7.26 Urea Daily Review: futures price closed daily limit at the end of the day, and the spot rose after the stalemate

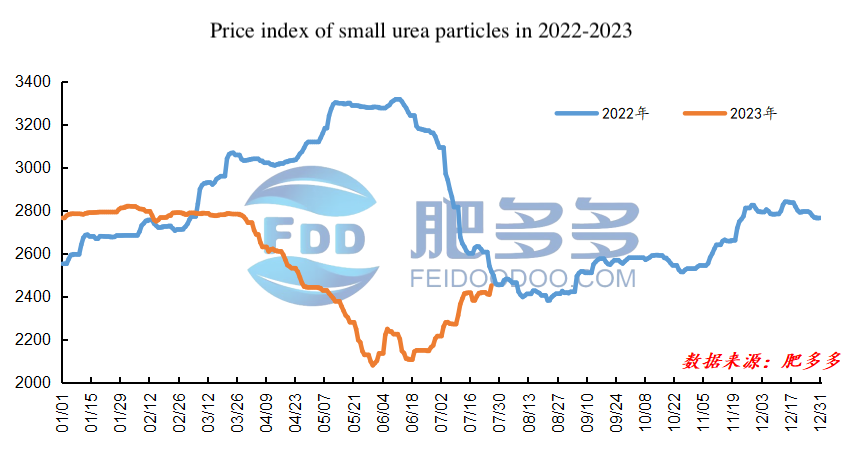

Domestic urea price index:

According to data from Feiduoduo, the price index of small urea particles on July 26 was 2451.05, an increase of 43.18 from yesterday, a month-on-month increase of 1.79%, and a year-on-year decrease of 2.56%.

Urea futures market:

The futures price of urea UR2309 contract opened higher today, and the rising trend continued to ferment. In the late opening of the morning session, the price first reached the lowest point of 2231, and then continued to rise, reaching the daily limit before noon. In the afternoon, the futures price on the disk rebounded and fluctuated within a narrow range, reaching the intraday high of 2335, and then went up again, closing at 2335 in late trading. Urea UR2309 contract opening price: 2267, highest price: 2335, lowest price: 2231, settlement price: 2302, closing price: 2335, the closing price increased by 173 compared with the settlement price of the previous trading day, and the chain rose by 8.00%. The fluctuation range of the whole day is 2231 -2335, the price difference is 104; the 09 contract reduced the position by 11994 lots today, and the position so far is 293895 lots.

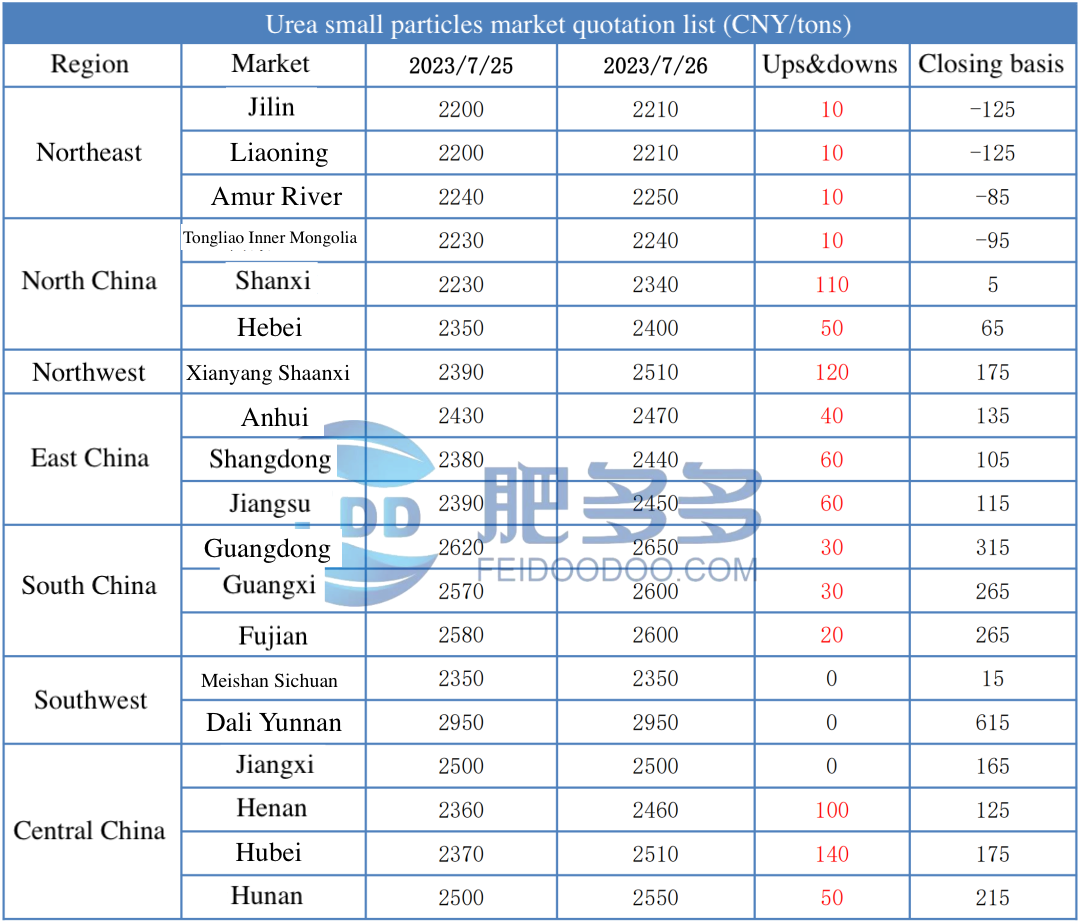

Spot market analysis:

Today, the domestic urea spot market price has risen in an all-round way, and the price increase range in various regions ranges from 10-150 yuan/ton. At present, the domestic urea spot supply is loose, and the demand for agricultural demand is gradually entering a blank period. The demand for compound fertilizer industry will not be released in large quantities until late August, while the demand for melamine and plywood also remains weak. Comprehensively, the rigid demand of the terminal has been released. slow. Specifically, the price in Northeast China rose to 2190-2290 yuan/ton. Prices in North China rose to 2240-2460 yuan/ton. Prices in Northwest China rose to 2510-2520 yuan/ton. The price in Southwest China is stable at 2350-3000 yuan/ton. Prices in East China rose to 2,400-2,470 yuan/ton. The price of small and medium-sized particles in central China rose to 2410-2600 yuan/ton, and the price of large particles rose to 2380-2580 yuan/ton. The price in South China rose to 2580-2680 yuan/ton.

Outlook forecast:

Today's futures price limit has risen, news of strengthening international prices has come out one after another, and the sentiment on the market has also risen accordingly, while domestic spot prices are also driven by a favorable atmosphere, rising after a few days of stalemate. From a fundamental point of view, on the supply side, the industry has maintained a relatively high level of operation, and some devices have been shut down for a short period of time, and some devices have been restored, and the daily output has returned to about 170,000 tons. In the long run, some enterprises in Shanxi and Inner Mongolia have maintenance plans in August, and the industry will start operations later or narrowly. In terms of demand, agricultural demand is gradually moving towards the off-season. Conservatively speaking, there will be a gap of about one month. Short-term agricultural demand is hardly optimistic; in terms of industrial demand, downstream compound fertilizer factories and plywood factories maintain appropriate replenishment, and the overall demand is weakening . Internationally, rising global food prices during the week led to rising international prices for urea, and India's new round of bidding has made my country's export expectations stronger. On the whole, it is expected that the price of urea will continue to be organized in the near future, and the low price will tend to make up for it.

- International Fertilizer Market - Potash Giants Report First Quarter: Signs of Recovery in Potash Demand! Meanwhile, Russian Fertilizer Exports to the US Reach Annual High2629

- Phosphate Fertilizer Weekly Report: Supported by Pending Orders and Costs, Firm Prices2317

- Urea Weekly Review: Cautious Buying and Slow Follow-Up, Prices Hold Steady2430

- Urea Daily Review: Weakened Supply-Demand Support, Enterprises Lower Prices to Attract Orders2453

- Phosphate Fertilizer Daily Review: Pending Orders Support Prices, Stability in the Short Term2357