach Annual High2643

- Phosphate Fertilizer Weekly Report: Supported by Pending Orders and Costs, Firm Prices2325

- Urea Weekly Review: Cautious Buying and Slow Follow-Up, Prices Hold Steady2438

- Urea Daily Review: Weakened Supply-Demand Support, Enterprises Lower Prices to Attract Orders2465

- Phosphate Fertilizer Daily Review: Pending Orders Support Prices, Stability in the Short Term2369