Urea Daily Review on August 2nd: Market Runs with Fluctuations, Awaiting Indian Tender Outcome

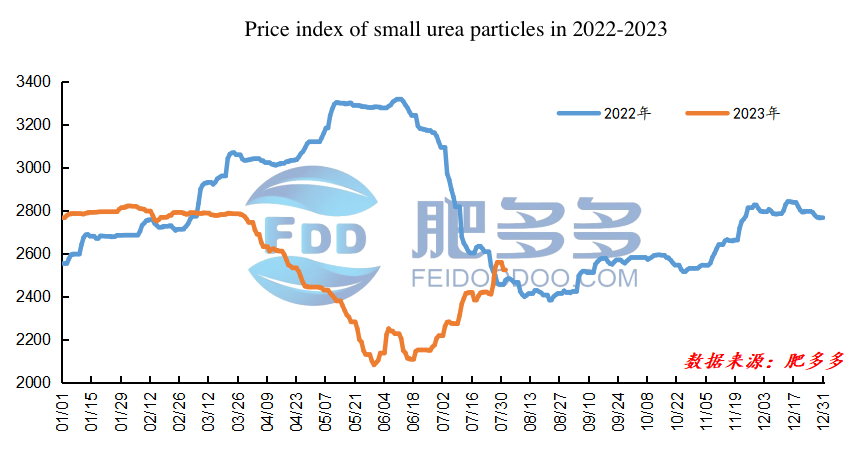

Domestic Urea Price Index:

According to data from FeiDoodoo, on August 2nd, the price index for small granular urea was 2516.82, a decrease of 2.27 compared to the previous day, a decrease of 0.09% compared to the previous period, and an increase of 1.44% compared to the same period last year.

Urea Futures Market:

Urea UR2309 contract opened at 2332, with the highest price at 2364, the lowest price at 2300, the settlement price at 2336, and the closing price at 2308. The closing price decreased by 23 compared to the previous trading day's settlement price, a decrease of 0.99% compared to the previous period. The price fluctuated between 2300 and 2364 throughout the day, with a spread of 64. The contract 09 reduced its positions by 16439 hands today, with a current holding of 219511 hands.

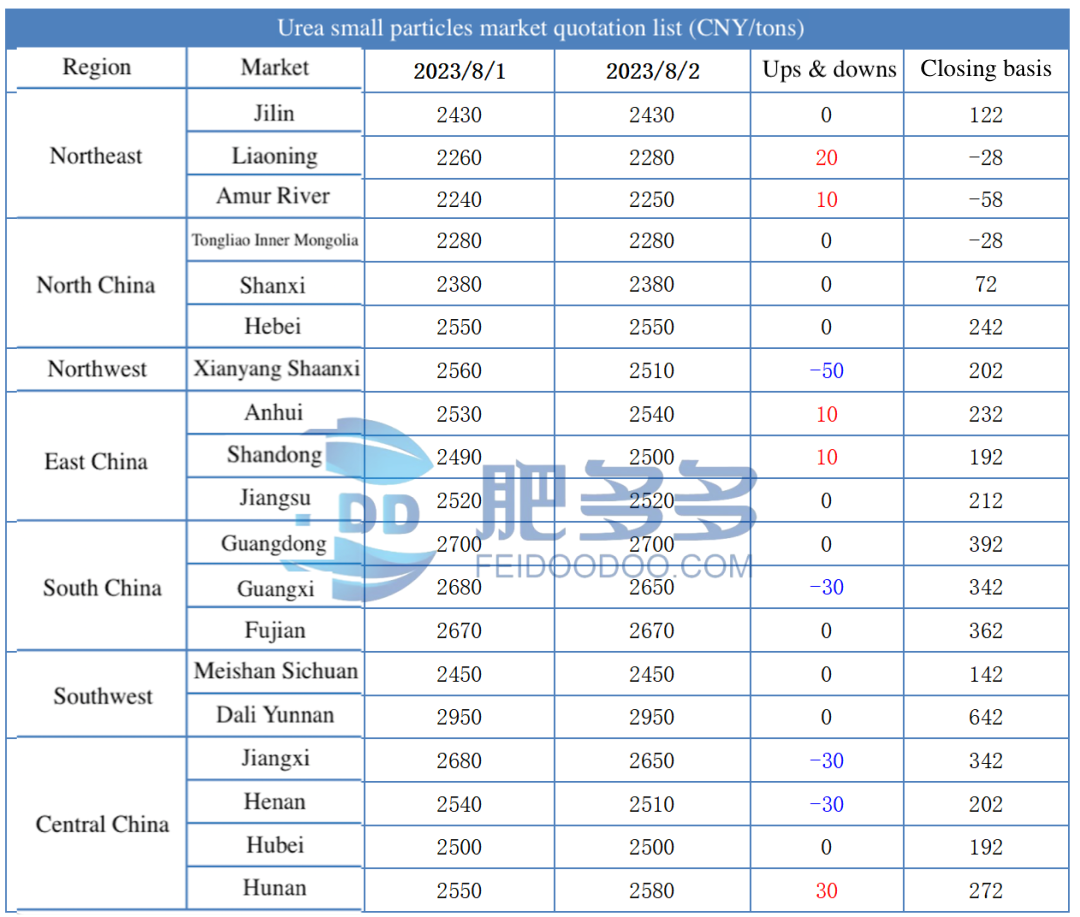

Spot Market Analysis:

Today, domestic urea prices showed mixed trends, and the overall urea market operated relatively steadily. The main reason for the decline is that some mainstream regions have experienced slow shipments recently, and inventories are under pressure. Additionally, domestic demand has weakened, leading to slight downward adjustments in offers. On the other hand, the main reason for the price increase is the continued export advantages in the international market, with orders awaiting fulfillment from overseas factories providing support. Inventories are generally under pressure, and prices have risen accordingly, providing some mild support for the market's downturn.

Specifically, prices in the Northeast region increased by 180 to 2230-2450 yuan/ton. Prices in North China fell by 20 to 2280-2590 yuan/ton. Prices in Northwest China remained stable at 2510-2520 yuan/ton. Prices in Southwest China remained stable at 2450-3000 yuan/ton. Prices in East China fell by 10 to 2470-2550 yuan/ton. Prices in Central China remained stable for small granular urea at 2490-2700 yuan/ton, while prices for large granules fell by 30 to 2540-2630 yuan/ton. Prices in South China fell by 30 to 2620-2700 yuan/ton.

Future Forecast:

Regarding futures, urea futures trading prices are relatively stable, which also influences the sentiment in the urea market. It is expected that the spot urea prices will also develop steadily. In terms of supply, upstream factories are still awaiting fulfillment, and their quotations remain relatively stable. However, certain regions have been affected by heavy rainfall, leading to limited factory shipments and weaker actual transactions. Some factories have begun to slightly lower their ex-factory quotations. In terms of demand, domestic agricultural demand has entered the off-season. Combined with the recent continuous increase in domestic urea prices, downstream merchants have some resistance to high prices, making it difficult to support further significant price increases. Internationally, urea prices remain high, driving the domestic urea market prices higher due to exports. Additionally, India has released tenders for importing urea, which will further stimulate the domestic urea market.

Overall, the current urea market's supply and demand are relatively balanced, and the upward trend has slowed down. It is expected that the domestic urea market will remain relatively stable until the full implementation of the Indian tender, and prices are not likely to experience significant retracement, mainly showing minor fluctuations.

- International Fertilizer Market - Potash Giants Report First Quarter: Signs of Recovery in Potash Demand! Meanwhile, Russian Fertilizer Exports to the US Reach Annual High2645

- Phosphate Fertilizer Weekly Report: Supported by Pending Orders and Costs, Firm Prices2327

- Urea Weekly Review: Cautious Buying and Slow Follow-Up, Prices Hold Steady2438

- Urea Daily Review: Weakened Supply-Demand Support, Enterprises Lower Prices to Attract Orders2467

- Phosphate Fertilizer Daily Review: Pending Orders Support Prices, Stability in the Short Term2373