July 24th Urea daily assessment: The two markets are narrow and weak

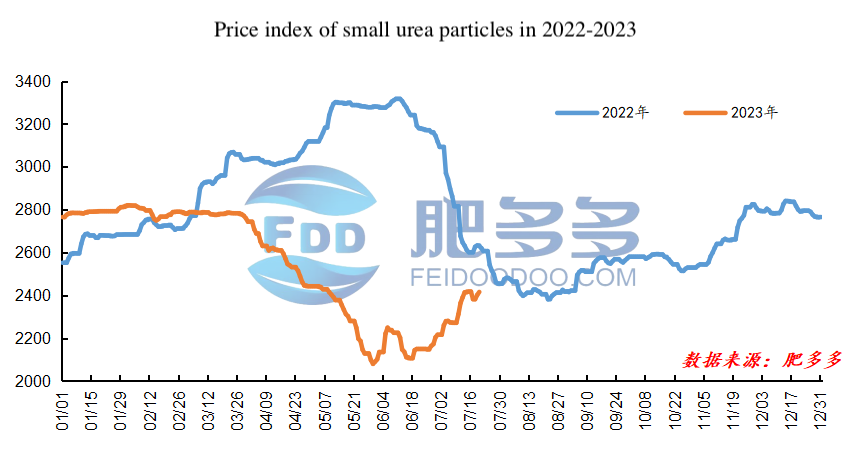

Domestic urea price index:

According to Feidoodoo data estimates, the price index of small urea particles on July 24 was 2410.91, down 8.18 from last Friday, down 0.34% from the previous month, down 7.50% year-on-year.

Urea futures market:

The urea UR2309 contract price fell first and then rose today, but the price fluctuated little. Later in the morning, the price fell to the lowest point in the session 2076, and then the price fluctuated upward. The afternoon price maintained a volatile trend and fell in the end to close at 2095. Urea UR2309 contract opening price: 2110, the highest price: 2134, the lowest price: 2076, the settlement price: 2107, the closing price: 2095, the closing price compared with the previous trading day settlement price fell by 3, down 0.14% from the previous day, the fluctuation range of 2076-2134, the spread 58; 09 Contract reduced 21418 lots today, as of the current position of 287,936 lots.

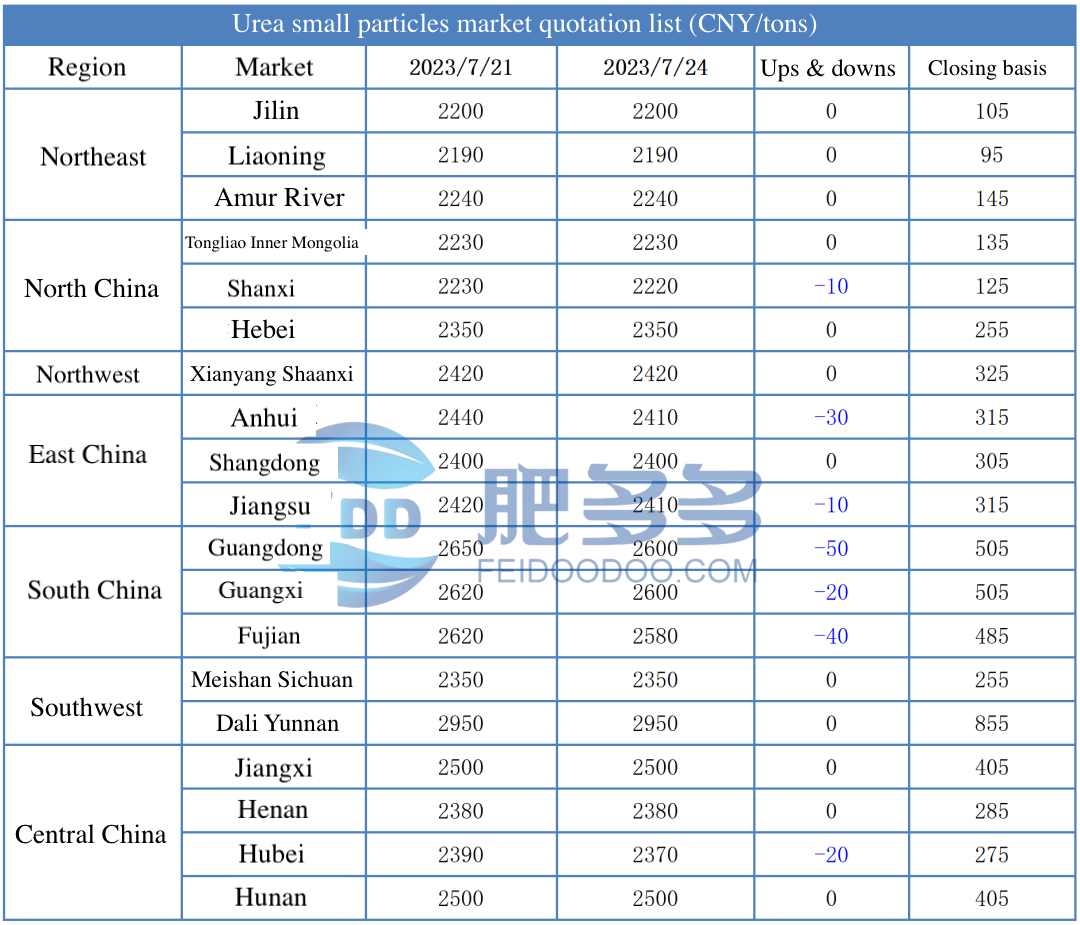

Spot Market analysis:

At the beginning of the week, the domestic urea spot market was weak, and the price fluctuation in some areas ranged from 10-50 CNY/ton. International urea prices rose again on Friday, and the export market was optimistic. The recovery supply of early troubleshooting enterprises has increased, but the agricultural demand has continued to decrease, and the overall wait-and-see sentiment of the market is heavier at present. Specifically, the price in the Northeast region is stable at 2170-2260 CNY/ton. Prices in North China fell to 2220-2400 CNY/ton. The price in Northwest China is stable at 2420-2430 CNY/ton. The price in southwest China is stable at 2350-3000 CNY/ton. The price in East China is stable at 2360-2420 CNY/ton. In central China, the price of small and medium-sized particles fell to 2360-2560 CNY/ton, and the price of large particles was stable at 2380-2420 CNY/ton. The price in South China fell to 2550-2600 CNY/ton.

Future market forecast:

From the perspective of futures, today's futures price is narrow down, observing the Bollinger belt three tracks, the middle and lower tracks have support, but the upper track is suppressed, the price trend is not clear, and the spot guidance is not strong. From the fundamental point of view, the supply side of the industry to maintain a high level of construction, the early maintenance device recovery, the Nissan may be increased within the week, but the overall change is not large. In terms of demand, summer corn topdressing in some parts of the north has gradually come to an end, and it is expected to be fully over by the end of the month, agricultural demand has gradually weakened, and industrial demand has continued to maintain an appropriate amount of replenishment in the near future, and the overall demand is weakening. Internationally, the northern hemisphere agriculture needs to come to an end, the focus of consumption has moved to the southern hemisphere, although there has been no new news, but the market is expected to increase exports. In summary, short-term urea prices are expected to run, accompanied by sporadic declines in some areas.

- International Fertilizer Market - Potash Giants Report First Quarter: Signs of Recovery in Potash Demand! Meanwhile, Russian Fertilizer Exports to the US Reach Annual High2651

- Phosphate Fertilizer Weekly Report: Supported by Pending Orders and Costs, Firm Prices2335

- Urea Weekly Review: Cautious Buying and Slow Follow-Up, Prices Hold Steady2445

- Urea Daily Review: Weakened Supply-Demand Support, Enterprises Lower Prices to Attract Orders2470

- Phosphate Fertilizer Daily Review: Pending Orders Support Prices, Stability in the Short Term2380