Mid-Year Report on the Ammonium Phosphate Market in 2023

Mid-Year Report on the Ammonium Phosphate Market in 2023

1.1 Overview of the Chinese Ammonium Phosphate Market in 2023

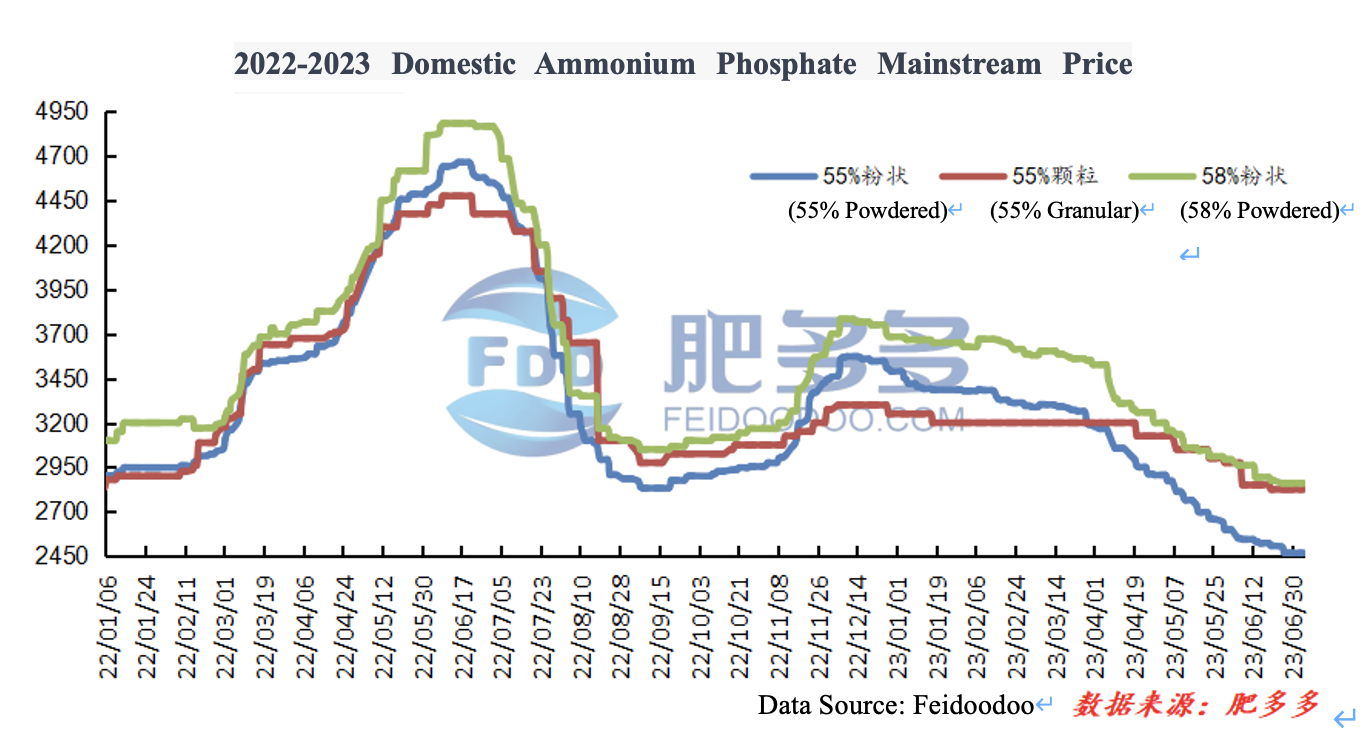

In the first half of 2023, the domestic ammonium phosphate market in China experienced initial stability followed by a decline. According to data from Feiduoduo, as of June 30, the mid-year lowest value of the 55% powdered ammonium phosphate index decreased by 1021.25 compared to the highest value at the beginning of the year, with a decline of 29.27%; the mid-year lowest value of the 55% granular ammonium phosphate index decreased by 425 compared to the highest value at the beginning of the year, with a decline of 13.08%; and the mid-year lowest value of the 58% powdered ammonium phosphate index decreased by 823.33 compared to the highest value at the beginning of the year, with a decline of 22.35%.

Figure 1

In the first quarter, the domestic ammonium phosphate market saw a narrow downward adjustment in prices. Among them, the prices of 55% powdered and 58% powdered varieties fluctuated significantly, while the 55% granular variety only saw one price decrease. At the beginning of the quarter, demand was somewhat weak, and some factories reduced prices to alleviate inventory pressure. A few factories implemented price floor policies. As raw material prices continued to fall, cost support gradually weakened. However, with downstream pre-Spring Festival procurement and delayed deliveries that could be executed until mid-quarter, prices stabilized. In the middle of the quarter, the ammonium phosphate market fluctuated slightly downward. After the Spring Festival holiday, raw material prices continued to decline, accompanied by a decline in urea prices. The market sentiment turned bearish, new orders were scarce, and factory inventory pressure increased. In the later part of the quarter, starting from March, the market continued to operate weakly. Initially, the price of raw material synthetic ammonia remained high, causing an inverted market price. Towards the end of the quarter, the prices of synthetic ammonia and sulfur continued to decline, and cost support began to weaken. Factories reduced production or conducted plant maintenance, leading to a significant decrease in the ammonium phosphate industry's operating rates. As the spring fertilization season came to an end, downstream demand for ammonium phosphate decreased, resulting in a weak market supply and demand situation.

In the second quarter, the ammonium phosphate market continued its downward trend, with prices of 55% powdered and 58% powdered varieties falling by around 700 yuan per ton. In terms of raw materials, the prices of sulfur and synthetic ammonia continued to decline throughout the quarter, and the market sentiment remained unfavorable. Coupled with the poor sales performance of downstream compound fertilizer companies and a significant decrease in inventory pressure due to reduced operating loads, the enthusiasm for purchasing raw material ammonium phosphate decreased. Consequently, the ammonium phosphate industry's operating rates dropped to the lowest level of the year, leading to a significant reduction in production. In mid-May, following the May Day holiday, there was a slight improvement in sales of corn fertilizers downstream. However, since summer fertilization and topdressing primarily rely on high-nitrogen fertilizers, the market space for ammonium phosphate was limited. Therefore, downstream purchases were limited, factories had limited order intake, and inventory continued to be under pressure, resulting in a continuous decline in prices. Towards the end of the quarter, compound fertilizer companies placed just-in-time orders for raw materials, mainly in preparation for autumn fertilization. Autumn fertilization primarily relies on high-phosphorus fertilizers, resulting in a small wave of positive market sentiment for ammonium phosphate. Companies gradually received orders, and inventory pressure eased.

Overall, in the first half of 2023, the ammonium phosphate market faced continuous price declines due to insufficient cost support and weakening demand, and the market sentiment was far from optimistic.

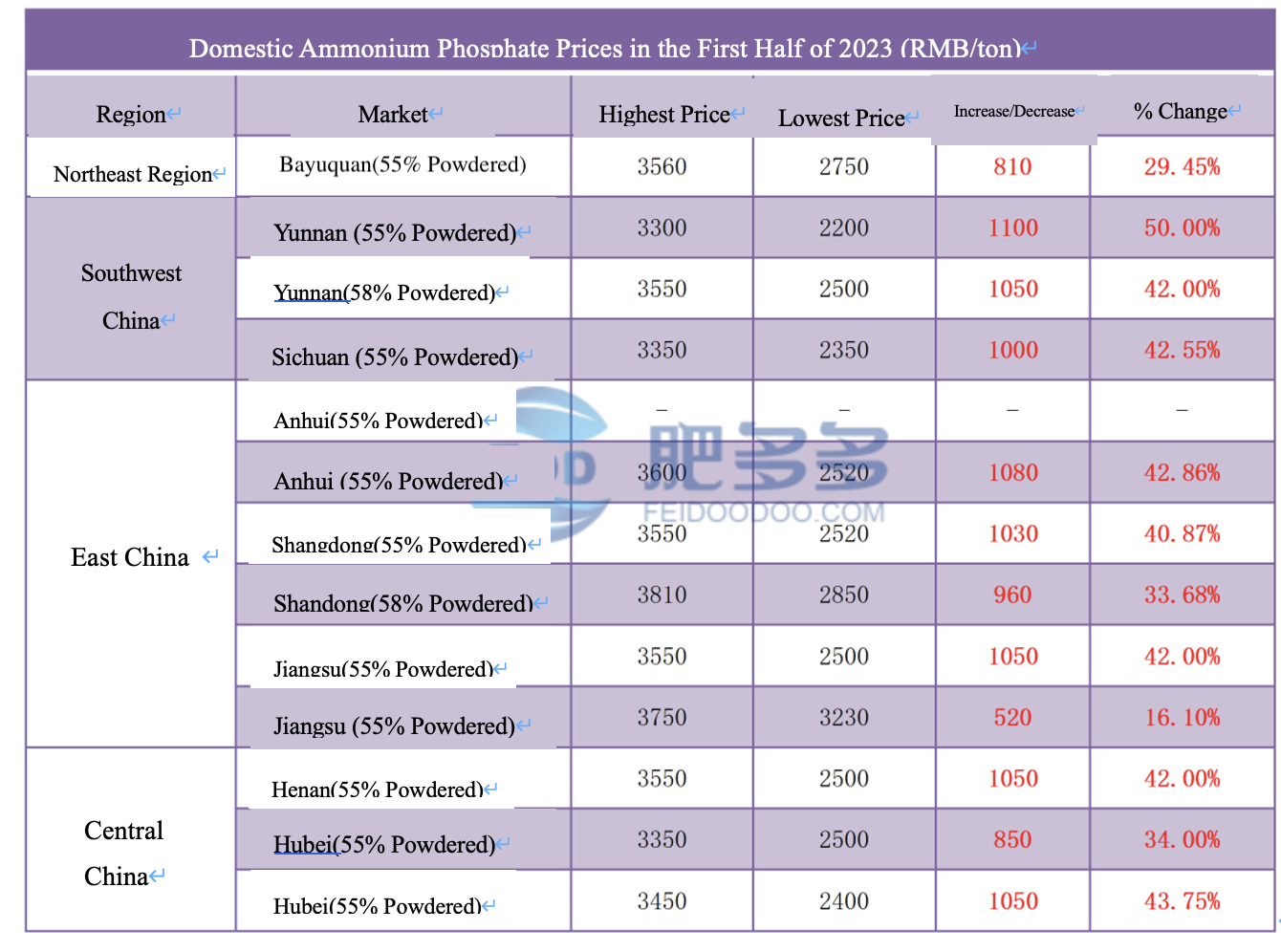

1.2 Comparison of Lowest and Highest Prices in the Chinese Ammonium Phosphate Market in 2023

Table1

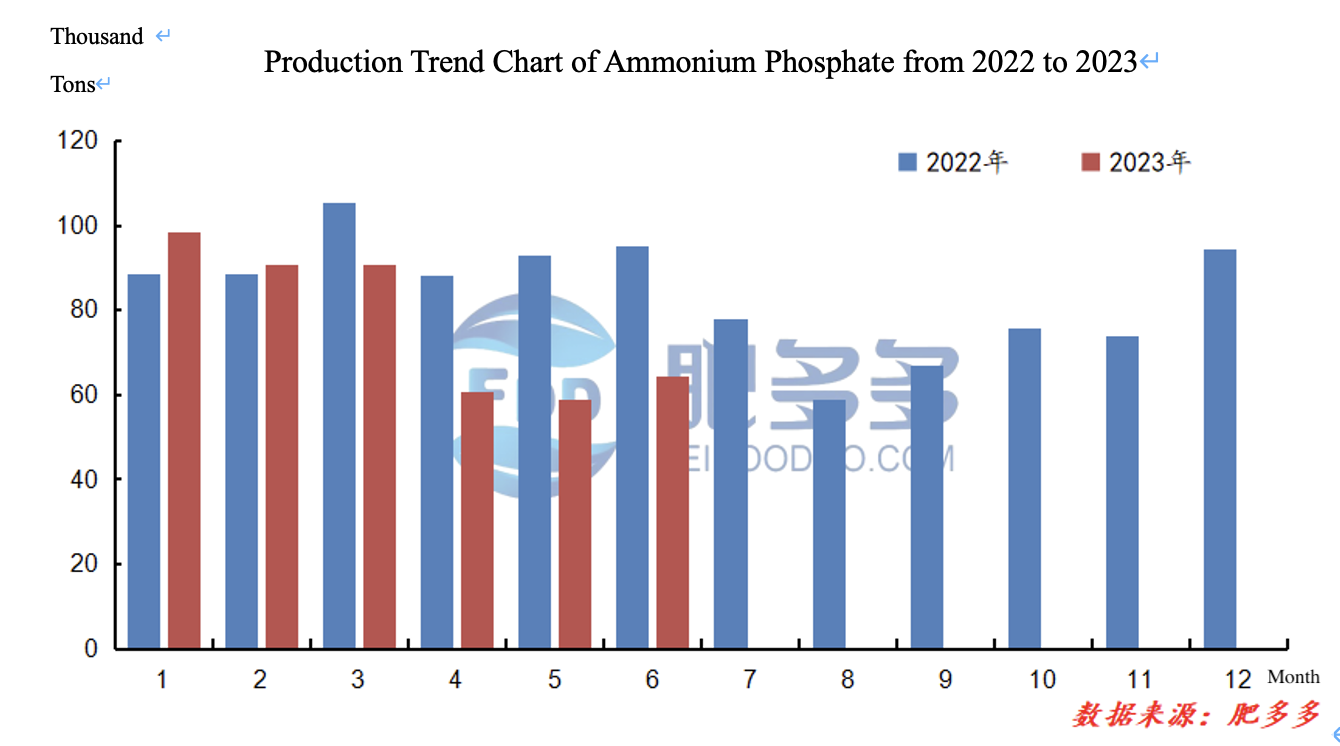

2.1 Analysis of Ammonium Phosphate Production in China in 2023

Figure 2

The production of ammonium phosphate in the Chinese market from January to June 2023 was approximately 4.6346 million tons, a decrease of 0.9437 million tons compared to the previous year, representing a 20.36% year-on-year decrease. Overall, the production decreased compared to the previous year.

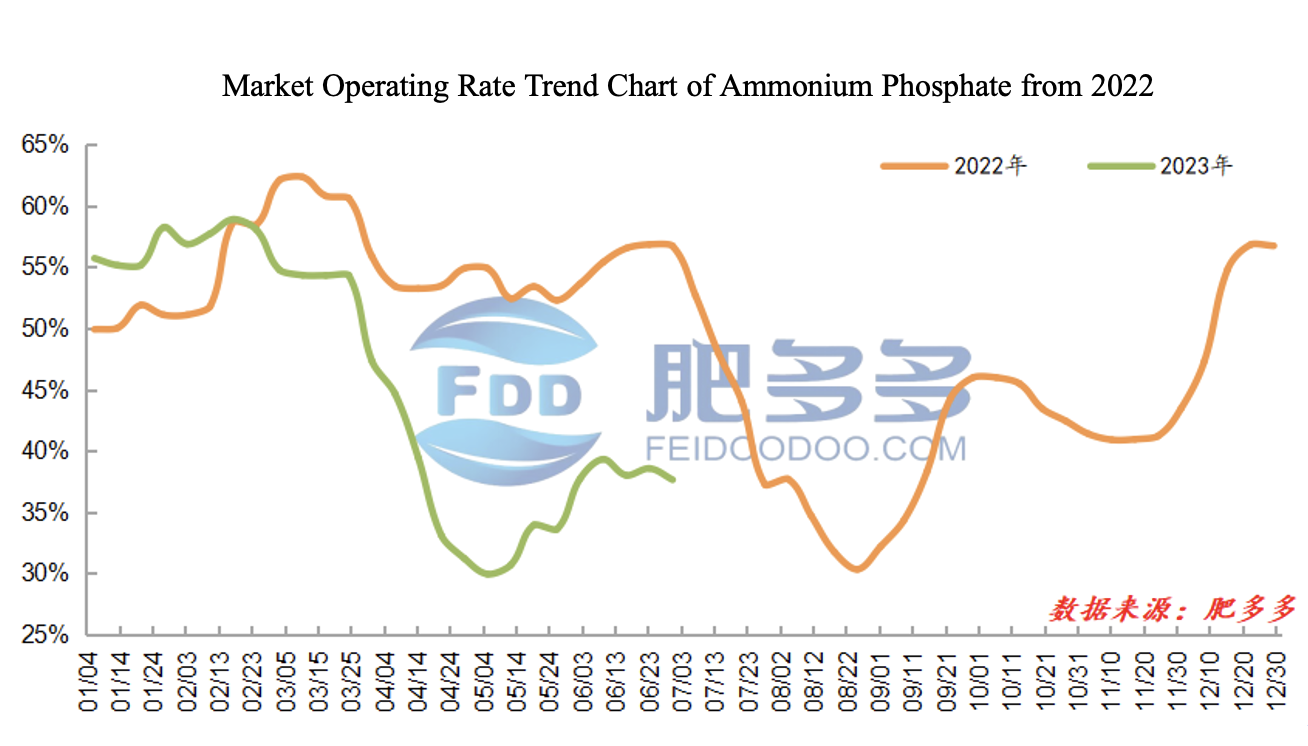

2.2 Analysis of Operating Rates in the Chinese Ammonium Phosphate Market in 2023

Figure 3

In the first half of 2023, the operating rates of ammonium phosphate facilities in the Chinese market decreased compared to the same period last year. In the first quarter, it remained above 50%, but in the second quarter, as demand weakened and costs continued to decline, the operating rates decreased to around 30%. In June, there was a slight rebound in the operating rates.

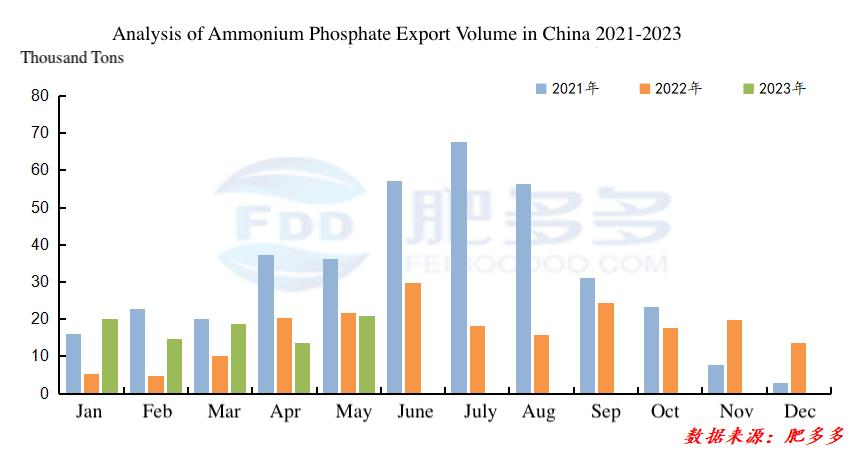

3.1 Analysis of Ammonium Phosphate Exports in China in 2023

Table 2

Figure 4

Ammonium phosphate exports from China increased in 2023. According to customs data, from January to May 2023, the cumulative total export volume of ammonium phosphate from China was 0.8778 million tons, an increase of 0.2545 million tons compared to the same period last year, representing a 40.83% year-on-year increase. Currently, although there is an increase in exports, it falls short of expectations due to the ongoing inversion of domestic and international urea spot prices, resulting in a lack of price competitiveness in exports.

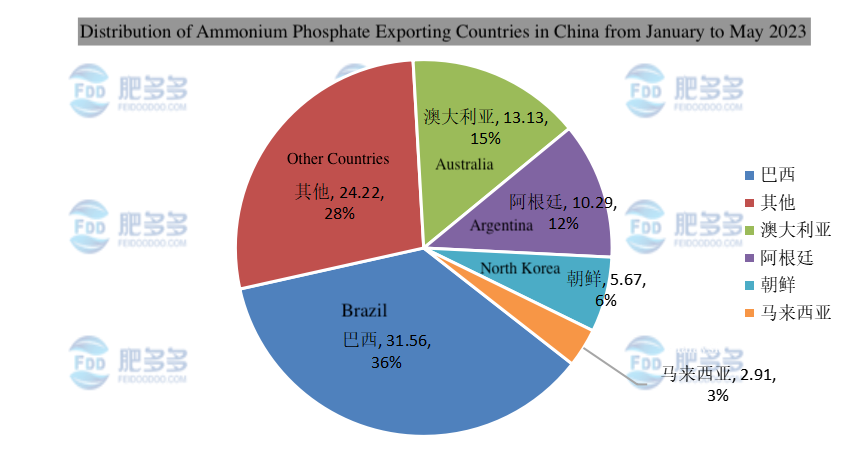

3.2 Analysis of Exporting Countries of Ammonium Phosphate in China in 2023

Table 3

Figure 5

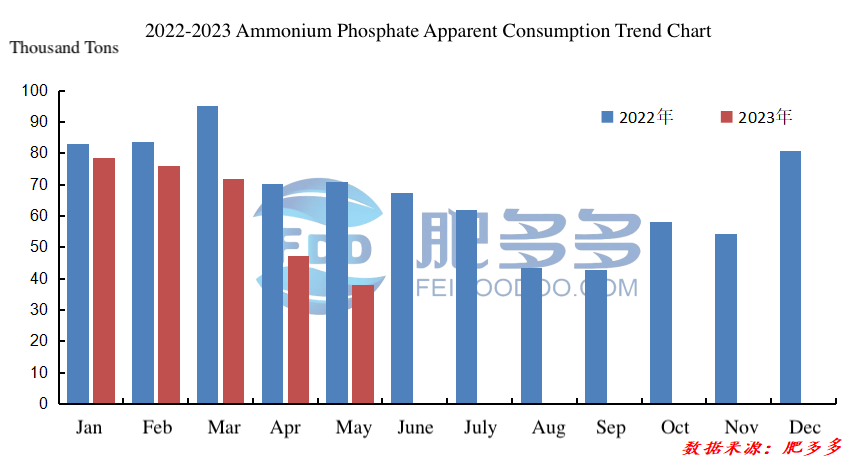

4.1 Analysis of Apparent Consumption of Ammonium Phosphate in China in 2023

Figure 6

According to Feiduoduo data, the apparent consumption of ammonium phosphate in China from January to May 2023 was 3.1149 million tons, a decrease of 0.914 million tons compared to the same period last year, representing a 22.69% year-on-year decrease.

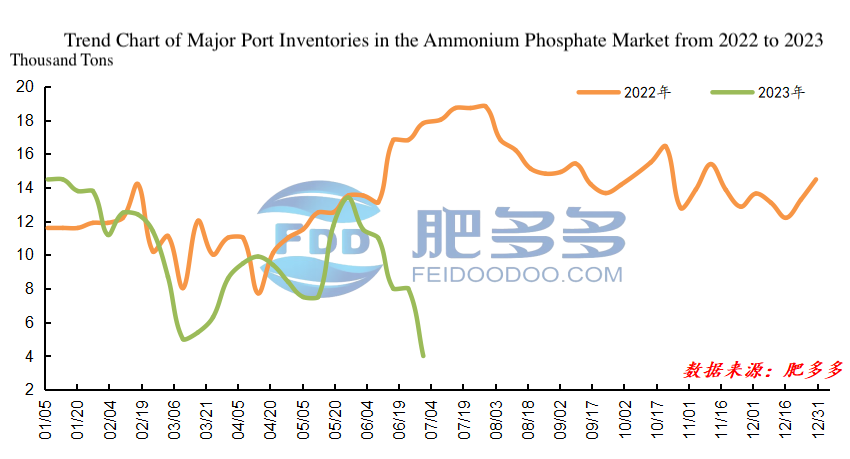

5.1 Analysis of Ammonium Phosphate Inventory in China in 2023

Figure 7

In the first half of 2023, the port inventory of ammonium phosphate in China showed a trend of initial decline, followed by an increase and then a decline. According to Feiduoduo data, the highest inventory of phosphorus fertilizer in China occurred at the beginning of the year, reaching 144,800 tons, while the lowest inventory occurred at the end of June, reaching 40,000 tons.

6.1 Forecast for the Future of Ammonium Phosphate in China in 2023

In terms of supply and operating rates, there may be new capacity expansions for ammonium phosphate in the second half of 2023, and as the autumn market unfolds, previously idled facilities will gradually resume normal production.

In terms of demand, it will mainly focus on the production demand for compound fertilizers. However, with the continuous increase in new energy battery production capacity, the rapid development of water-soluble fertilizers and high-efficiency compound fertilizers, and expansion of some fire equipment production, the demand for industrial ammonium phosphate is expected to increase.

In terms of policies, the current national policy of stable supply and pricing is in effect, and under its influence, bulk commodity prices have been gradually declining in the past six months, which has also affected the prices of ammonium phosphate. Policy restrictions on exports have led to a significant reduction in export volume, with the supply flowing to the hands of traders, resulting in a higher level of social inventory.

In terms of costs, in the case of phosphate ore, with the adjustment of the industrial structure in recent years and the introduction of intensive environmental policies, the concentration of domestic phosphate ore capacity continues to increase, and the market has recently shown a bearish outlook for phosphate ore. Due to the decline in coal prices, the prices of synthetic ammonia and sulfur have been fluctuating frequently in the past six months, mainly showing a downward trend, which does not provide strong cost support for ammonium phosphate.

Overall, with the arrival of the autumn market, trading in the ammonium phosphate market is expected to increase, and inventory pressure will gradually ease. However, the overall economic environment does not provide substantial positive support for ammonium phosphate, and it is necessary to closely monitor changes in raw material markets and domestic and international demand. Future market development may be influenced by more factors, and the changes in spot prices will be more complex and diversified based on the supply and demand dynamics.

- International Fertilizer Market - Potash Giants Report First Quarter: Signs of Recovery in Potash Demand! Meanwhile, Russian Fertilizer Exports to the US Reach Annual High2427

- Phosphate Fertilizer Weekly Report: Supported by Pending Orders and Costs, Firm Prices2138

- Urea Weekly Review: Cautious Buying and Slow Follow-Up, Prices Hold Steady2275

- Urea Daily Review: Weakened Supply-Demand Support, Enterprises Lower Prices to Attract Orders2243

- Phosphate Fertilizer Daily Review: Pending Orders Support Prices, Stability in the Short Term2109