Urea Weekly: The current two markets positive dominant spot prices continue to move up (28th July 31, 2023)

01 Market Overview

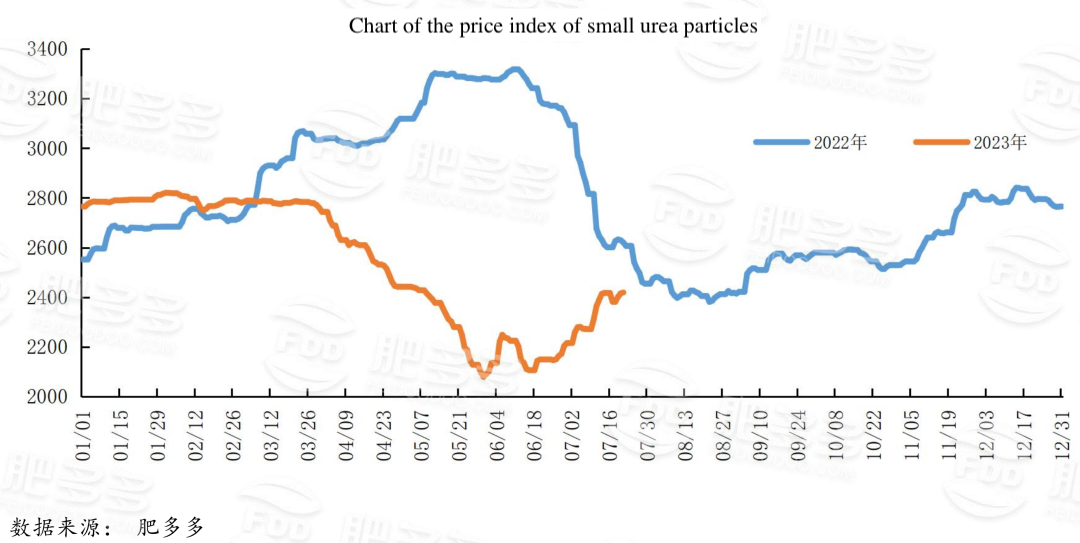

1.1 Fatoduo Price index

This week, the average price of domestic urea small particle price index was 2471.96, up 72.14 from last week, up 3.01% from the previous month. At the beginning of the week, the spot price of urea fell sporadically, and then, driven by the strong trend of international prices and futures, the spot market reappeared last week, and launched a larger pull up. In the middle of the week, the futures rose by the limit, the advance orders of enterprises increased greatly, and the daily output rose to more than 170,000 tons in the week. In terms of exports, the release of hidden bidding information has also led to the upward movement of the market emotionally. Although it is the gap period of downstream agricultural demand, the market is still positive in the short term.

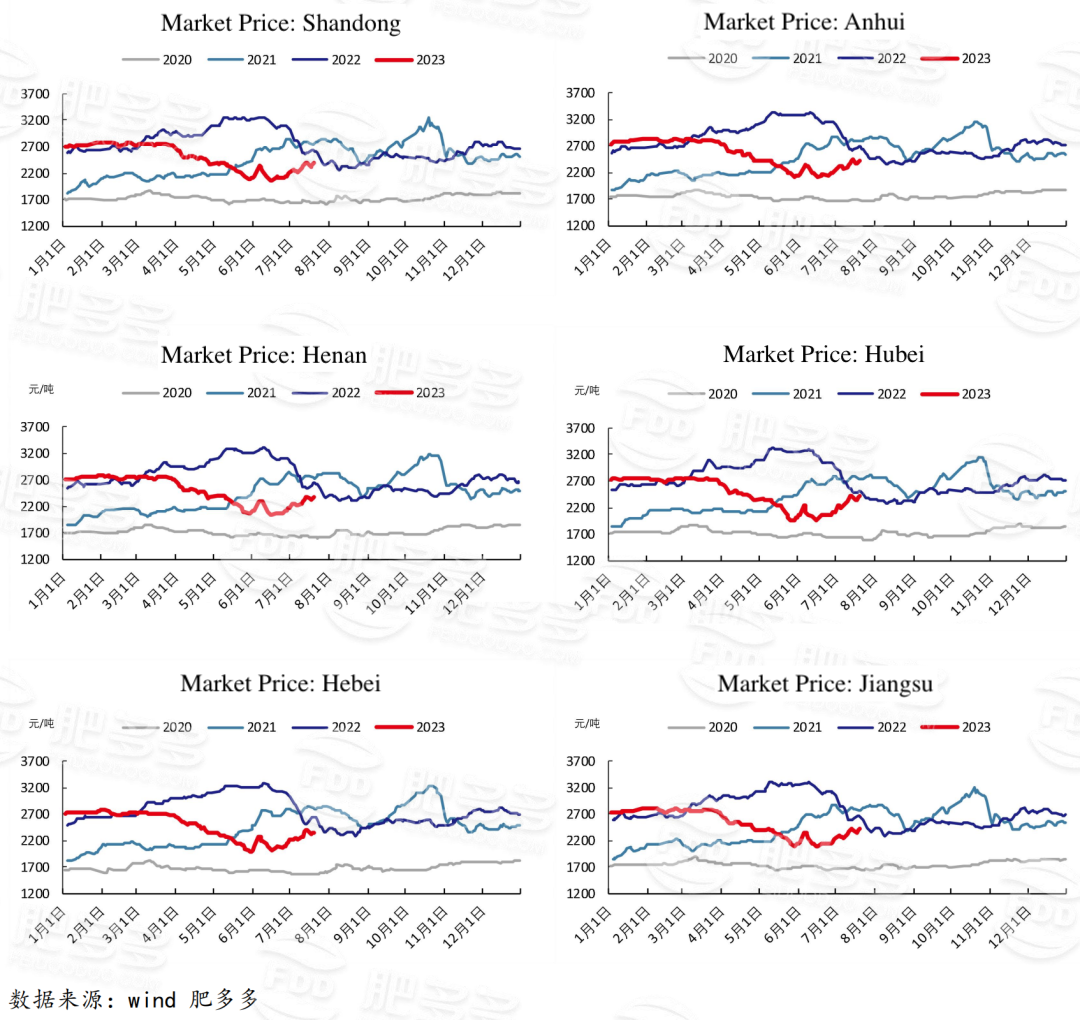

1.2 Urea delivery area quotation

Specifically, the price in Northeast China rose to 2260-2320 yuan/ton. In North China, the price rose to 2,320-2,700 yuan/ton. The price in Northwest China rose to 2610-2620 yuan/ton. The price in southwest China rose to 2450-3000 yuan/ton. In East China, the price rose to 2580-2670 yuan/ton. In central China, the price of small and medium-sized particles rose to 2,540-2,700 yuan/ton, and the price of large particles rose to 2,620-2,650 yuan/ton. In southern China, the price rose to 2,700-2,740 yuan/ton.

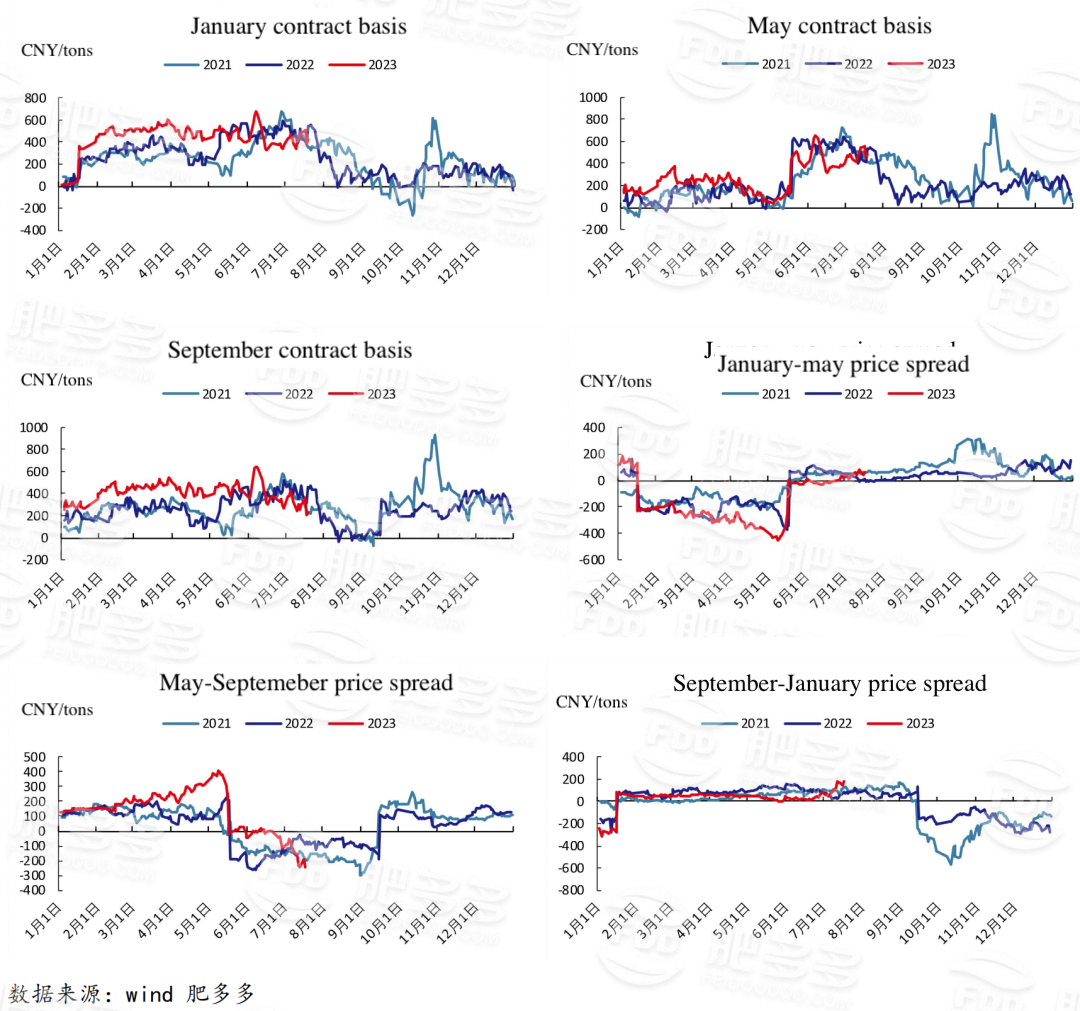

1.3 Urea futures base spread & spread

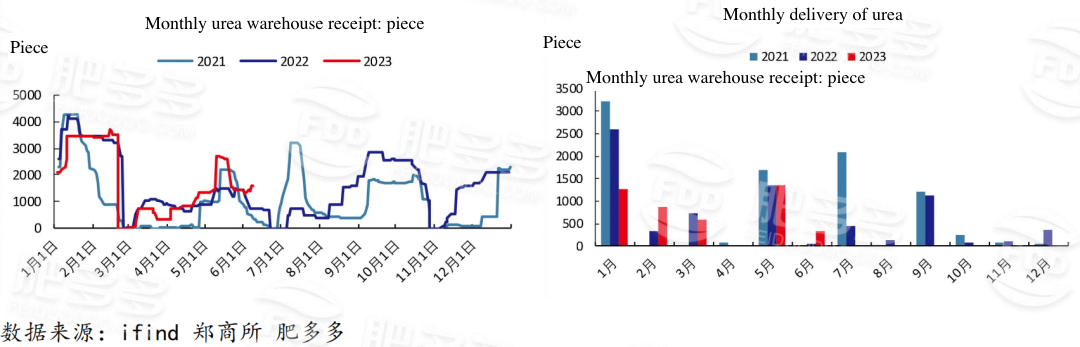

1.4 Distribution of futures warehouse receipt

As of Friday, Zhengshang Exchange urea futures 1319, down 401 from last week. The total delivery in July was 472.

02 Industry chain dynamics

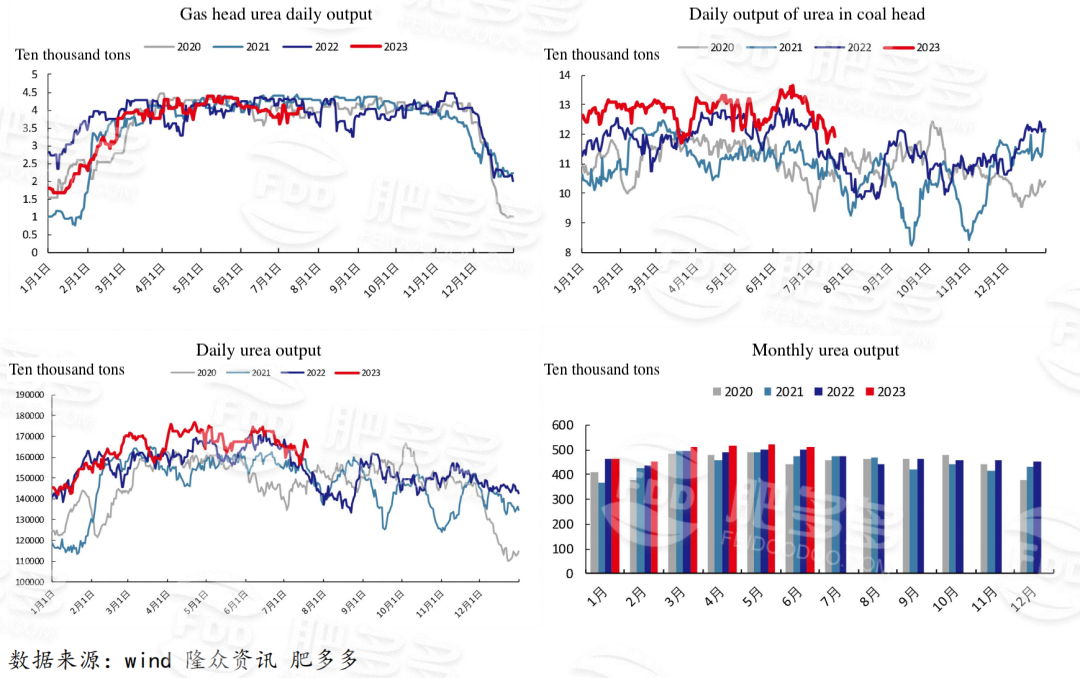

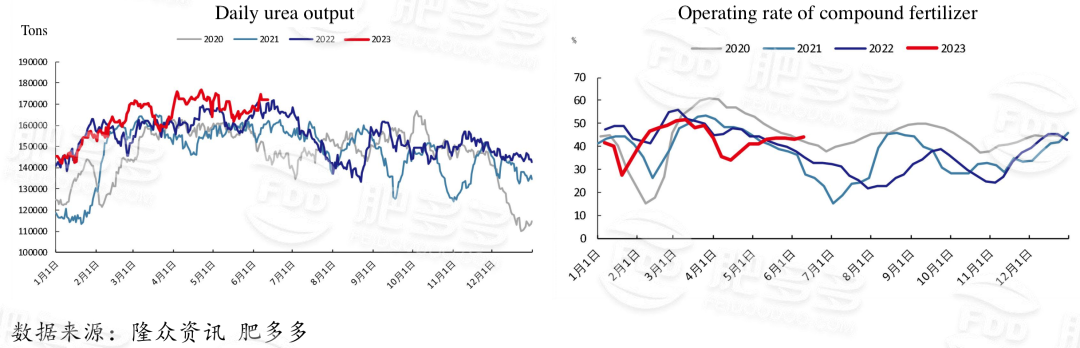

2.1 Nissan recovered rapidly

This week, domestic urea production was about 1.20100 million tons, an increase of 5.08% from the previous month, up 15.51% year-on-year; The daily output is 171,400 tons, and the daily output rises within the week. The operating rate of domestic urea industry was about 80.95%, an increase of 3.91% quarter-on-quarter and 14.46% year-on-year; Domestic urea industry operating rate increased, higher than the same period last year.

From the point of view of the process, the production of coal to urea is about 907,400 tons, an increase of 46,400 tons from last week, an increase of 135,700 tons from the same period last year, the operating rate is about 81.68%, an increase of 4.18% from last week, an increase of 14.94% from the same period last year; The production of gas-derived urea was about 292,700 tons, an increase of 11,600 tons from last week, an increase of 25,400 tons from the same period last year, and the operating rate was about 78.77%, an increase of 3.12% from last week, an increase of 13.00%.

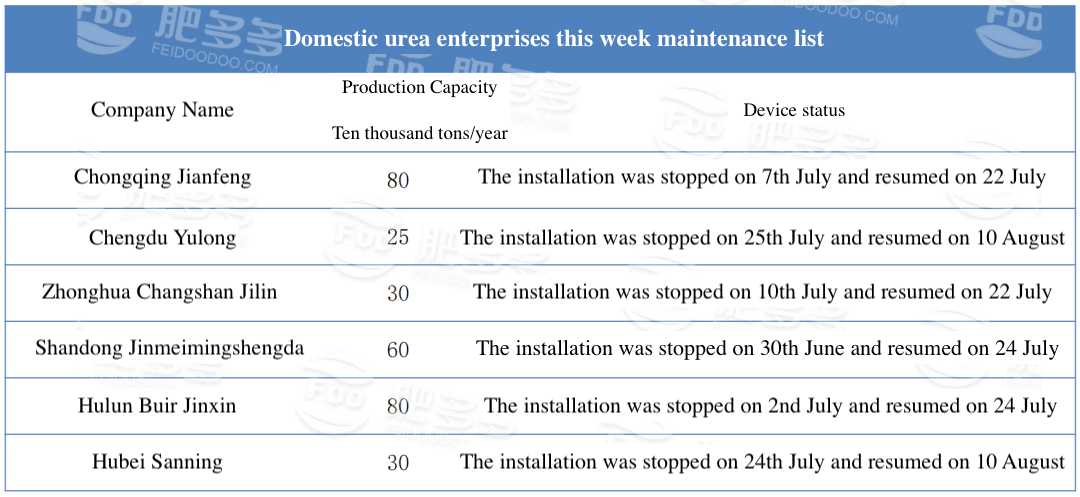

2.2 Urea plant dynamics

2.3 Raw Material market

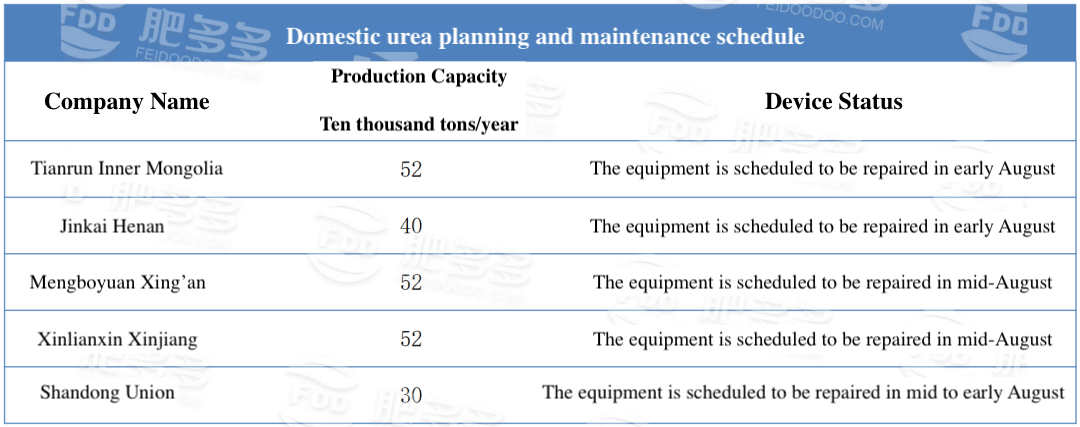

This week, the coal market fluctuated in a narrow range, and the port coal price slowly slipped from 900 yuan/ton, down 5 yuan/ton per day. Due to precipitation and the arrival of Typhoon Dusuri, the high temperature in the south weakened, and the daily consumption of coastal power plants dropped from 2.46 million tons to about 2.25 million tons. Overseas thermal coal prices have stabilised and inflows of imported coal have declined.

Traders welcome the summer kurtosis expected to be good, low-cost shipment intention is low. The high temperature has increased the daily consumption of the power plant, and the port inventory has continued to be destocked. Coal mine safety inspections have increased and market supply has tightened. Overseas thermal coal prices have stabilised and inflows of imported coal have declined. The weakening of domestic trade sentiment led to a decrease in import market inquiries; In addition, the price of imported coal is low, and the price of foreign mines is inverted, and most traders suspend operation.

However, the downstream chemical enterprises to maintain just need to replenish the inventory, traders mainly wait-and-see, procurement intention is low. In terms of anthracite lump coal, some urea enterprises have recently stopped production for maintenance, chemical enterprises have a slow pace of raw coal procurement, and more need to be replenishment, civilian customers' purchasing sentiment has cooled slightly, and traders have seen a decline in speculative demand based on the current market situation.

Port coal prices increased this week, Qinhuangdao thermal coal Q5500 offer 900 yuan/ton, last week increased 50 yuan/ton. The quotation of anthracite lump coal to the factory is 1000-1100 yuan/ton, and the price is 0 yuan/ton higher than last week.

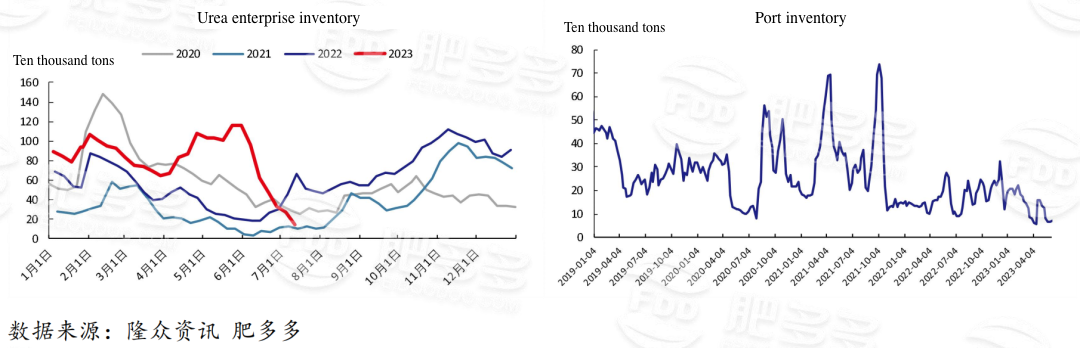

2.4 Market inventory

This week, the domestic large particle urea port inventory of 60,000 tons, an increase of 17,000 tons from last week, a decrease of 12,000 tons from the same period last year, large particle urea port volume increased within the week, lower than the same period last year.

This week, the domestic small particle urea port inventory of 61,000 tons, an increase of 24,000 tons from last week, an increase of 7,000 tons from the same period last year, higher than the same period last year.

This week, the inventory of enterprises was about 138,100 tons, down 14,100 tons from the previous month; The port inventory totaled 90,000 tons, an increase of 12.50% from the previous month.

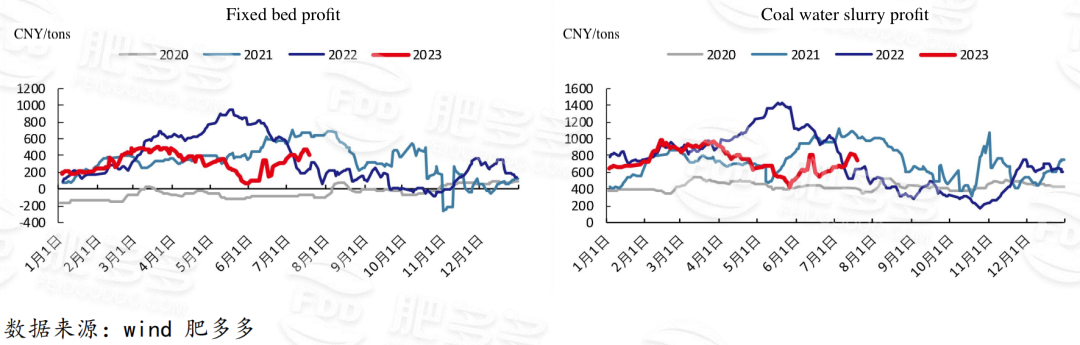

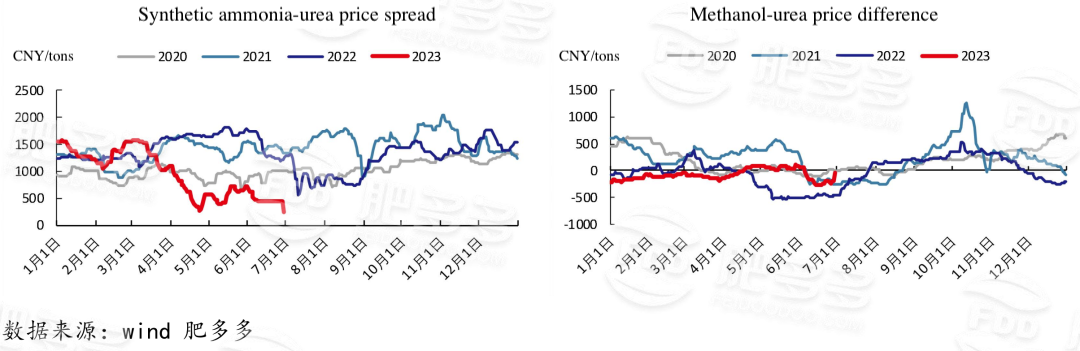

2.5 Urea production profit

2.6 Compound fertilizer industry

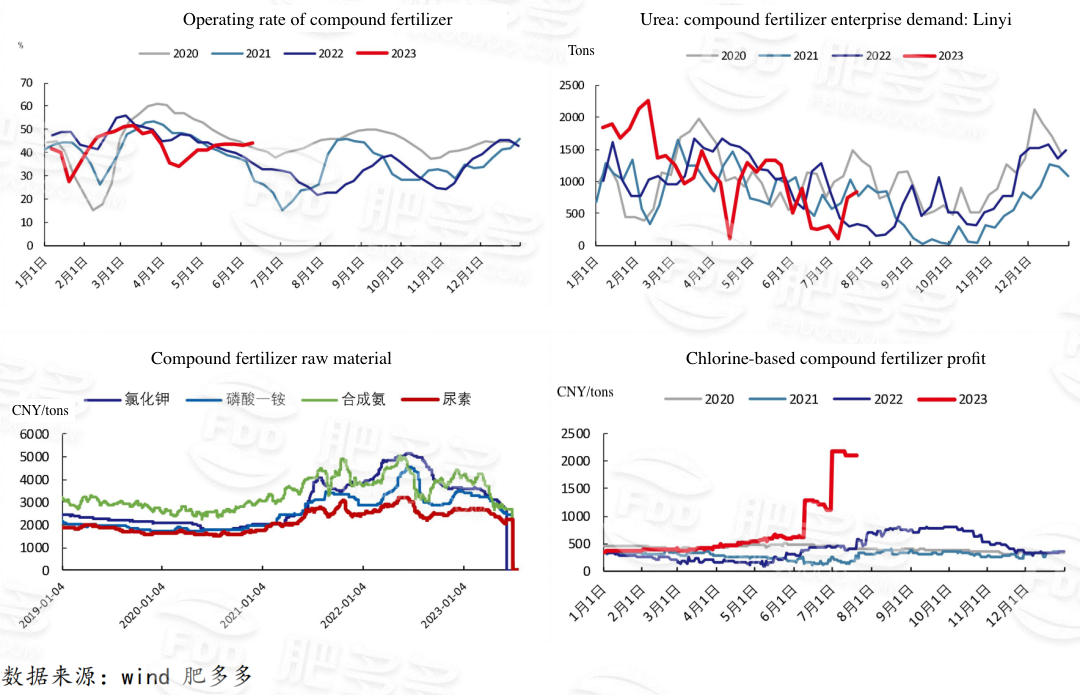

This week, the domestic fertilizer market stabilized upward. In terms of raw materials, urea continues to rise in international prices, boosted by superimposed labeling news, some factory port orders have increased, and prices have risen rapidly; Monoammonium phosphate factory restricted and suspended orders mainly, the price increase intention is still strong. The rise of various products in different ranges has increased the cost of compound fertilizer, which makes it difficult to continue the low-end quotation of some high nitrogen and high phosphorus ratios in the early stage, and compound fertilizer enterprises intend to increase the quotation. From the point of view of supply and demand, the capacity utilization rate of some large-scale enterprises is relatively stable, while the production scheduling of small and medium-sized enterprises may be delayed, because the cost of raw materials has risen too fast recently, resulting in a wait-and-see market sentiment. In terms of demand, rice fertilizer in the south swept up the tail, while wheat fertilizer in North China was advanced in advance, and winter storage was mainly in the Northeast region, and the just-released demand was limited nationwide, and the supply and demand side was not much support. Downstream dealers are skeptical about the price trend during the fertilizer period, so they are still cautious. The operating rate of domestic compound fertilizer industry was 35.11%, up 4.49% from last week; Compound fertilizer enterprise inventory of 424,500 tons, 3.70% less than last week.

2.7 Melamine industry

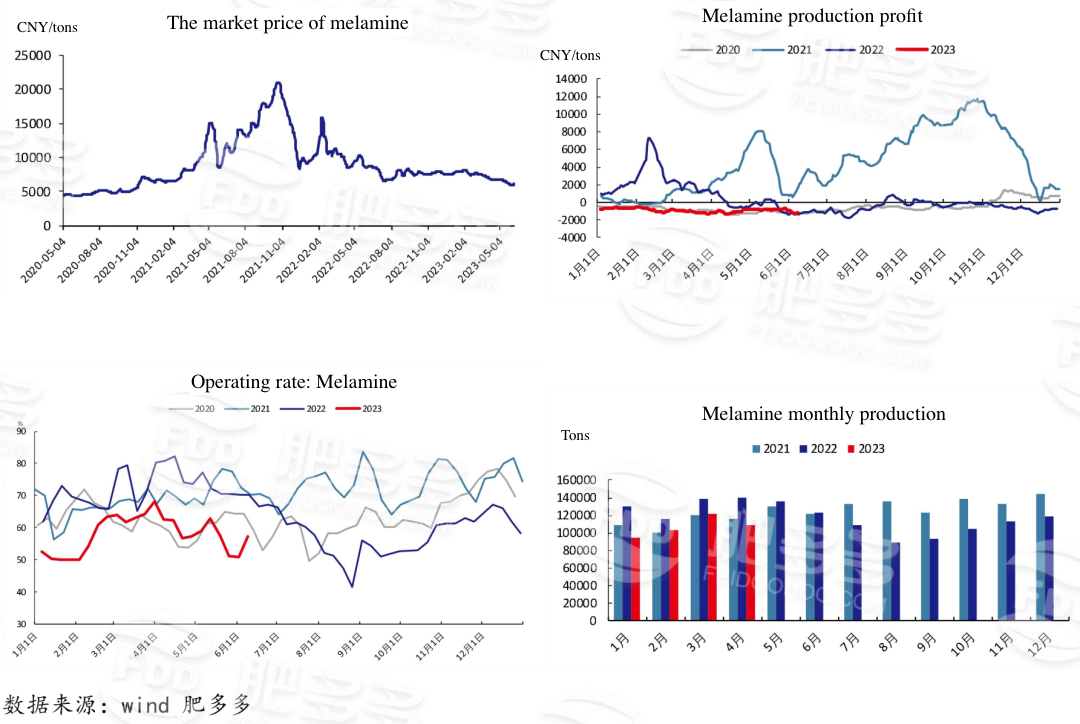

The domestic melamine market has been mixed this week. At the beginning of the week, the market is mainly stable, manufacturers mainly issued early orders, downstream demand performance is flat, a few enterprises according to their own new single transaction situation slightly lower prices, but to the middle of the week, raw material urea market in the international price rise, export news fermentation of the case significantly upward, melamine enterprise mentality has changed, most enterprises began to stop selling or raise prices, limited orders. In the short term, under the support of the cost side, the melamine market still has upside, and the high and low price difference or gradually reduce. The operating rate of the domestic melamine industry was 65.17%, up 3.58% from last week; Melamine weekly production of 28,400 tons, an increase of 5.97% from the previous week.

2.8 Price difference of related varieties

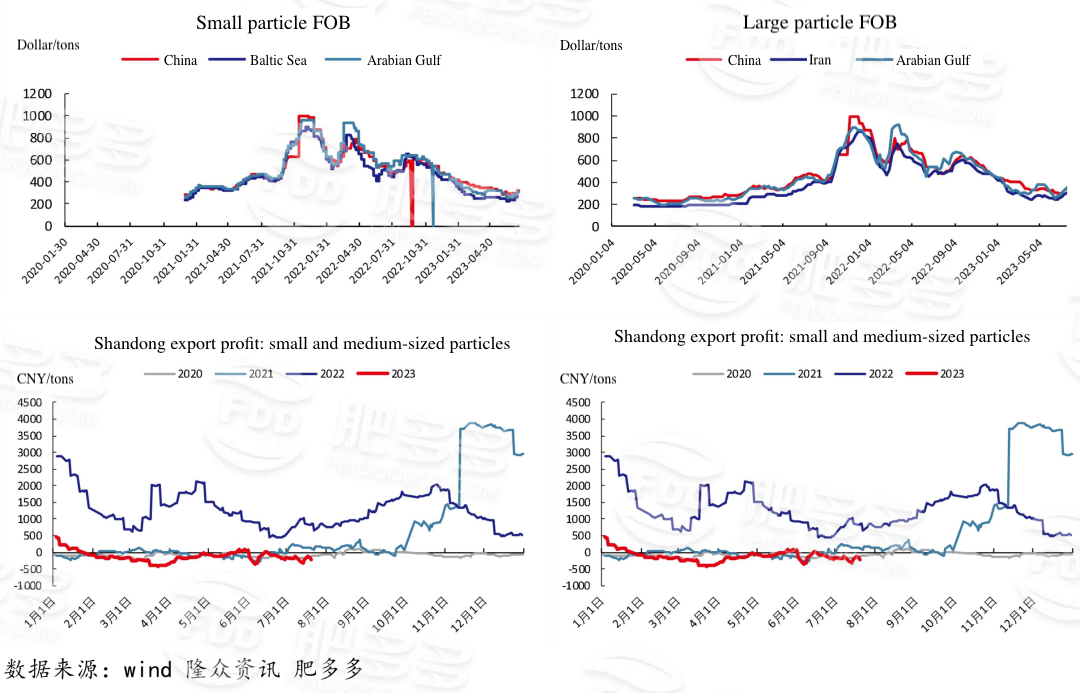

2.9 International market quotation

In the international market, the bulk small particles FOB China price is 345-380 US dollars/ton, and the mainstream price is 27-60 US dollars/ton higher than last week; The Baltic FOB price is $340-365 / ton, and the mainstream price is up $35-40 / ton from last week.

Large particle FOB China price 380-400 US dollars/ton, mainstream price increased by 40-50 US dollars/ton compared with last week; Iran's large particle FOB price of 335 US dollars/ton, the mainstream price increased by 29 US dollars/ton from last week.

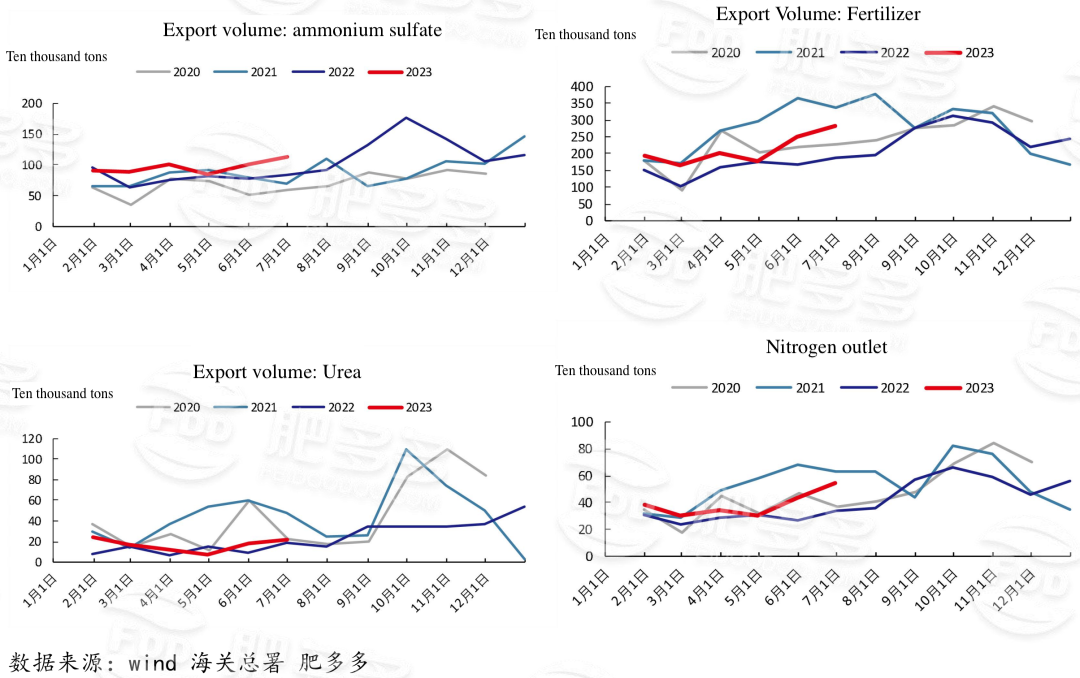

2.10 Nitrogen fertilizer export situation

In June, China's urea exports were 223,900 tons, and the cumulative total exports from January to June were 100.95 million tons, an increase of 285,400 tons from last year.

03 Future market outlook

Supply: The current maintenance is gradually ending, and the daily output is increasing. New capacity is already on the way.

Inventory: Inventory declined further, factory inventories were low, and factories were more willing to raise prices. However, the beginning of the library is a matter of time, and the end of July is cautious.

Cost: Thermal coal prices are stable, but there is little room for rebound. The price of anthracite lump coal hit the bottom, and the fixed bed cost ended to explore.

Demand: agriculture needs to end, export demand short-term release, pay attention to the port situation. With low inventories, speculative demand appears.

- International Fertilizer Market - Potash Giants Report First Quarter: Signs of Recovery in Potash Demand! Meanwhile, Russian Fertilizer Exports to the US Reach Annual High2645

- Phosphate Fertilizer Weekly Report: Supported by Pending Orders and Costs, Firm Prices2327

- Urea Weekly Review: Cautious Buying and Slow Follow-Up, Prices Hold Steady2438

- Urea Daily Review: Weakened Supply-Demand Support, Enterprises Lower Prices to Attract Orders2467

- Phosphate Fertilizer Daily Review: Pending Orders Support Prices, Stability in the Short Term2373